PepsiCo (PEP) The quarantine 15 didn't materialize out of thin […]

Do Big Brands have a Private Label Problem? $KO $PEP

The last time I went to the grocery store, I left with only 3 bags.

I didn’t even need a cart to push out and load my bounty.

But my grocery bill was a different story.

Despite purchasing fewer items, it felt higher.

And I’m not alone.

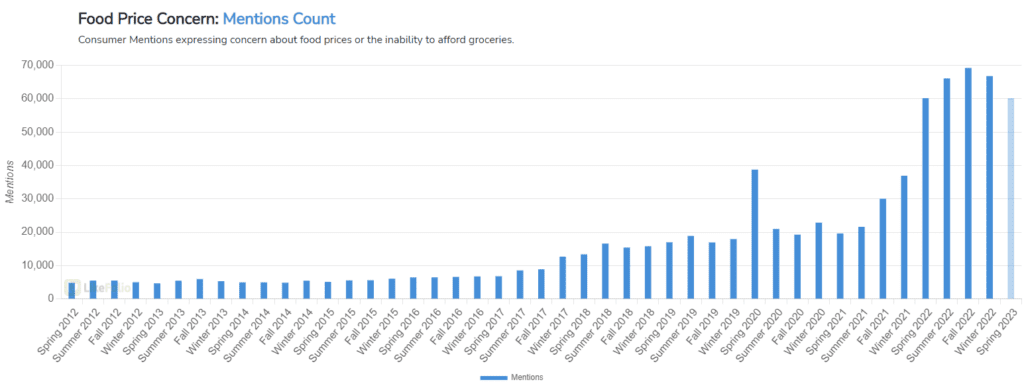

Between January 2022 and January 2023, grocery prices increased by +11.3%.

No wonder food price concerns among consumers remain more than +200% higher than they were 2 years ago.

When food prices started to rise at the end of 2021, companies blamed price boosts on increased costs on their end…namely the rising costs of ingredients.

But now that ingredient prices have settled, grocery prices remain high due to other factors including transportation and labor. And many food companies have forecasted that while price increases may slow or stall, they won’t head lower.

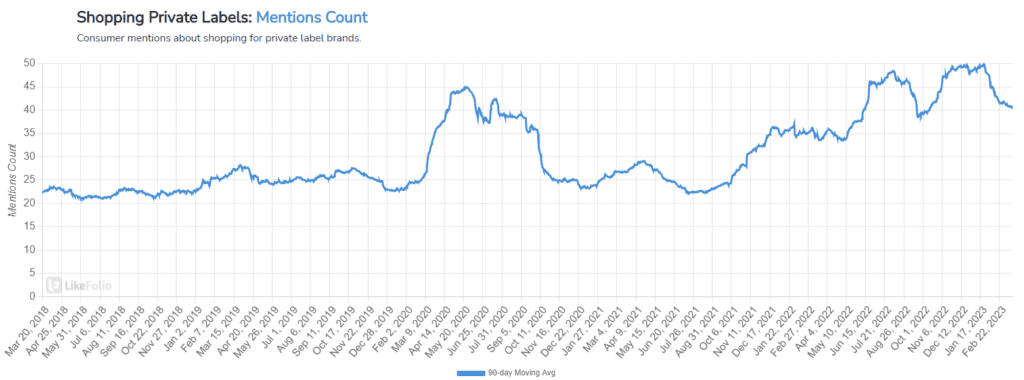

Persistent, elevated prices are leading many consumers down a cost-saving aisle: private labels.

Consumer mentions of purchasing a private label (generic) product reached all-time highs at the start of 2023 and are currently pacing +20% higher on a YoY basis.

This could have serious implications for “big brands” who have grown accustomed to passing along higher prices to the consumer. When the budget breaks, which brands are most likely to feel the pain?

We’ve got our eyes on two massive consumer staples: Coca-Cola (KO), and PepsiCo (PEP).

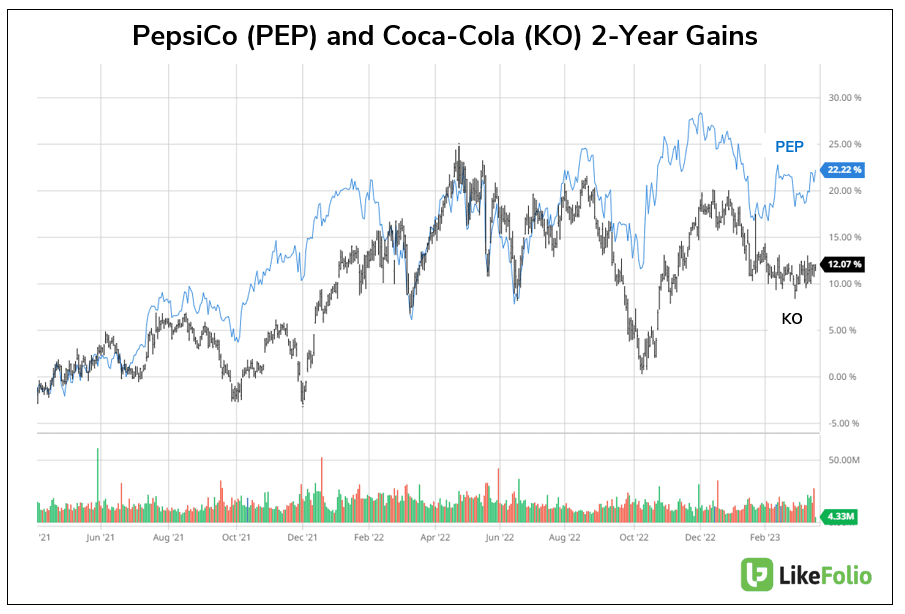

Over the last 2 years as food price inflation took hold, PEP and KO shares have posted double-digit gains (+22% and +12% respectively).

How? Price increases buoyed a slide in volume (overall demand).

Looking ahead, one name appears to be garnering a slight advantage vs. its well-known peer.

Here’s what we’re watching:

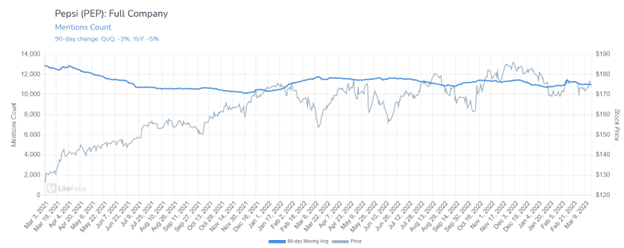

PepsiCo (PEP) Demand Slides As the Company Eyes Additional Price Increases

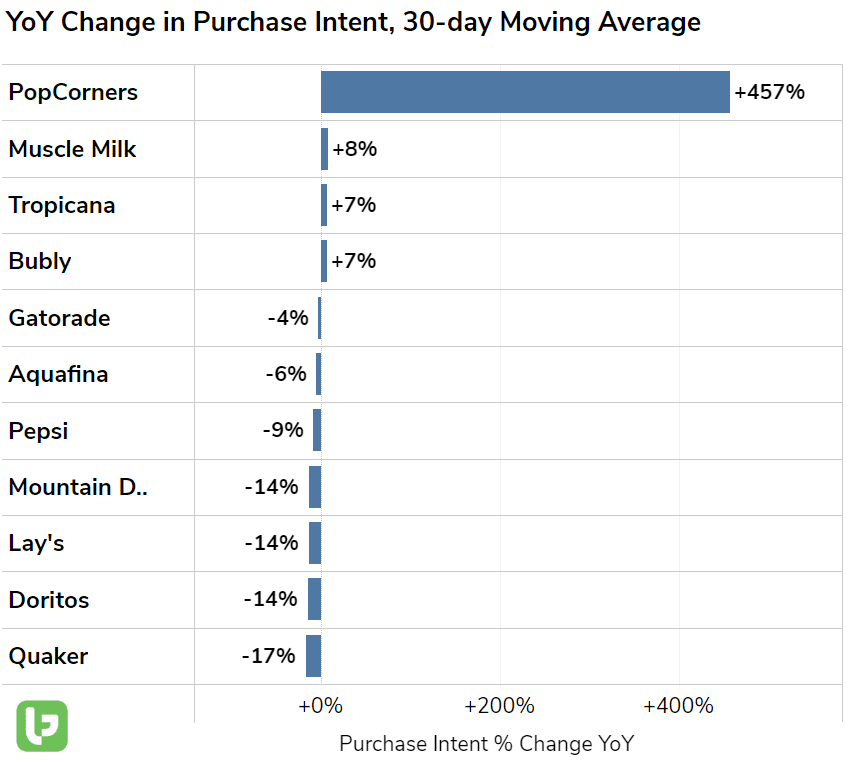

Consumer mentions of PEP products ranging from the “eetos” (Cheetos, Doritos), to Bubly, to Pepsi’s classic soft drinks have slid -5% lower YoY.

Last quarter, PepsiCo acknowledged its elevated pricing plan was hindering consumer demand: volume fell -2% across its foods business worldwide.

LikeFolio data shows persistent weakness in volume on PepsiCo’s snacking front.

Quaker product demand has slipped significantly (-17% YoY), and chips are losing traction on a volume front – check out Dorito’s and Lay’s below.

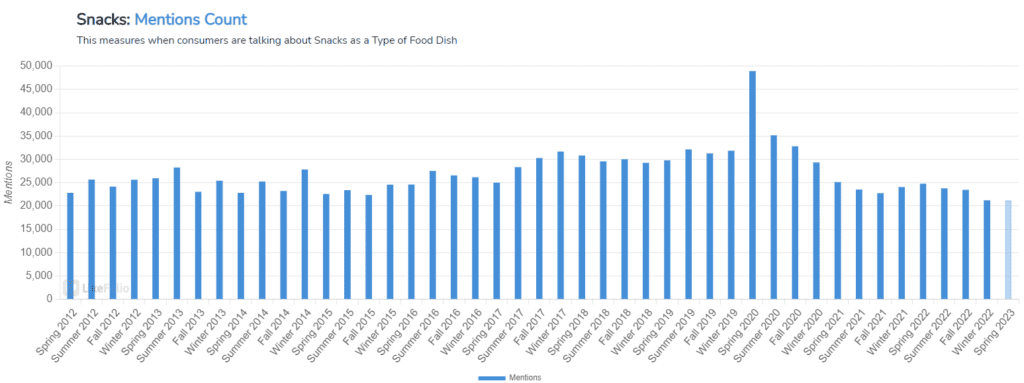

While this snacking exposure has given PEP a leg up vs. KO over the last few years as many consumers opt to eat at home, the momentum is waning.

Snacking mentions have slipped by -13% YoY.

Especially as more people realize that going out to eat may actually feel more affordable vs. at-home consumption.

This makes sense when you consider that at-home food pricing has increased by more than +11% YoY compared to just over +8% for food purchases in restaurants.

PEP expects its brand power to remain resilient in the near term, though it did indicate on its last earnings call that economic headwinds could rise in the second half of the year.

Analysts will be expecting an improvement in PEP margins as the prices of commodities like wheat and corn fall.

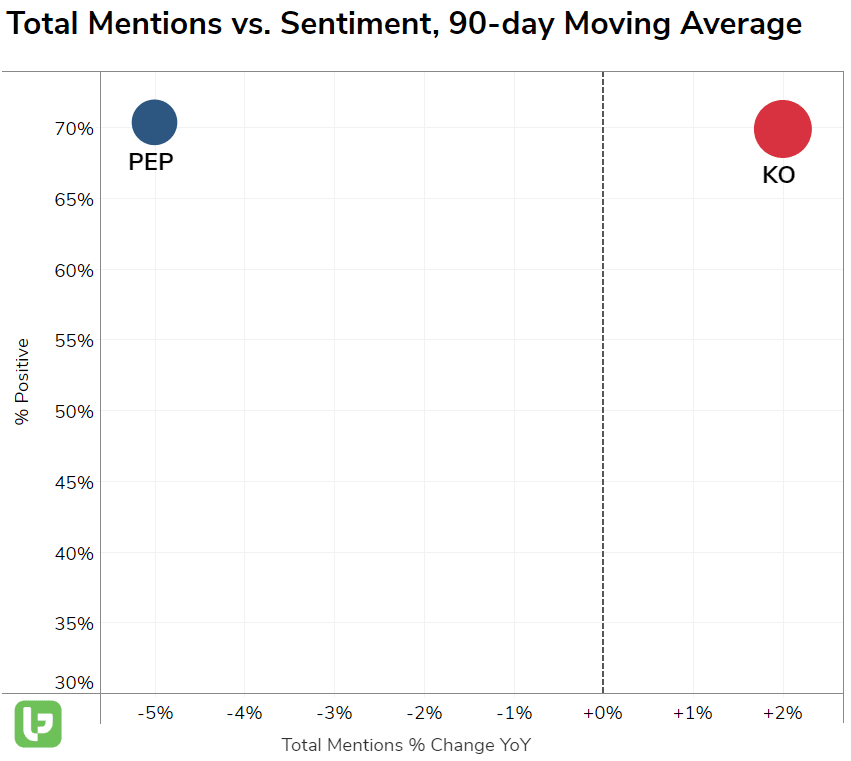

But at LikeFolio, we’ve got a close eye on consumer sentiment. Pepsi happiness levels remain consistent at 70% positive, right on par with Coca-Cola.

The bad news: PepsiCo had a +3 point edge vs. Coca-Cola 2 years ago.

This could be the first sign that the company is losing some of its pricing power.

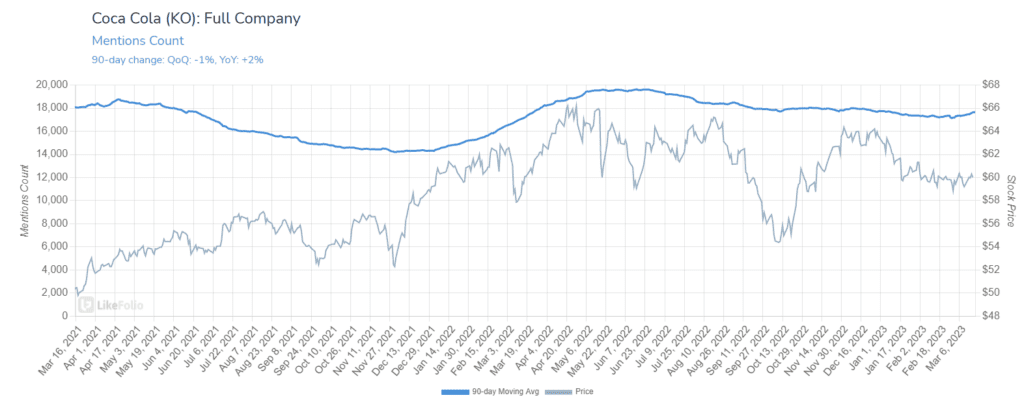

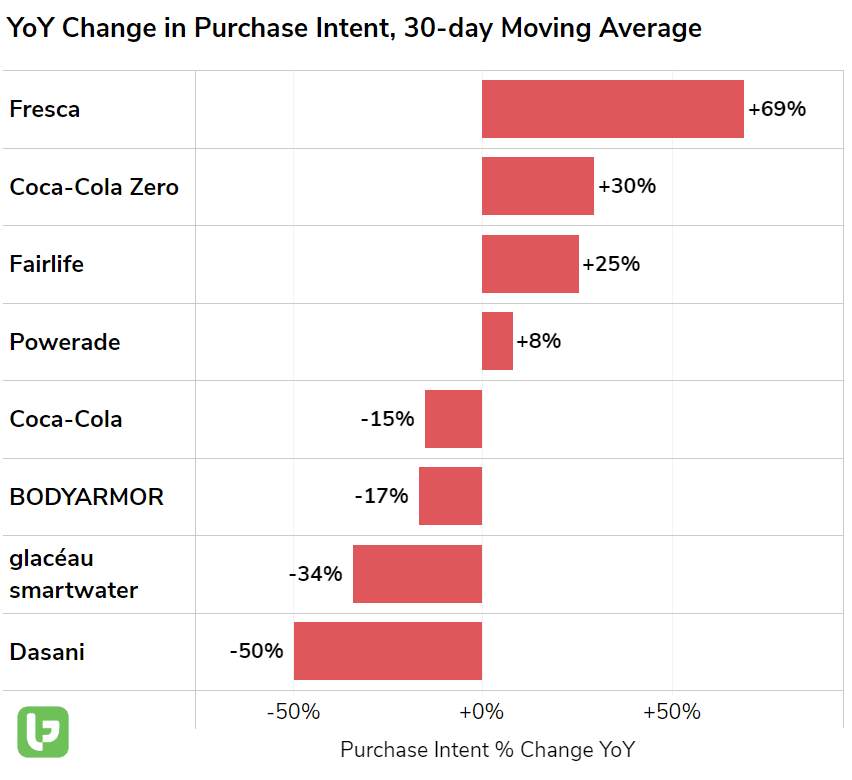

Coca-Cola Brand Power Grows

While PepsiCo’s snacking division faces a buzz and demand slowdown, Coca-Cola is posting surprising buzz growth.

Demand for a wide range of products is helping to boost mention volume, including Fresca, Coke Zero, Fairlife milk, and Powerade.

And Coke isn’t spared from the same inflation-driven problems plaguing Pepsi.

Last quarter, higher prices translated to a -1% drop in volume, driven largely by softness in Europe.

But Coke’s long-term strategy differs a bit from Pepsi’s.

On its last earnings call, KO noted it hopes to maintain volume growth alongside price mix thanks to affordability measures:

“Within the RGM [revenue growth management], we have, as one of our objectives, to maintain consumers within our franchise by leveraging our pricing and packaging strategies to support affordability around the world to keep the lower -- perhaps lower-income consumers in the franchise, which, of course, is to some extent an underpinning on volume. We prefer that as a strategy than to have more price and less volume. So, again, our central view is to see continued level of unit case growth in the second half with obviously a moderating price/mix to get to the overall revenue.”

This has translated to improved happiness levels for Coca-Cola products.

Bottom line: PEP shares have outperformed KO thanks to its diverse product line including snacks and its ability and proclivity to pass along price increases to consumers.

However, this balance of power may be shifting.

- KO has closed the 3-point happiness gap with PEP over the last 2 years, a long-term bullish tailwind.

- PEP volume levels are dropping at a steeper clip vs. KO in part due to its snacking exposure. Consumers are showing less interest in snacking (-13% YoY) and more interest in private label brands (+20% YoY).

- KO has a margin edge vs. PEP. Coca-Cola’s operating margin was roughly 29% of sales in 2022 compared to PepsiCo’s 13%.

These factors could translate to a larger long-term opportunity for KO vs. PEP over the next year.

We’ll be monitoring through the end of the 1st quarter for continued signs of volume slides and any sentiment degradation.