When social-data and stock price are moving sharply in opposite […]

Inflation Hit Ecommerce Shoppers Are Focused on the “Value Option”

The eCommerce sector found an extra gear during the pandemic.

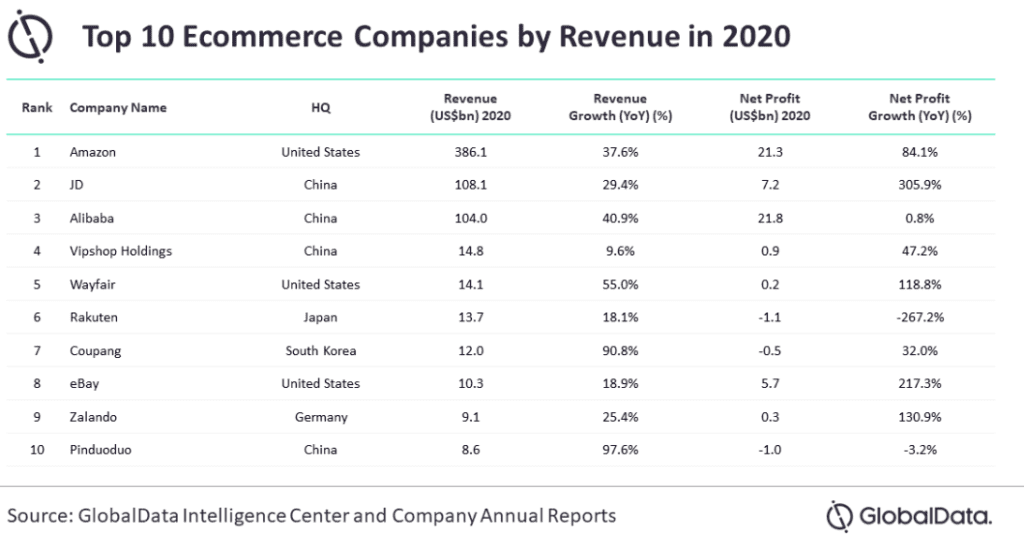

That new gear saw companies like Amazon, Alibaba, and Wayfair flourish. Below you can see a chart of the top 10 eCommerce companies by revenue in 2020…

Amazon’s net profit jumped 84.1% YoY, while Wayfair’s grew 118.8%.

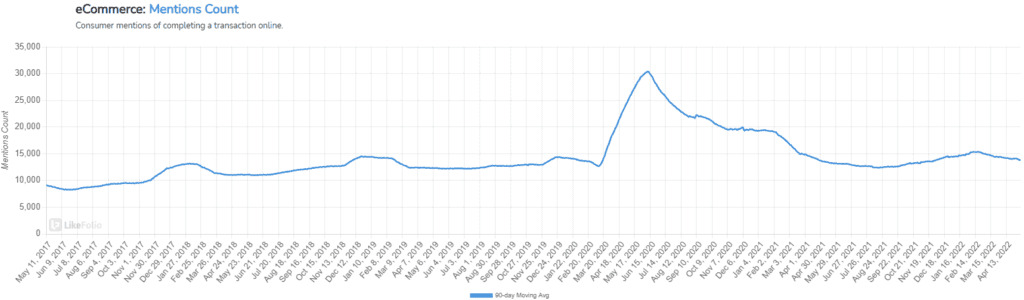

We can see the massive uptick in eCommerce customers via our data on consumer mentions of completing transactions online.

Between March and June 2020, there was a massive jump.

Ecommerce sales grew by $244.2 billion or 43% in 2020, rising from $571.2 billion in 2019 to $815.4 billion in 2020.

But now, as LikeFolio data shows, the eCommerce trend is approaching pre-pandemic levels.

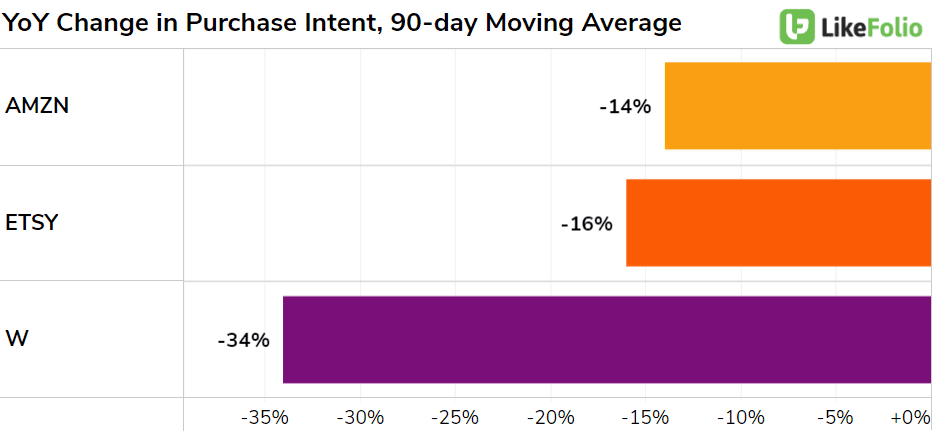

Purchase Intent for Amazon, Wayfair, and Etsy are all decelerating.

However, there is one area of eCommerce that is experiencing growth.

Resale websites.

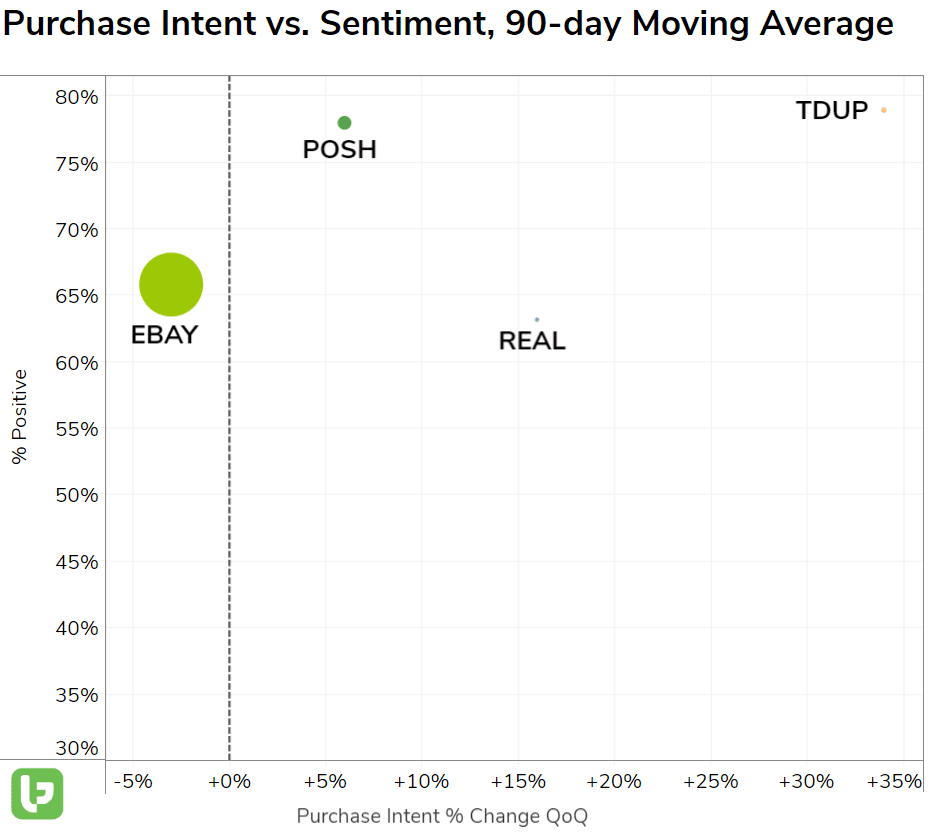

We are seeing an acceleration in PI growth for commerce sites where users can buy and sell new and used clothing.

But, the traditional and probably best-known resale site, eBay, is lagging.

Poshmark, TheRealReal, and Thredup are outpacing eBay and larger eCommerce peers when it comes to Purchase Intent growth over the last quarter.

It may be that current inflationary pressures are forcing consumers to look for high-quality goods at a lower price.

ThredUp, which is leading the pack, is an online thrift store where you can buy and sell second-hand clothes. The company states on its site that consumers can find their favorite brands at up to 90% off.PI mentions for TDUP have remained elevated for a considerable period.

There was a risk, following the pandemic that demand would decline.

But that isn’t the case, with TDUP’s PI on course to jump +10% QoQ in the current quarter. YoY, it is on track to close -1%.

Meanwhile, Consumer Buzz is trending +8% QoQ and +7% YoY.

The company reported a record of 1.7 million Active Buyers in Q1 and Orders of 1.6 million, representing growth of 33% and 45% year-over-year, respectively.

Maybe it's not the eCommerce sector that is decelerating, but eCommerce sites with pricier items?

It's something The RealReal’s founder and CEO Julie Wainwright touched on in the company’s Q1 earnings release Tuesday, May 10th…

“We continue to see strong demand in our business despite recent geopolitical events and uncertainty surrounding macroeconomic trends,” stated Wainwright.

“In fact, as inflation has ramped and prices have increased in the primary (i.e., new goods) luxury market, we believe The RealReal is a demonstrated value option offering unique and highly coveted items in our online marketplace,” she added.

On current evidence, Wainwright is correct. The inflation headwind is fueling growth in resale sites as consumers hunt for luxury goods at discount prices.

Whether that will continue as inflation remains near 40-year highs, is another question.