Chipotle has been one of LikeFolio's biggest winners over the […]

Is Chipotle ($CMG) Losing its Cool with Consumers?

Is Chipotle ($CMG) Losing its Cool with Consumers?

Last quarter, Chipotle earnings beat market expectations as online sales overtook in-person orders. This makes sense. When was the last time you ordered in person at a Chipotle?

Now, Chipotle is coming up against 2020's "weakest quarter" and same-store sales growth is expected to increase +30% YoY.

LikeFolio data suggests Chipotle's report may not be as rosy as investors are expecting.

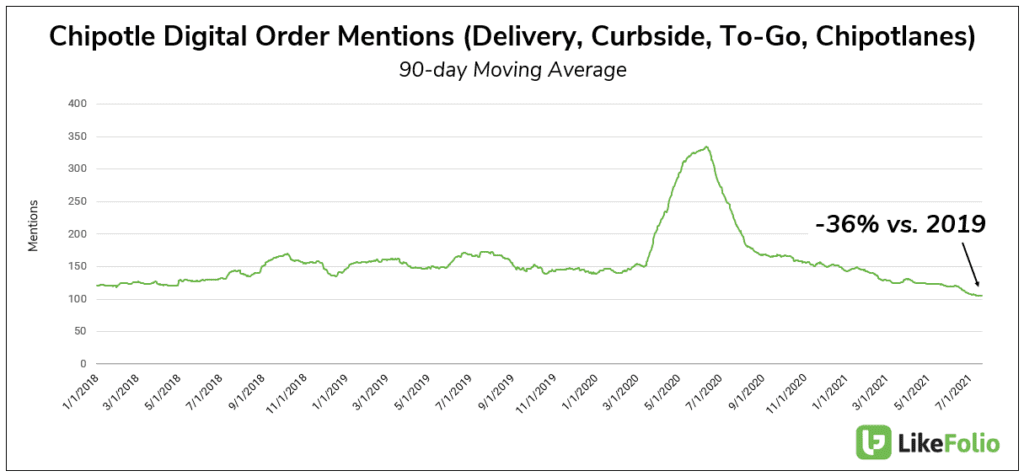

After surging during the pandemic, digital fulfillment mentions (including delivery, curbside pickup, and app order-aheads) are settling below 2019 levels.

This measure is probably the best gauge of digital adoption momentum. While many new customers on-boarded the app over the last year, this growth is tempering.

This is in line with total buzz mentions: -37% YoY in the quarter being reported.

While Chipotle was a great option during the pandemic, fast-casual may not be the dine-in method of choice for pent-up eaters ready to socialize.

Restaurant sales continued to rise through June, +6.6% higher vs. levels recorded in February 2020 (pre-pandemic).

LikeFolio data actually has Chipotle trailing fellow fast-casual chain, Shake Shack, when it comes to overall Purchase Intent growth: -12% QoQ vs. flat at Shake Shack.

In addition, Chipotle doesn't have the new menu-item buzz it had last quarter from its quesadilla and cauliflower rice drops.

It's also important to note what LikeFolio data may not pick up on:

- Repeat buyers. Tweets from Chipotle app users are extremely positive. This is the ideal user experience. Users may tweet about using Chipotle's app once or twice, but probably not every time. In addition, Chipotle's app orders are fulfilled via DoorDash, which sits nearly 10% higher in consumer happiness vs. peer Uber Eats.

- Impact of increased menu prices: Chipotle raised prices +4% to cover costs of rising employee wages. Noting that during this menu hike, sentiment has remained stable....this is typically a good sign of pricing power.

We'll be watching to see if Chipotle can meet a very high bar when it releases 21Q2 earnings July 20 after the bell.