How we nailed $TSLA earnings

Wednesday, I discussed Tesla (TSLA) ahead of earnings with Tom and Kevin on the TD Ameritrade Network.

LikeFolio data has been very predictive of TSLA’s success and for years has been mostly bullish. This continued during the show on Wednesday as TSLA came in with an earnings score in the +38 to +46 range (depending on when you cut it off).

Model 3 has been dominating mentions of TSLA vehicles.

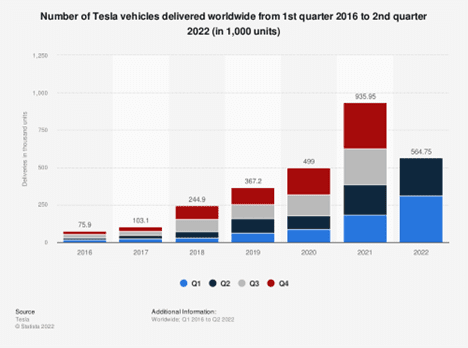

But what was most likely on investors' minds was delivery ability.

Can Tesla actually produce the vehicles in time to satisfy demand?

I made the case that this concern was overblown and that demand was the key for this company.

With consumer demand booming, Tesla was going to be just fine.

If investors got it wrong and sold off on what we knew would be a solid report, I was ready to pick up shares at a lower price, but as LikeFolio predicted, they beat expectations, and the stock traded higher.

New Entrants are joining the growing EV market all the time. One of these new entrants is Canoo, trading under the ticker GOEV (nice).

Canoo has a similar business model to that of Rivian (RIVN), as both companies started by developing a rolling chassis (Rivian calls it a “skateboard”) which can be utilized as a base for various styles of electric vehicles.

Canoo has plans to produce a sedan and pickup truck in the future, but right now, it's focused on selling to other businesses, with the ‘Multi Purpose Delivery Vehicle’ (MPDV) scheduled to begin production in 2022.

Walmart (WMT) has already placed an order for 4500 MDPVs, drawing further parallels to RIVN, which recently teamed up with Amazon (AMZN) to produce a fleet of electric delivery vehicles.

We just added GOEV to our coverage list and will continue to push new up-and-coming participants in the EV space.

Enjoy!

Landon Swan

founder, LikeFolio