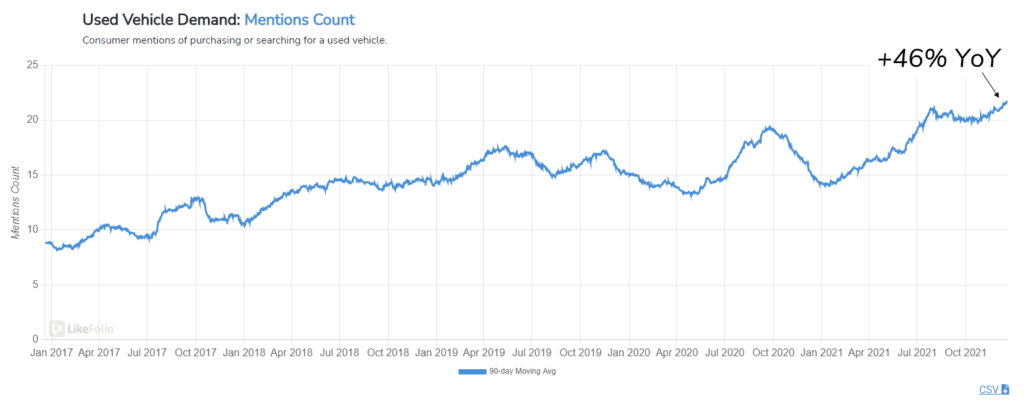

Used-Vehicle Demand is Surging A worsening chip shortage and corresponding production drop are expected to […]

Is the Ship Sailing on CarMax (KMX)?

One of our main goals at LikeFolio is to identify major shifts in consumer behavior as they are happening and understand how these shifts may impact publicly traded companies. We spotted one of these shifts in June, as the term "Chip Shortage" went mainstream. In this instance, a chip shortage was impacting the availability of new vehicles, and sending demand (and pricing) for used vehicles soaring. In fact, demand for used vehicles continues to push through all-time highs.

We featured CarMax as a major beneficiary of this shift when shares were trading under $117. Since then, share value increased by as much as +33% and currently sit ~13% higher vs. June levels. So -- is this MegaTrend still in play? Somewhat, but CarMax's growth rate has tempered.

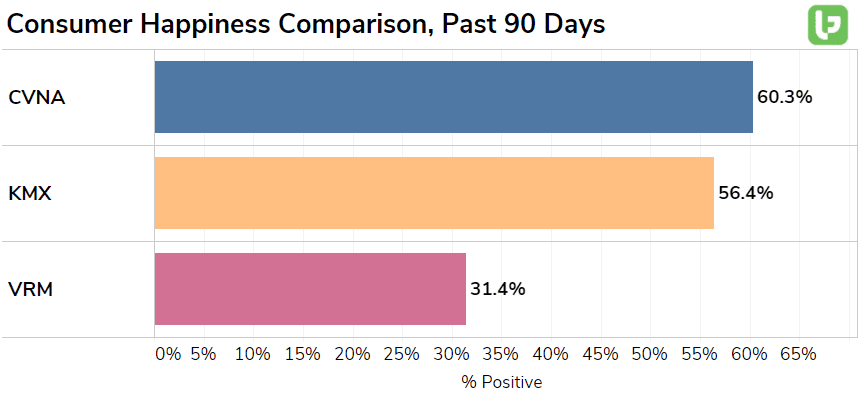

While consumer mentions of buying or selling a vehicle with CarMax have increased +40% YoY, this is a deceleration vs. levels recorded this summer (+57%). In previous quarters, the company has benefitted from its omnichannel approach that provides consumers with the option of conducting business in person or online...or a mix of both. This omnichannel approach has helped elevate the company well above digital peer Vroom. However, it continues to lag fellow omnichannel peer Carvana, known for its vehicle "vending machines."

Last quarter, CarMax was dinged after beating revenue expectations but posting lower-than-expected earnings. Essentially, the company was punished due to the costs incurred from, "an increase in staffing and sales-related compensation, continued spending on our technology platforms and strategic initiatives to support increased consumer demand [including] advertising expense." While used vehicle demand remains high, KMX demand is showing signs of stabilization. However, the recent sell-off in the stock suggests the market may already have priced this in.