PayPal (PYPL) Last week we touched on a huge crypto […]

Investors are Earning Passive Income with Crypto

Investors are Earning Passive Income with Crypto

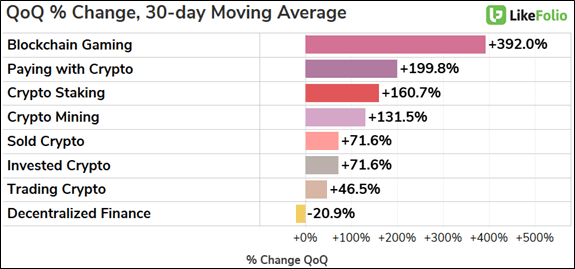

In the realm of cryptocurrency, there’s no shortage of powerful trends…But within the sector, there's still outperformers.

We’ve discussed the rise of blockchain gaming ad-nauseam in recent months and recently highlighted a surge in cryptocurrency payments.

However, there’s one trend that’s been a top performer for the better part of the past year: Crypto Staking.

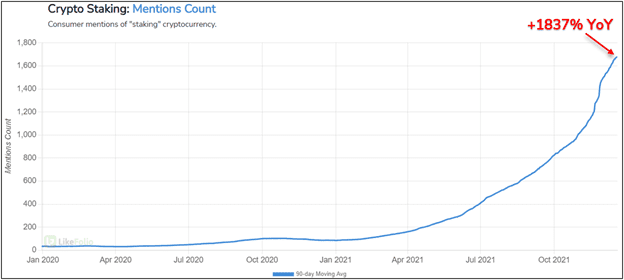

Over the past year, consumer Mentions of staking cryptocurrency have risen ceaselessly, up +1837% YoY on a 90-day moving average.

The rising popularity of Proof-of-Stake (PoS) blockchains has led to an increase in network participation from investors — Staking tokens, validating blocks, and receiving passive rewards. But staking isn’t the only way to earn passive income with cryptocurrency.

The other? Yield Farming.

Yield farming is a practice supported by various Decentral Finance (DeFi) protocols, wherein a user can provide liquidity for a given token with a guaranteed interest rate.

Certain protocols specialize in crypto-to-crypto lending, such as AAVE ($AAVE).

Providing liquidity for a trading pair on a Decentralized Exchange (DEX), like Uniswap ($UNI), also qualifies as “yield farming”.

Although Yield Farming remains a more fringe practice than basic staking, underlying Mentions exhibit strong near-term growth: +21% MoM and +65% QoQ.

The concurrent rise of these 2 trends points to one major takeaway: a growing number of investors are re-investing their holdings within the crypto ecosystem.