Here are some stocks that the LikeFolio team is watching […]

Does SoFi have a growth problem?

SOFI reported earnings before the bell yesterday (April 29) and the market didn't like what it saw.

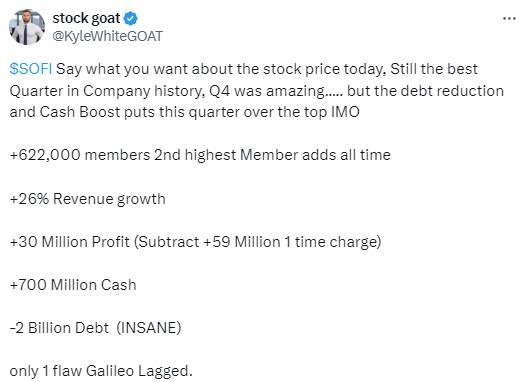

At first glance, it's a headscratcher. SoFI reported:

- Second consecutive quarter of profit (2 cents a share)

- Revenue +37% YoY to $645 million, besting expected $555.3 million

- Raised guidance, revenue now expected betwen $2.39 billion and $2.43 billion in FY'24

What gives?

We think the answer somes down to this question: Is SoFi just another bank, or is it an actual tech/digital wallet play of the future?

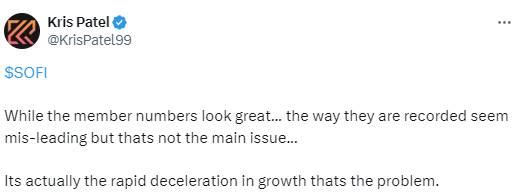

Right now, the company's growth deleration has investors wondering if it should really be labeled "bank" and be valued as such.

This X user highlights this point, with some data to illustate the slowdown:

The company's "unispiring" call didn't help to quell investor fears about its growth prospects.

Some investors are betting on the transformation of the company's target marked, expanding beyond student loans.

But near-term its clear -- even the "best quarter in the company's history" couldn't push its stock higher, as Wall Street grows impatient.

We are betting on SOFI becoming far more than just a bank, and will add shares on dips like these, but acknowledge that the company needs to recover its user growth momentum and continue to execute on those users BEING MORE PROFITABLE than traditional banking customers.

Two "loyalty" tests are happening in parallel -- is the SOFI customer actually loyal enough to be highly profitable for the platform down the road, and are SOFI shareholders loyal enough to take that bumpy ride to find out?

We've got a close eye on growth and the company's long-term vision.