Consumers are trimming the fat

| Elon Musk ignited a firestorm of discussions when he announced Twitter Blue, a subscription for verification on Twitter, earlier this month. |

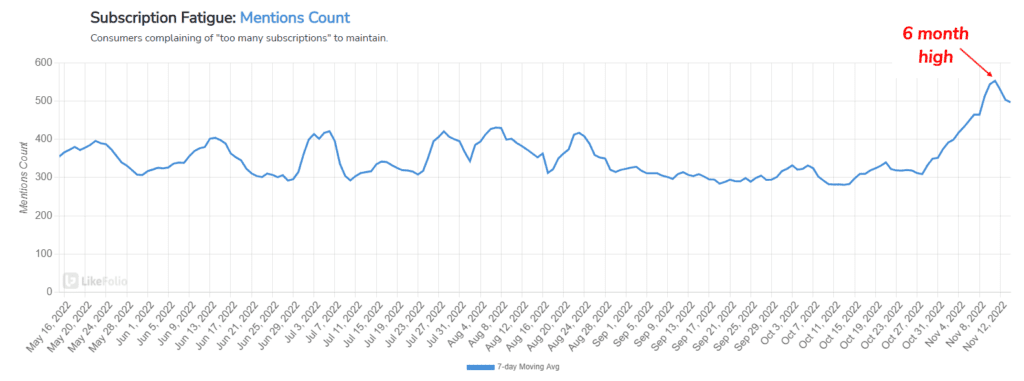

| But this story isn’t about Twitter Blue…it’s about the larger issue buried in the tweet above. The emphatic consumer response to Twitter Blue was just one symptom of a growing consumer pain point: Subscription fatigue. The social media announcement spurred a 6-week high in the number of consumers talking about the fact that they have too many subscriptions to manage. |

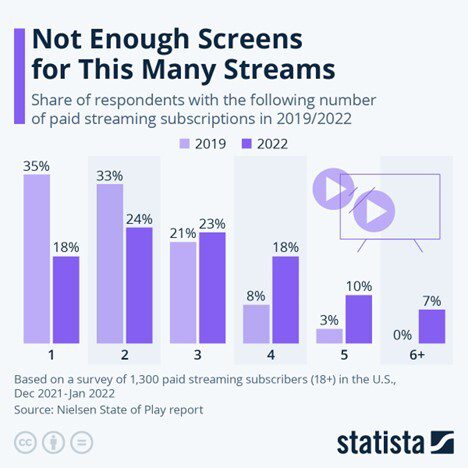

| To be clear, this fatigue has been building for months. This spring and summer, subscription fatigue mentions were more than +40% higher than a year ago. Any guesses on the main contributors to consumer pain? Streaming Services. 58 percent of U.S. streamers pay for at least three different services according to Nielsen's latest State of Play report. This is a major shift from 3 years ago. |

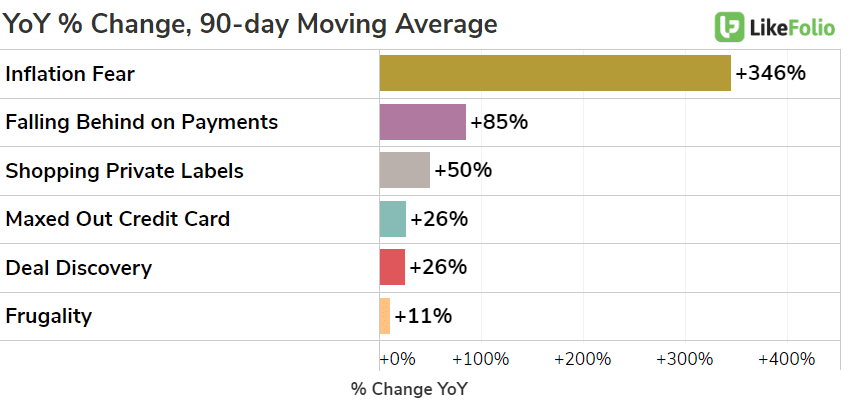

| While consumers juggle more subscriptions, they’re also feeling the strain from inflation. To put it bluntly, they’re trimming the fat. |

Consumers falling behind on payments are trading down for generic brands, hunting for deals, and becoming more frugal across the board.

And behavior changes are absolutely trickling into the world of streaming.

Namely, consumers are now playing the game.

Here’s what we’re watching unfold in the streaming sector, and how the major players stack up…

Consumers are getting smart about subscriptions

| We see strong evidence of content-based cancellations and renewals. |

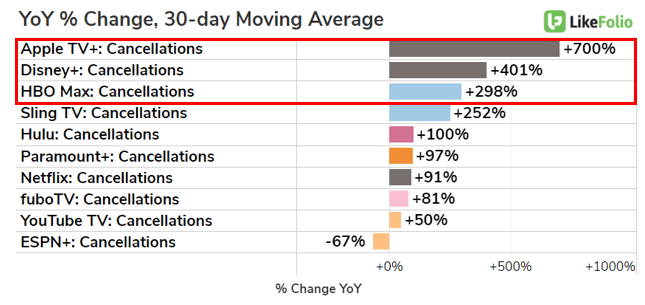

| This appears to impact Apple TV, Disney+, and HBO Max most significantly. You can see all companies logging extremely high rates of cancellation mentions on a YoY basis while new content lags. |

| Meanwhile, streamers providing live content, especially live sports, appear more insulated. Netflix is also outperforming peers comparatively, thanks to its wide library – though +91% increased cancellation rate is nothing to brag about. This brings us to our second key takeaway… |

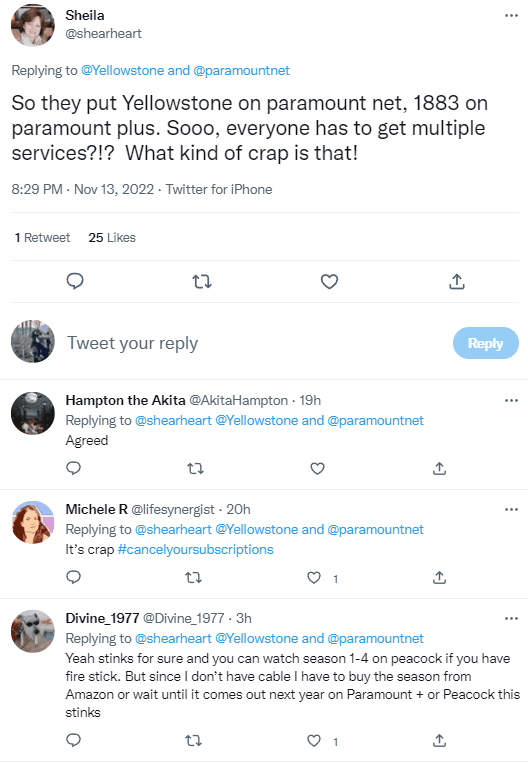

Streamers aren’t Loyal to Platforms, they just want Content

| Sunday’s Yellowstone Season 5 premiere was a prime example of consumers’ lack of platform loyalty. The event lured in 12.1 million live-plus-same-day viewers, its largest premiere yet.But what’s critical is HOW it achieved this record viewership. Aside from being generally good content, the series expanded streaming access. Yellowstone wasn’t ONLY launched on Paramount Network. It supported simulcast airings on CMT, TV Land, and Pop (and streaming channels who provide access to those channels) – thus, adding in more than three million extra viewers. While access was technically expanded, many consumers still expressed frustration and confusion related to how to watch. |

Bottom Line: the pressure is building

Consumers are getting wise to the streaming game, and they don’t have a personal connection with any provider.

Keep an eye out for streaming service consolidation over the next year, like the one we’re watching unfold with Discovery + and HBO Max, which will launch a new single interface in the spring of 2023.

These packaged buckets of content are likely to be well received by consumers, who care most about having a large library of quality content.

Near-term, we’ll be tracking cancellation mentions very closely. The New Year Resolution season is a prime time for consumers to cut low-hanging fruit weighing on their wallet.

Members can expect a streaming update to kick off the New Year as we watch this all shake out.