Carnival Cruise Lines is starting to show some weakness in […]

Carnival Corporation (CCL) Upcoming Earnings

Carnival Corporation (CCL), an international cruise operator of over ninety vessels across nine cruise lines such as Carnival, Princess, and Holland America, reports its second quarter earnings tomorrow morning.

Company Performance

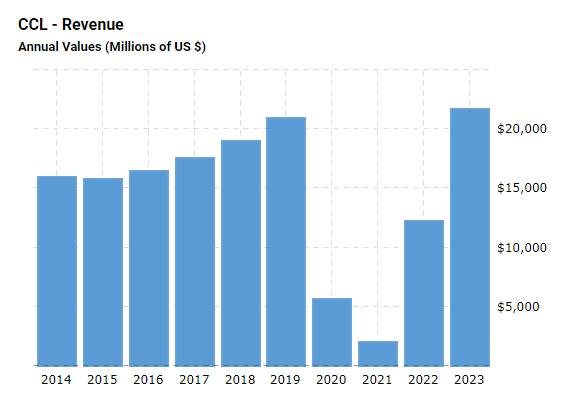

Strong revenue performance - Quarterly revenue increased 22% from 23Q1 to 24Q1. Annually, 2023 had the highest revenue year finally outperforming revenue in 2019 signifying CLL’s return to post covid normalcy along with a +77% YoY revenue growth.

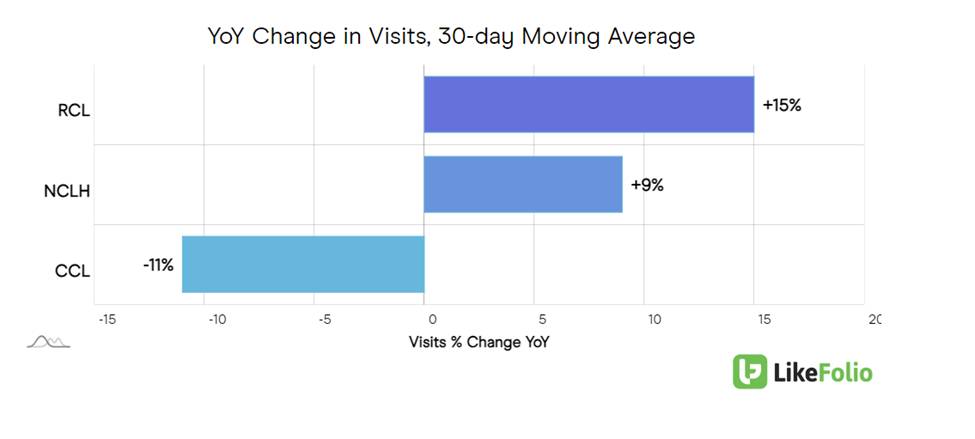

LikeFolio data shows underperforming web traffic with CCL having decreases in visits both YoY and QoQ at -11% and 8% respectively, while competitors Royal Caribbean (RCL) and Norwegian (NCLH) have undergone YoY web traffic growth (NCLH is down QoQ)

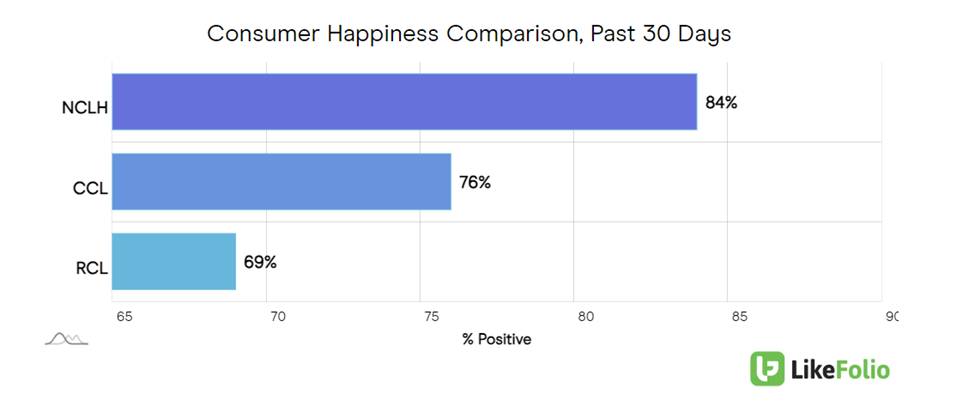

LikeFolio data reveals a middle of the road happiness level with primary competitors falling on either side of CCL’s performance at 76%. CCL budget cuts have decreased amenities for passengers. Cabin service has been reduced from twice a day to only once, with the signature pillow chocolates also being removed as a part of the service.

Much of CCL’s cash flow contributes to decreasing debt of which it has around $30 billion in long term debt. CCL is slowly chipping away, paying off around $3.5 billion in 2023. Large debt poses a primary risk for CCL investors.

CCL’s focus on brand awareness and increasing passenger capacity allow for increases in supply as well as demand. New ships, exclusive destinations, and diverse consumer bases boost CCL demand. CCL also has a hand in AI with its OceanMedallion, which uses facial recognition for boarding processes and amenity access, reducing hassle for passengers aboard CCL's Princess Cruise Line.

Overall Market Status

Overall market revenue is expected to increase to $15.16 Billion in 2024, a 21% growth from 2023. Total cruise passengers reached 31.7 million in 2023, a pre-pandemic high, once again contributing to post covid normalcy.

Travel cost increases place cruise lines in more affordable positions as an average domestic land trip can cost around $144 to $250 per day while cruises can cost on average $90 per day. Thanks to diverse amenities and itineraries, cruise prices can drop to as little as $40 per day or to much higher prices for experiences like all-inclusive trips.

Takeaway:

A very cheap stock price, down 13% YoY, paired with CCL’s huge brand, demand, and operational abilities give plenty of room for their stock to grow, however tomorrow's earnings report will be quite telling, and we'll be keeping an eye on it.

It's also important to note that CCL reports earnings before its peers, setting the tone for the rest of the market. Tomorrow's earnings report is likely to hint at how the rest of the cruise lines have performed.