Can AutoZone Keep its Earnings Win Streak Alive? (AZO) Replacement […]

Cars are getting older...

Cars are getting older...

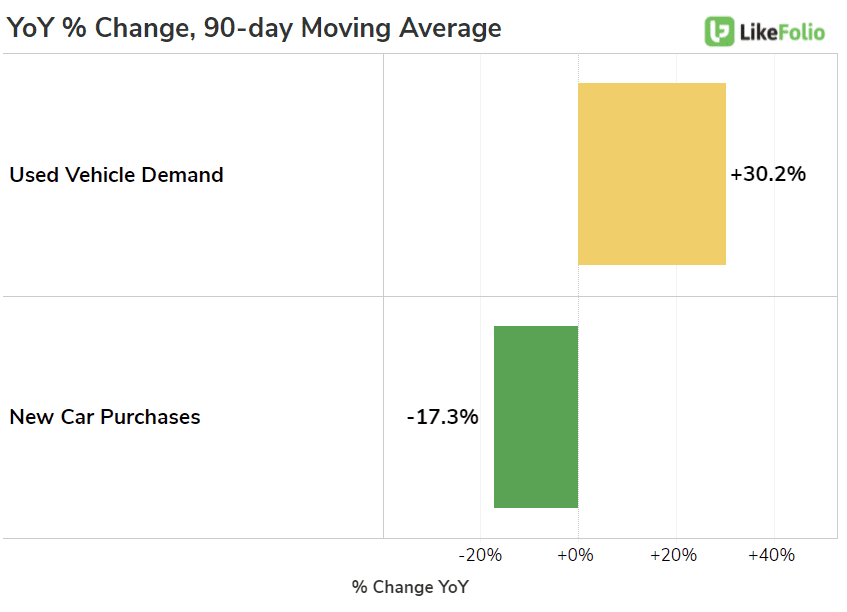

The average age of cars on U.S. roads is rising. In 2021, the average age of a vehicle on U.S. roadways was 12.1 years. In 2002, the average was 9.6 years. Improved performance, rising vehicle costs, and chip shortages are contributing to this extended car aging process. You can see this dichotomy on the chart below.

The rising demand for used vehicles accompanied by the decline in new vehicle purchase mentions certainly confirms external research cited above. Has this impacted consumer demand for auto parts retailers, like AutoZone? i.e. do older cars need more love from consumers? According to AutoZone's last report, yes. AZO net sales increased +8.1% YoY on top of 2020's 'historic growth,' driven higher by resilience in DIY and growth in commercial sales. Even dealers have noted the ripple effects of vehicle pricing and availability into the auto parts market, "Some customers have balked at paying top dollar for new cars and have opted to make do with older vehicles. That has increased demand for parts and service, one of the most profitable businesses for car dealers. Many dealers have extended repair-shop hours." This would translate to the commercial side of AutoZone's business, an element of sales that LikeFolio data may not capture. But we do have special insight into the DIY consumer. Data suggests the company is defending a market share grab recorded in 2020.

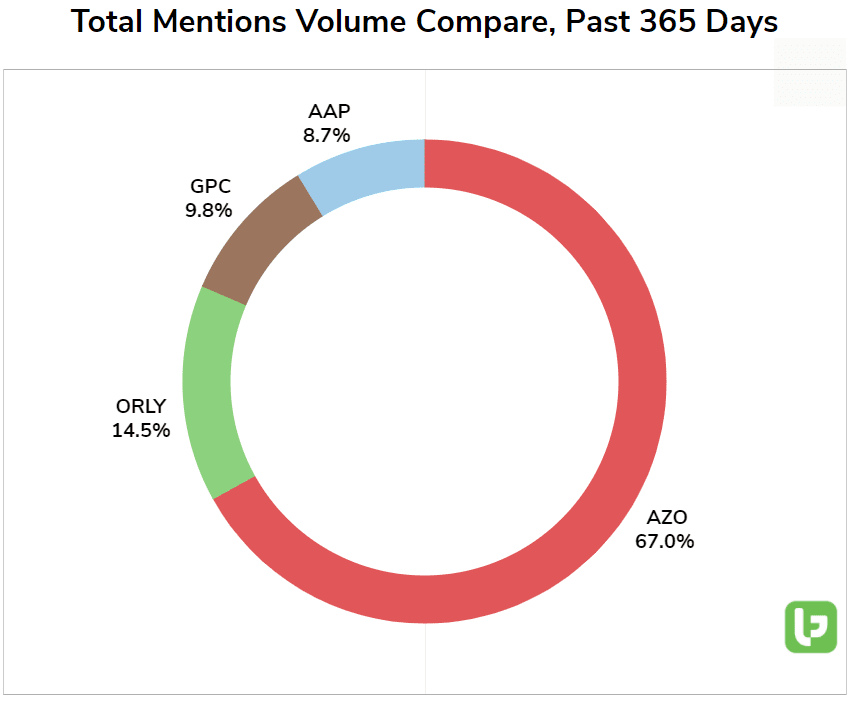

AutoZone commands market share dominance when it comes to total mention volume vs. peers over the last year. Heading into 22Q1 earnings, AutoZone demand mentions are building: +8% QoQ. The company expects DIY comps to be an easier mark vs. Q4, and data confirms this. AutoZone DIY repair mentions remain higher vs. 2020. We expect AutoZone and its peers to continue to be bolstered by macro-level trends associated with aging vehicles and strain on new vehicle supply. Stay tuned...