“You know it's time to sell when shoeshine boys give […]

Centralized Cryptocurrency Exchanges are Vying for Supremacy

Centralized Cryptocurrency Exchanges are Vying for Supremacy

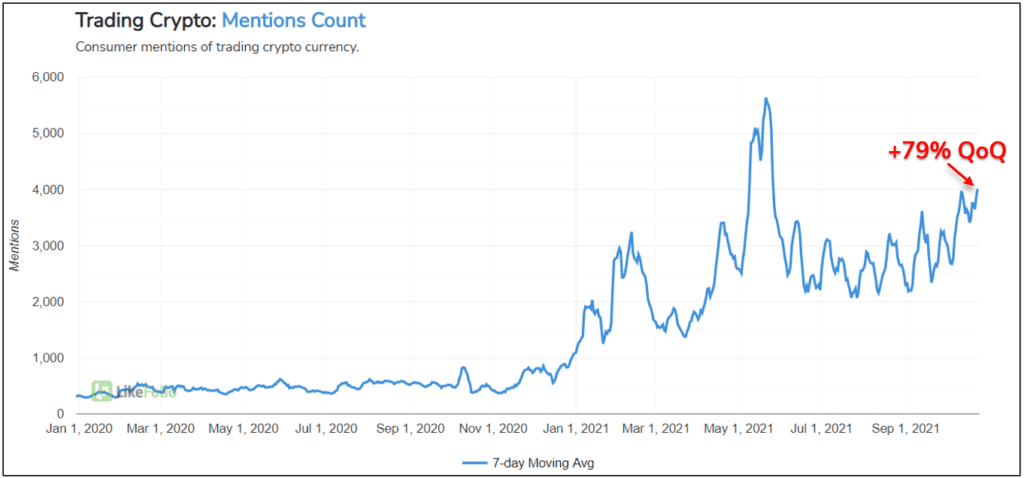

LikeFolio data shows that the number of cryptocurrency traders is on the rise again. Consumer Mentions of actively trading cryptocurrency are trending +79% QoQ on a 7-day moving average.

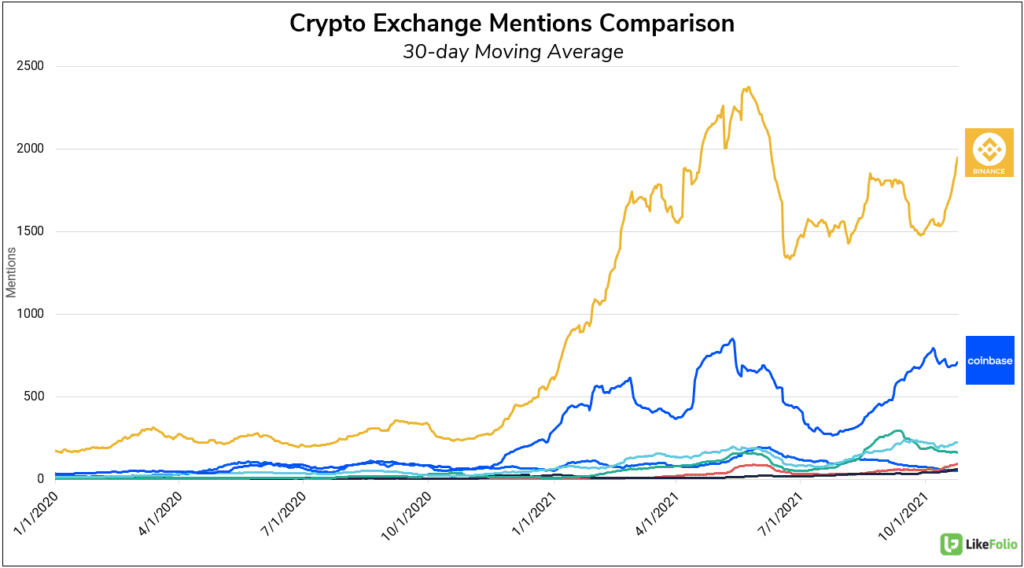

As a result of this growing interest, centralized cryptocurrency exchanges have enjoyed an influx of users and trading volume.

Two centralized exchanges reign supreme in terms of users and trading volume: Binance and Coinbase. A chart plotting the 30-day moving average of crypto exchange Mentions shows just how dominant these two have become.

However, the “smaller” exchanges are engaged in a fierce battle, competing for a share of the growing number of cryptocurrency traders.

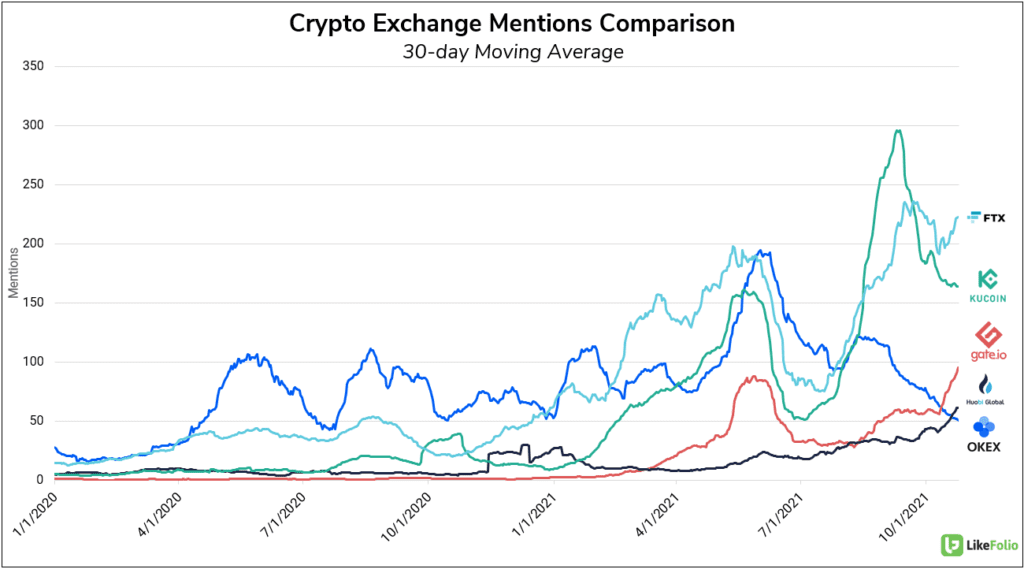

A closer look at the lower portion of the comparison chart shows surging Mention volume, with FTX, Kucoin, and Gate.io all making substantial gains in recent months.

Exchange Mentions, relative to respective 24-hour trade volumes, shows that FTX and Gate.io are outperforming and OKEx and Huobi are underperforming – This could be due to the popularity of the latter 2 with non-English-speaking traders.

All of the exchanges shown above offer native exchange tokens.

Exchange tokens primarily serve to provide additional liquidity, granting holders various incentives like trading discounts and access to unique derivatives Furthermore, these tokens serve as “shares” of the underlying exchange, increasing in value as the exchange grows.