This week's Sunday Earnings Sheet is off to a good […]

Dollar General’s Demand Yet to Feel the Inflation Impact?

With inflation sitting at a 40-year high and predictions for it to continue rising for some time, you might expect demand for discount stores to increase with it.

However, according to LikeFolio data, people aren’t clamoring for discounted items.

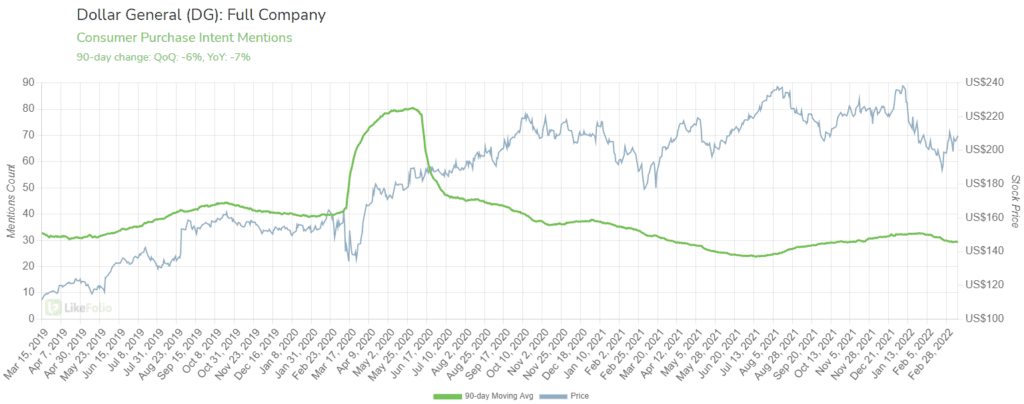

Take a look at Consumer Purchase Intent Mentions for Dollar General…

The company, which is set to report earnings this week, is experiencing a demand decline, with Purchase Intent Mentions trending -6% QoQ and -7% YoY.

We don’t know about you, but we expected a bit of a surge.

The spike you see back around the beginning of the pandemic (March 2020) is due to Dollar General stores running out of toilet paper and customers taking to Twitter to tweet their disappointment…

Not really sure what else to add to that, but the word “bonkers” comes to mind.

Now, if we look at the data split into quarters, there was a slight rise in Q4, +11% QoQ, but nothing that suggests consumer behavior has drastically changed course.

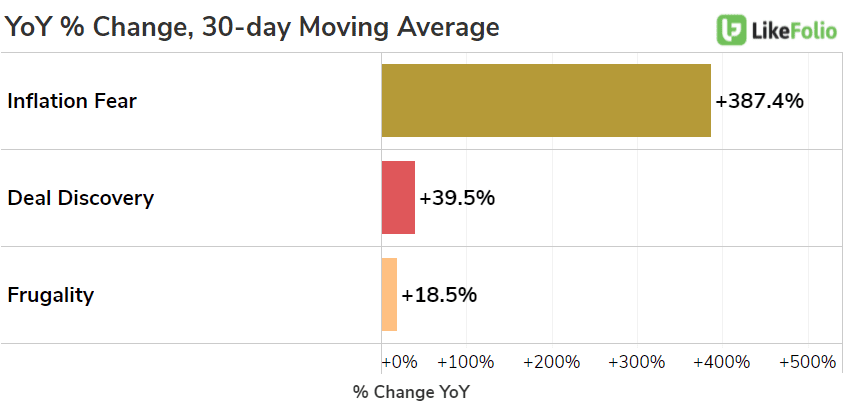

Anyway, looking at current trends, we can see Inflation Fear, Deal Discovery, and Frugality are all up year-over-year.

But, overall Mentions of Dollar General are trending -9% QoQ and -9% YoY.

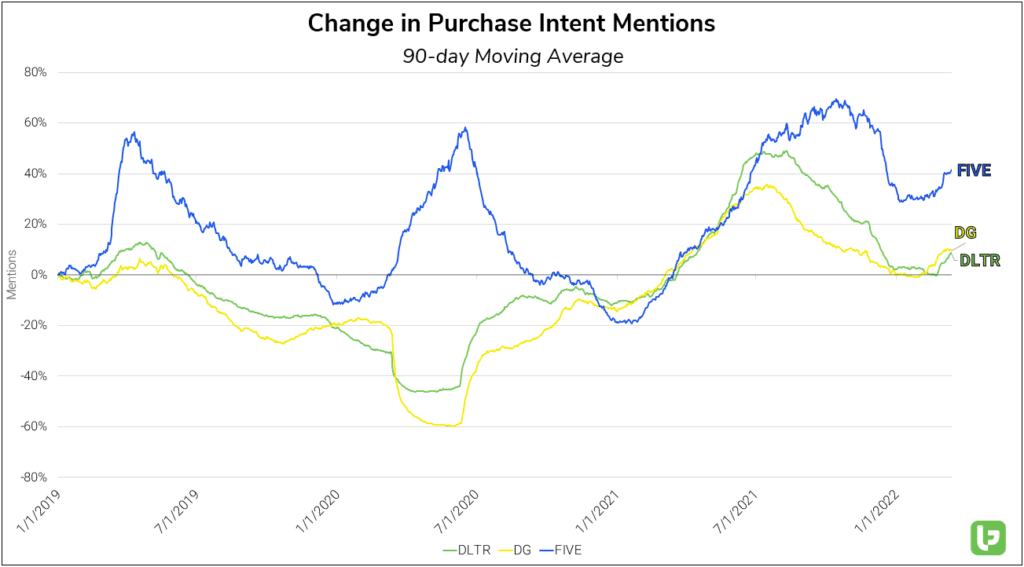

And it's not just DG that has yet to see a Mentions pick-up, with other discount stores such as Dollar Tree, or 1 Dollar 25 Tree as it's otherwise known, and Five, also yet to see a spike.

What does this mean?

Are we yet to feel the full impact of the inflation surge? Or rather than a surge in demand for discount stores, will we see a gradual rise as more and more people gradually tighten their wallets?

Those questions are, of course, difficult to answer, and it's something we will delve further into in the coming weeks, but for now, while there was a demand rise for DG during Q4, LikeFolio data doesn’t suggest revenue will provide any massive shocks.