Inflation Fears are Rising Today the Labor Department released its Consumer […]

Food Inflation Begins to Bite

Not that long ago, we spoke about discount stores and how despite inflation surging, consumer demand for companies such as Dollar Tree and Dollar General were yet to see any significant rises.

However, inflation has continued to rise.

Inflation remains near 40-year highs...and in April, wholesale inflation increased 11% YoY.

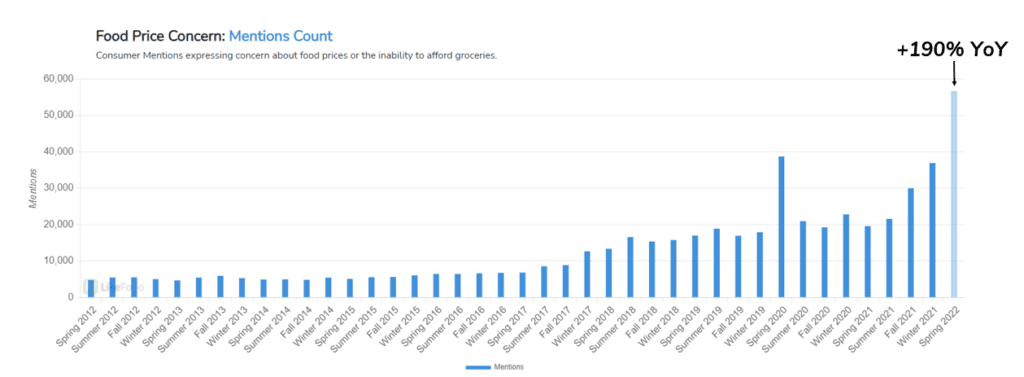

According to LikeFolio data, food price concerns are now on course to hit a new all-time high, smashing the previous Spring 2020 record.

If consumer mentions of concern about food prices (or the inability to afford groceries) continue on their current trajectory, they will close at +54% QoQ and +190% YoY.

Of course, food prices are not the only concern... Gas price worries are at a whopping +287% QoQ and +529% YoY.

Inflation-related fears are everywhere.

Although, surprisingly, supply chain fear mentions have decelerated slightly at -16% QoQ.

If supply chain fear mentions correlate with an actual reduction in supply chain challenges, will we see inflation begin to ease?

Following the latest CPI data, Business Insider wrote, “The recent print reflects the first slowdown since August and a sign that the country is past peak inflation.”

Of course, the decrease in consumer mentions of supply chain fear does not mean supply challenges are behind us, but just maybe, it is a sign of easing.

However, that is just speculation.

Anyway, back to the discount stores…

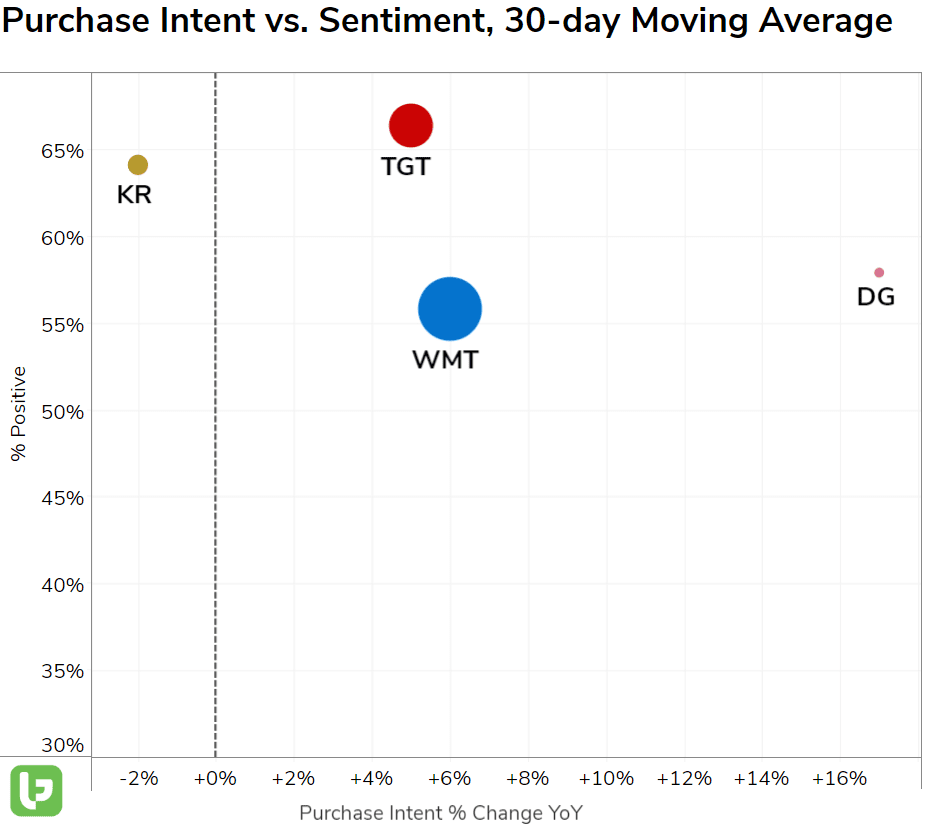

With frugality mentions edging higher at +7% QoQ and +15% YoY, it was just a matter of time before we started to see Purchase Intent mentions for discount stores such as Dollar General rise.

Based on a 30-day moving average, Dollar General is outpacing Target, Walmart, and Kroger when it comes to demand, with Purchase Intent trending +17% YoY.

Discount store competitor Dollar Tree is at +22% YoY, while Five Below is at +4% YoY.

They aren’t pulling up trees just yet, but there has been a positive shift in discount store demand since our last update.

With inflation showing no sign of letting up, we can only assume the demand growth in discount stores will continue.

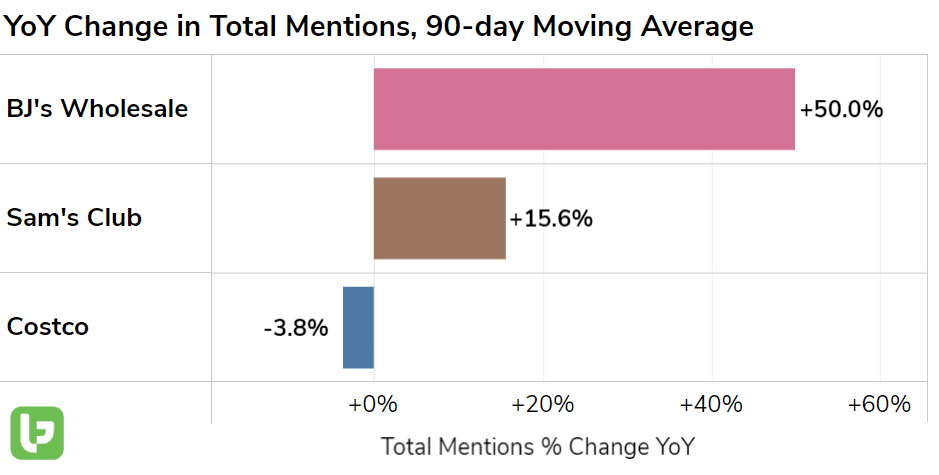

The same can be said of membership only big-box retail stores which we wrote about earlier this week.

BJ’s Wholesale is clearly leading the way in terms of Total Buzz mentions, but Sam’s Club mentions are also gaining.

With BJ’s said to be cheaper than Costco in many cases, that may explain the reason why it is steaming ahead.

Either way, it seems like Consumers are aiming to make bulk savings.

The data is revealing that food inflation is starting to bite...

And when it comes to consumer staples, customers are beginning to edge towards cheaper alternatives.

Landon spoke about this yesterday on the TD Ameritrade Network.