Carnival Cruise Lines is starting to show some weakness in […]

Has the Omicron Variant Spooked Travelers?

Has the Omicron Variant Spooked Travelers?

Nope. Here's what that means for cruise liners...

Cruise line stocks popped last week following the release of positive news regarding the omicron coronavirus variant's severity and vaccine effectiveness. While omicron variant fears have dominated news headlines since Thanksgiving, consumer mentions remain muted: -18% lower vs. delta variant fears. Not only do mentions remain well below concern levels recorded after the delta variant was discovered, but other consumers behaviors confirm consumers aren't spooked. Consumer mentions of surrounding travel continue to show signs of normalization.

- Booking a Cruise: +18% YoY

- Booking or Taking a Flight: +14% YoY

- International Travel Mentions: +12% YoY

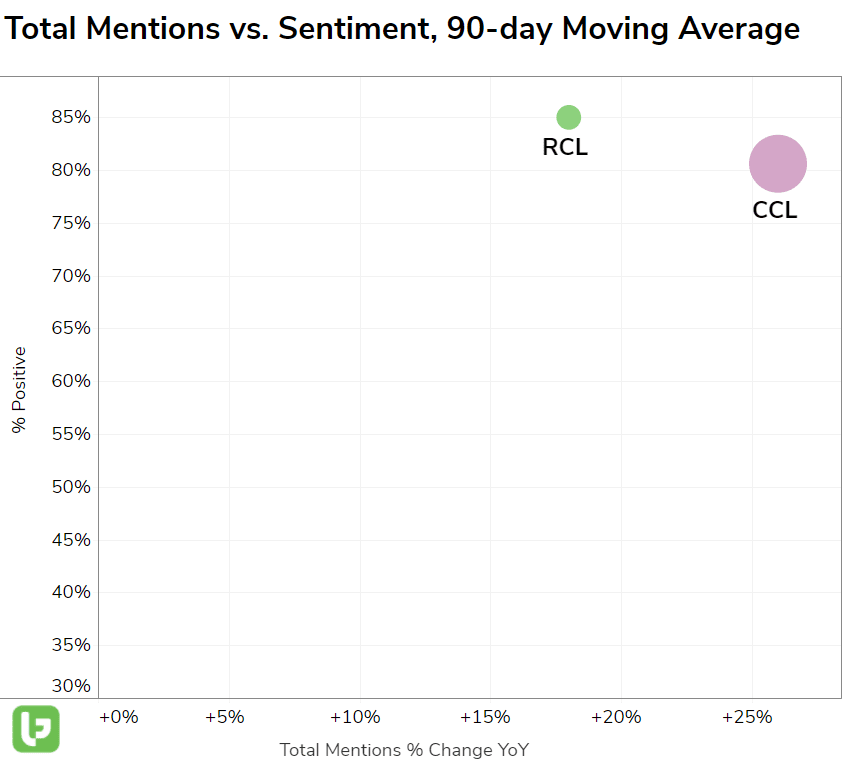

Industry reports confirm LikeFolio data: consumers are warming up to cruises again. According to survey data from travel advisors, 40% of cruise transactions accepted by advisors in the last week were for cruise departures within the next 100 days. Typically, bookings are much more forward-looking. In addition, consumer satisfaction for recent cruises is higher than ever as consumers report elevated levels of service and cleanliness. Analysis of two major cruise lines, Royal Caribbean and Carnival, show both companies are gaining steam in demand and happiness.

Royal Caribbean, the "luxury" cruise liner is maintaining higher levels of Consumer Happiness vs. its "family fun" peer, Carnival, but is lagging somewhat in demand growth. However, both companies show improved levels of consumer happiness, a positive indicator for future bookings. RCL happiness has improved +6% YoY and CCL happiness has improved by 14% in the same time frame. While generic "booking a cruise" mentions have not normalized to pre-Covid levels, mention volume for RCL and CCL fare better. In fact, Carnival Cruise demand levels have actually reached those recorded in 2019. Earnings aren't on deck this week, but LikeFolio data is trending in a positive direction.. We'll continue monitoring both companies into "Wave Season" -- i.e. peak booking season for continued momentum. This typically runs from mid-January to mid-March each year. For now, we are noting significant outperformance by CCL, though the recovery tide is lifting both boats.