Lowe's (LOW) Home Depot is trading ~3% lower today after […]

Eyes on Home Depot & Lowe’s This Week ($HD & $LOW)

Home Depot shares are sliding today following the company’s Q4 and FY21 report.

While sales grew by +11% YoY, topping Street expectations, HD shares fell -7% in tandem with the overall market amid Russia-Ukraine fears.

Now, investor eyes are shifting to Lowe’s ahead of its Q4 report Wednesday before the bell.

Here’s what we know:

- LikeFolio members have already profited from a LOW bullish alert issued in May 2021. Shares traded as much as +35% higher through December, and continue to trade at higher levels, despite the stock’s recent pull back.

- LOW shares are trading -3% lower today, alongside the broader market decline.

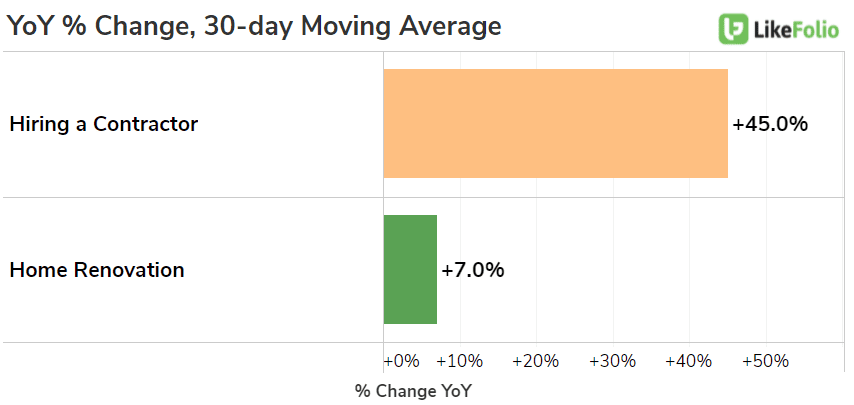

- Macro trend data suggests both HD and LOW can continue to benefit from increased consumer activity in DIY home renovation and contractor-driven renovation.

Home Depot has an advantage here, due to its contract business exposure. Nearly half of Home Depot sales are generated from professional customers. In contrast, only ~25% of Lowe’s sales are from professional contractors.

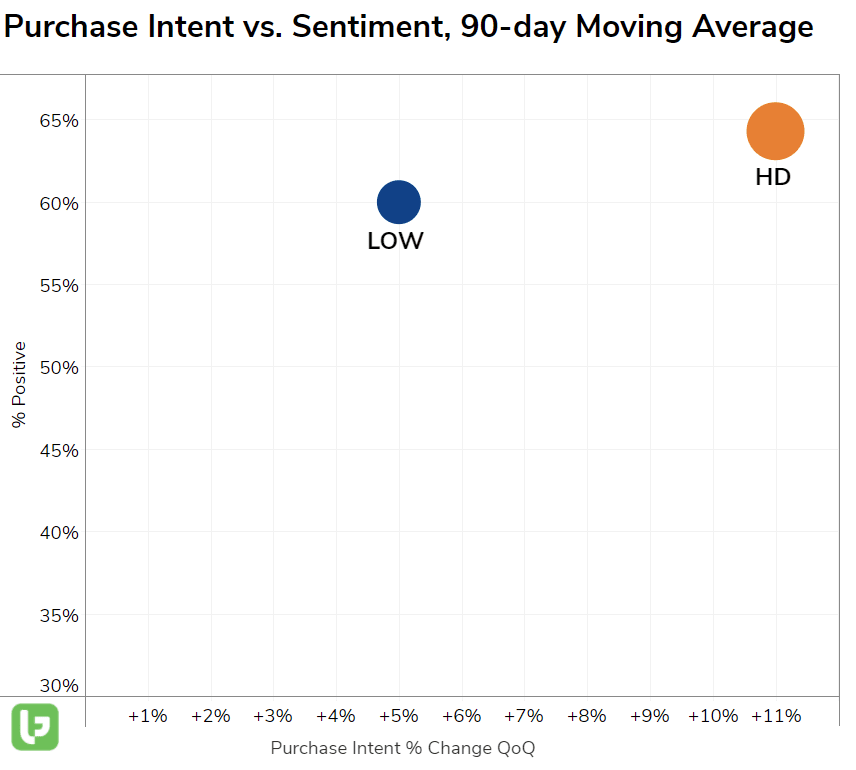

In addition, LikeFolio data shows relative outperformance from Home Depot among consumers. HD Purchase Intent mentions are growing at a higher rate vs. LOW, and HD sentiment remains 4 points higher, too.

We expect home improvement demand to continue to support sales growth for both names moving forward, and anticipate a strong Q4 report from Lowe’s. However, it’s important to stay risk-defined this week alongside market volatility.