Snapchat's IPO timing was...well... incredible. They literally took the company […]

Snapchat (SNAP) has a Model to Prove

In May Snapchat broke some tough news to investors: the company was on track to miss earnings and revenue estimates in the second quarter, stating "the macroeconomic environment has deteriorated further and faster than anticipated."

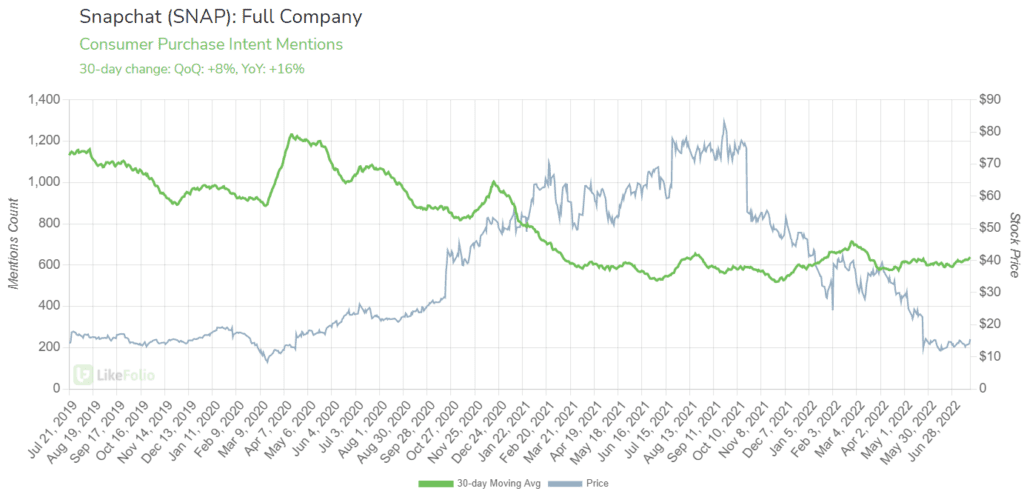

SNAP shares plunged and have continued to shed value, currently trading almost -80% lower than they were a year ago.

What's going on?

Advertising forecasts have weakened, Apple privacy changes decreased the efficacy of digital ad targeting, and major players like TikTok are stealing eyeballs on devices.

TikTok recently passed Snapchat as the favorite app among teens.

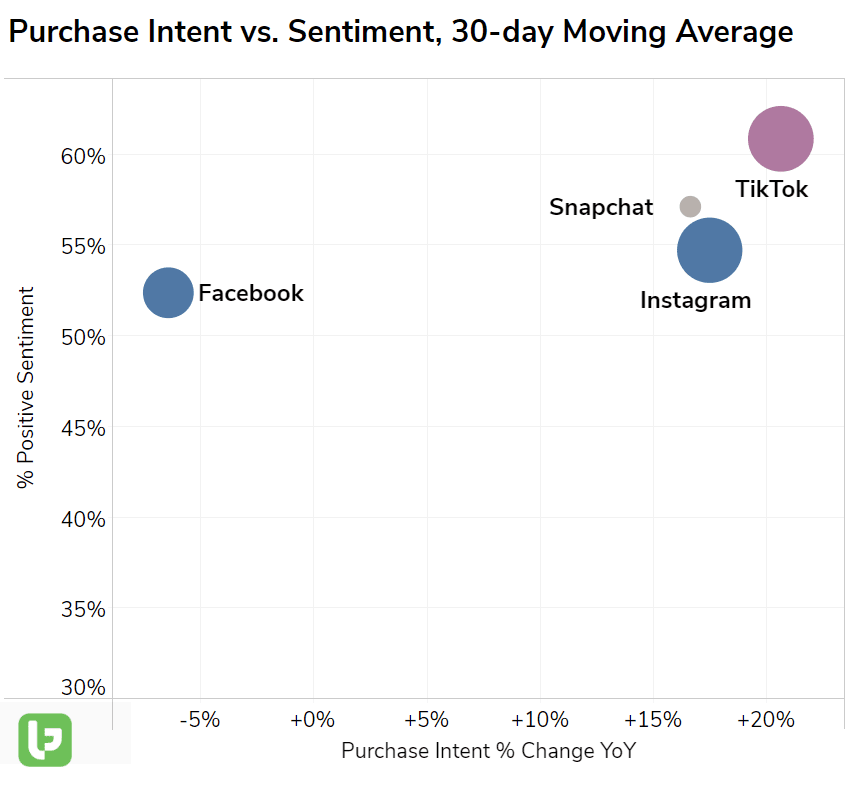

You can see this in action on the LikeFolio chart below, highlighting demand growth alongside consumer happiness.

So -- is all hope lost for Snapchat?

Not yet.

LikeFolio data does show near-term traction in Snapchat usage and download mentions, rising +16% higher on a YoY basis and bucking a multi-year downtrend.

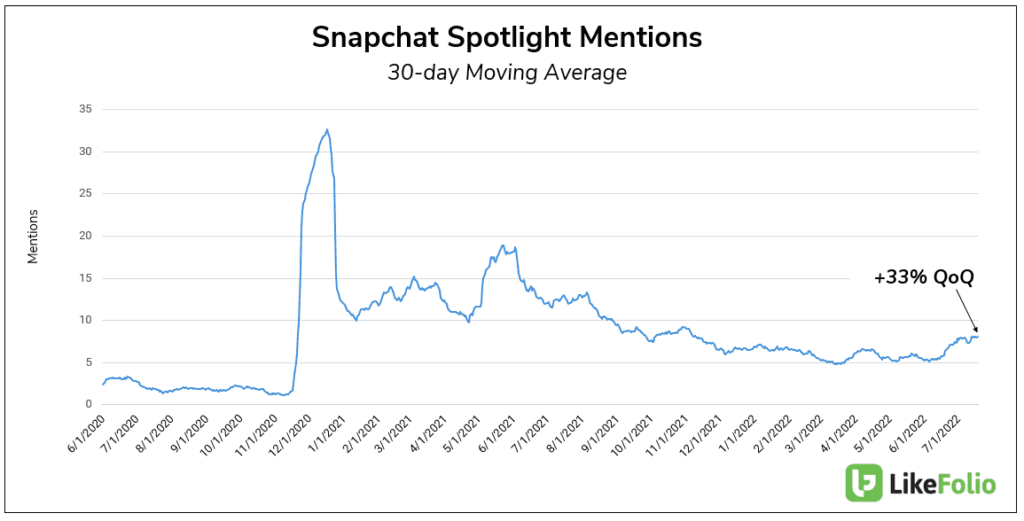

Data also suggests users are engaging with Snapchat's TikTok clone section, Spotlight, more than they were last quarter.

Spotlight mentions have risen by 33% in the past month.

This Spotlight adoption (and competition with TikTok) is critical for Snapchat's long-term revenue model. The majority of its revenue is generated from video ads. And who wants to see a video ad in the middle of direct messaging a friend?

By placing ads in between user-generated "entertainment" content, the interruption feels less obtrusive and more natural.

This model is likely why TikTok ad revenue is expected to surpass that of Twitter and Snapchat combined in 2022.

Heading into earnings, the bar for Snapchat is extremely low. LikeFolio data does show signs of increased user engagement and improved consumer happiness -- a nice sign for long-term user retention. However, it is more difficult to gauge advertising growth.