Kohl's stock was hammered in 2016 and 2017 as the […]

Department Stores: Investors are Warming Up, but Are Consumers?

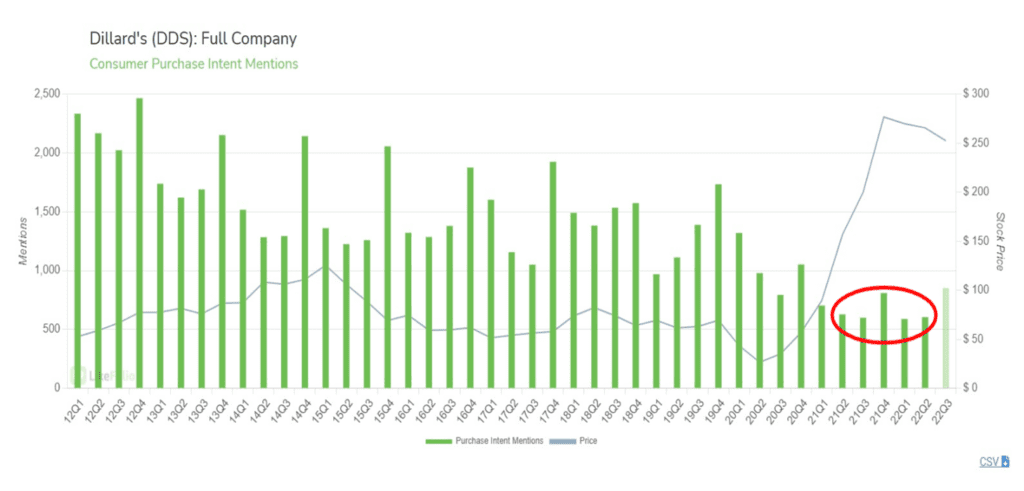

| When we saw Dillard's stock jump 20% after earnings, we wondered three things… 1. Is Dillard’s Becoming More Popular with Consumers? The Street was expecting Dillard’s Q2 sales to be flat compared to Q1. The good news: Sales actually went up 5% sequentially. The buzzkill: Comparable store sales were flat YoY. Earnings were a much different story. The department store chain crushed the consensus EPS estimate of $3.47 by almost 6 bucks! And despite an uptick in retail operating expenses tied to wage inflation, profits grew 6% YoY. Discretionary spending may not be dead just yet! But what are people spending on? Management noted particularly strong sales of cosmetics and men’s apparel & accessories. Translation: both the ladies and the gents like Dillard’s. Ok, so when we look at LikeFolio’s proprietary Purchase Intent (PI) mentions data we should see some pretty good activity. Eh, not so much. As the chart below shows, consumer PI mentions have dipped in recent quarters to their lowest levels in a decade. |

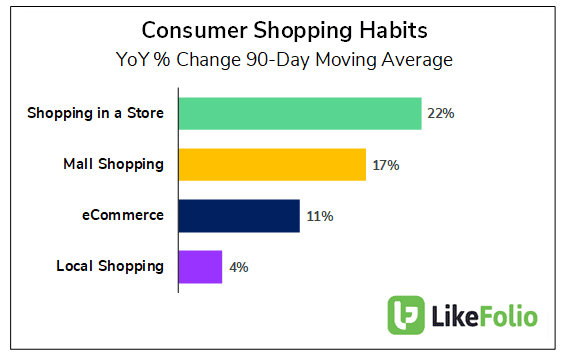

| The chatter around buying stuff at Dillard’s did tick up slightly in Q2 and is off to a good start in Q3—but doesn’t match the stock’s nearly 50% advance since June 30th. Management also stated that women’s clothing was the weakest performing category. Not great news considering women’s dresses and shoes take up much of the space on the website and in stores. In addition to its 250 ‘regular’ stores, Dillard’s operates 29 clearance outlets across its 29-state footprint. This leads us to believe that Dillard’s blowout quarter was more about clearing out discounted inventory for back-to-school shopping and the all-important holiday season (a la Target) than a seismic shift in consumer behavior. Like closeout sales, big earnings surprises are nice to see, but often not repeatable. To be fair though, Dillard’s leadership team deserves credit for cost control measures taken in an inflationary backdrop. Plus, dillards.com traffic picked up in June (and accelerated in July). Still, we just aren’t seeing the level of consumer interest that would suggest an extraordinary number of consumers are flocking to Dillard’s during the economic slowdown. This leads us to our second question… 2. Are Shoppers Really Returning to Department Stores? Department store operators are always staying on top of the latest consumer preferences—as are we. In the early days of the pandemic when e-commerce was the only show in town, social media discussion around online shopping exploded. But now that stores are reopened, is e-commerce still a go-to…or more of a sideshow? And what kinds of brick-and-mortar retailers are consumers gravitating towards, malls, national chains, mom-and-pops? Let’s check in with what the latest LikeFolio shopping habits data tells us. |

Yes, consumers are definitely spending more time in stores than they were at this time last year. Mentions of ‘Shopping in a Store’ are up 22% YoY on a 90-day moving average. Malls and local spots to a lesser extent, but overall, some healthy numbers for physical retail. eCommerce mentions are also up but may be fading.

Of course, most department stores have a significant online presence these days too. So, they should benefit from the positive trends in both on-premises and online channels.

Then again, maybe not.

Just because people are visiting stores and websites more often, doesn’t mean they are spending more.

The latest CPI reading revealed that although gas prices are on the decline, food, electricity, and rent are not.

With groceries prices still trending higher and gas prices still elevated, the discretionary slice of the spending pie is still probably quite limited for many Americans.

So, we have to take this shopping habit trend data with a grain of salt.

Back to the Dillard’s stunner.

Perhaps the market is underestimating the resilience of the classic department store and its customer base…

3. What Did We Learn from Kohl’s? Are we In-Store for Similar Results at Macy’s and Nordstrom?

As in any industry, not all department stores are created equal. As a smaller player, Dillard’s may not be our best guide.

Macy’s, which generates 4-times the revenue as Dillard’s, is probably the better bellwether. Kohl’s and Nordstrom’s also help cement the state of the department store.

Kohl's recent report suggests Dillards is doing a much better job navigating headwinds like macro-level high inflation and internal inventory management.

KSS inventory levels rocketed +48% YoY, attributed to investments in its Sephora beauty partnership and a strategy to pack and hold more goods. In addition, the company slashed guidance after signs of weakness from middle-class consumers who are trading down to lower-cost brands.

The end result: While the company beat revenue estimates, EPS fell -55% YoY sending shares tumbling.

Will the real department store benchmark please stand up?!

It’s possible that Dillard’s is just doing a superior job of navigating the current environment. After seeing Kohl’s latest report and the market’s reaction, department stores as a group certainly aren’t out of the woods.

In the coming days, we’ll hear from two more competitors. Macy’s & Nordstrom report on August 23rd. These are their respective EPS bogeys:

- Macy’s: $0.86 (-33% YoY)

- Nordstrom: $0.80 (+63% YoY)

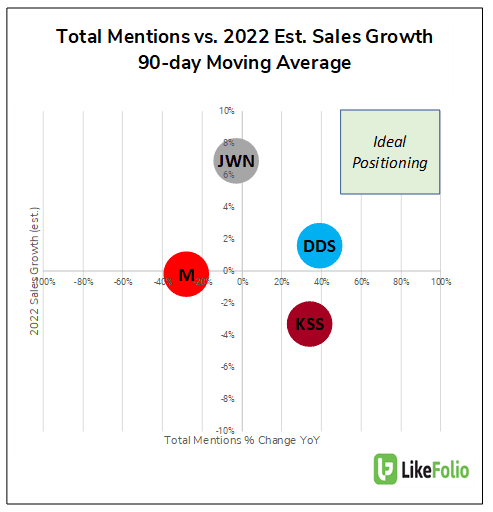

| Once again, a mixed bag. The bar is set low for Macy’s and relatively high for Nordstrom. Will they produce an earnings surprise to the magnitude of Dillard’s? Or another Kohl’s-like dud? Hard to say with consumer spending clearly on shaky ground and corporate expenses up. What we do know is that the social media buzz looks healthy for some, not so healthy for others. And when we compare that to what Wall Street is forecasting for 2022 sales growth, we gain insight into whether the consumer hype (or lack thereof) matches the market expectation. This chart plots each company’s growth in comprehensive consumer demand relative to the consensus full-year sales growth estimate: |

A bullish opportunity might arise from a company with high buzz growth but more modest sales growth.

Nothing stands out.

Nor does any company reside in the graph’s upper right quadrant where accelerating consumer interest meets above-industry growth.

Nordstrom, for instance, has strong projected revenue growth but lacks the consumer buzz to support it. Dillard’s and Kohl’s mentions are up nicely, but the corresponding sales trends are inconclusive.

Our conclusion: It’s too early to declare a department store renaissance.