When social-data and stock price are moving sharply in opposite […]

Tastes Great, WAY Less Filling -- Hard Sparkling Is Dominating The Alcohol Industry

Drinker’s tastes and priorities are shifting in a major way. Beer, wine and mixed drinks have traditionally dominated the adult beverage industry, beer being the front-runner.

But the low-carb movement is shaking up the industry as consumers shift to healthier alternatives, especially hard sparkling water:

The chart above shows increased purchase intent mentions for consumers drinking and purchasing hard sparkling water. This surge, coupled with impressive sales numbers for hard sparkling water brands in 2018 indicates strong growth across the board.

What's driving this shift in consumer behavior?

Carbs. Health-conscious consumers are avoiding sugars more and more, especially in their drinks. Nicole sums it up nicely here:

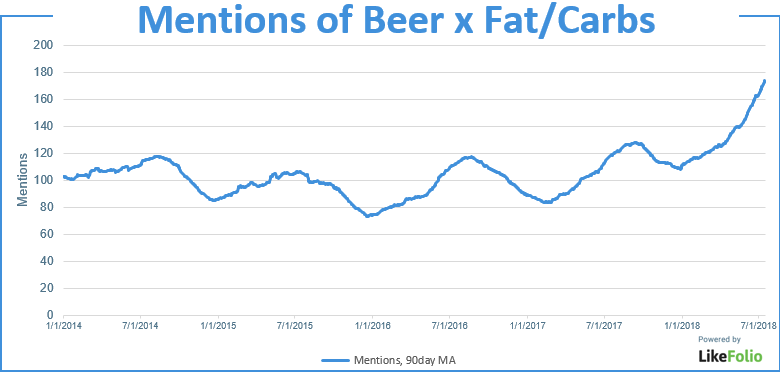

To investigate this trend towards health-conscious decision making, we looked deeply at consumer tweets that mentioned both beer and either "fat" or "carbs":

As you can see, the volume of tweets showing concern for beer's nutritional value (or lack thereof) has risen dramatically, with an especially sharp increase in mentions within the exact time frame that hard seltzer mentions began to skyrocket.

This becomes even more striking when we look at Purchase Intent for the dominant low-carb beer, Michelob Ultra, against newcomer and leader of the hard sparkling movement, White Claw:

Obviously, both brands are growing... another sign that the low carb movement is impacting alcohol sales. But it's the dominant growth of White Claw that really stands out, and threatens legacy brewers.

Who's winning the hard sparkling race so far?

White Claw (Mark Anthony Brands), Truly (Boston Brewing Company: $SAM), and Henry’s Hard Sparkling (Molson Coors: $TAP) were all launched in 2017 as a response to Anheuser-Busch ($BUD) purchasing SpikedSeltzer.

While White Claw is the early leader, here's a look at how some of the other hard sparkling beverages are performing in terms of consumer purchase intent mentions. We can see that Truly, SpikedSeltzer, and Henry’s Hard are showing record numbers this summer even before their traditional seasonal peak... further confirmation that this trend may just be beginning!

Who are the early adopters of hard-sparkling drinks?

Tweet analysis shows growth can be attributed to the successful targeting of consumers: young, mostly female, health-conscious, and “basic”. Alcoholic Sparkling Seltzers have found their way onto college campuses around the nation and the young people drinking them are more than willing to share their experience online.

However, It appears that the industry’s demographic of early adopters (young females) could also be a weakness. The drink has been proclaimed “feminine” by many on Twitter, and this conception could be putting a damper on potential sales as men could be reluctant in purchasing the product.

Key takeaways

- There is a clear consumer preference for healthier alcoholic beverages. People are avoiding carbs in their drinks, and hard sparkling drinks fill the need.

- Men will need to be exposed more to hard sparkling water, and adopt it as a drink of choice, in order to transition from a new trend in the alcoholic beverage industry into a full-blown movement.

Will the rise of White Claw and other hard sparkling water brands hurt revenue for major alcoholic beverage companies? At this point it is hard to say.

It will be interesting to see if $BUD, $SAM, or $TAP will make any more moves to expand their current hard sparkling water products, as Truly and SpikedSeltzer have introduced new flavors to their product line. With the growth that this industry has seen over the last three years, next summer will be key in telling if this was just a flash-trend or if it is something that is here to stay.

How it works

LikeFolio analyzes social media data for shifts in consumer trends on Main Street before it becomes news on Wall Street. Our members get access to this timely and accurate data via Opportunity Alerts and On Demand Research to help guide their investments and active trading.

We offer a the free LikeFolio Letter as well as premium memberships.