“You know it's time to sell when shoeshine boys give […]

Capital Gains Tax: Bad for Crypto, Good For Metals?

Capital Gains Tax: Bad for Crypto, Good For Metals?

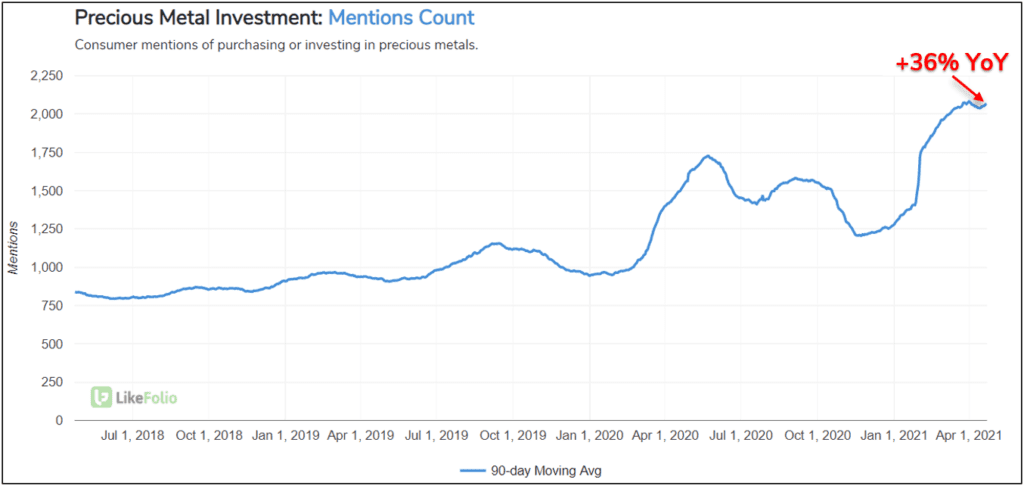

Fears surrounding a proposed capital gains tax increase have worsened the ongoing sell-off in the cryptocurrency market. The new tax would apply to returns on assets held in taxable accounts sold after more than a year… Which would not apply to precious metals. LikeFolio data shows a sustained increase in retail investors talking about purchasing gold, silver, and platinum. Precious metal Investment Mentions are holding near an all-time-high, +36% YoY on a 90-day moving average and more than +100% higher than the levels seen in 2019.

It’s worth mentioning that physical holdings of precious metals are classified as “collectibles” by the IRS and are subject to a maximum capital gains tax just of 28% (regardless of tax bracket).

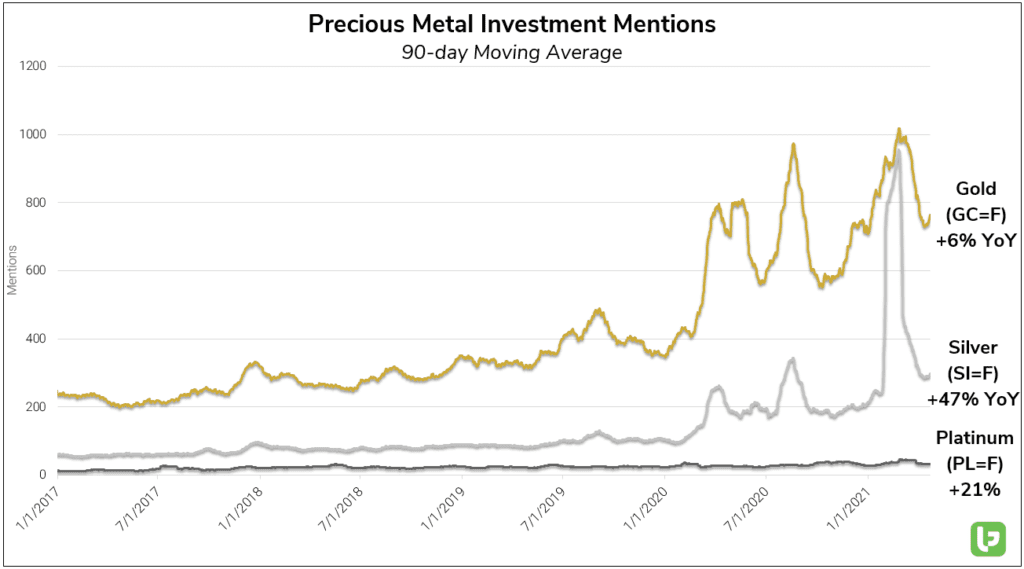

Considering President Biden’s new plan could result in +40% gains tax for some individuals, this adds mightily to the appeal of physical bullion holdings for the wealthiest US citizens. Breaking out the PM Investing trend into its individual components, it’s clear to see that one is undervalued in terms of recent Mention growth: Silver (SI=F) Investment Mentions have continued to rise in the wake of the February “silver squeeze,” trending +47% YoY (90-day moving average).

Although they’re still well below those of Gold (GC=F), outstanding industrial demand for silver means that this increased investment demand is putting pressure on extremely limited supply.

This still hasn’t seemed to affect the price—However, silver has a similar market cap to a large cryptocurrency, and moves can happen fast in a tight market.