Tiffany's (TIF) will report quarterly earnings Wednesday prior to the […]

Is Lululemon's 'Power of Three' Vision Working?

Is Lululemon's 'Power of Three' Vision Working?

Lululemon has deemed its growth plan the Power of Three:

- Product Innovation

- Omni-guest Experience

- Market Expansion

So ahead of the company's 21Q2 Earnings event, we're breaking down each component.

Is Lululemon effectively executing this growth vision? Mostly.

Product Innovation

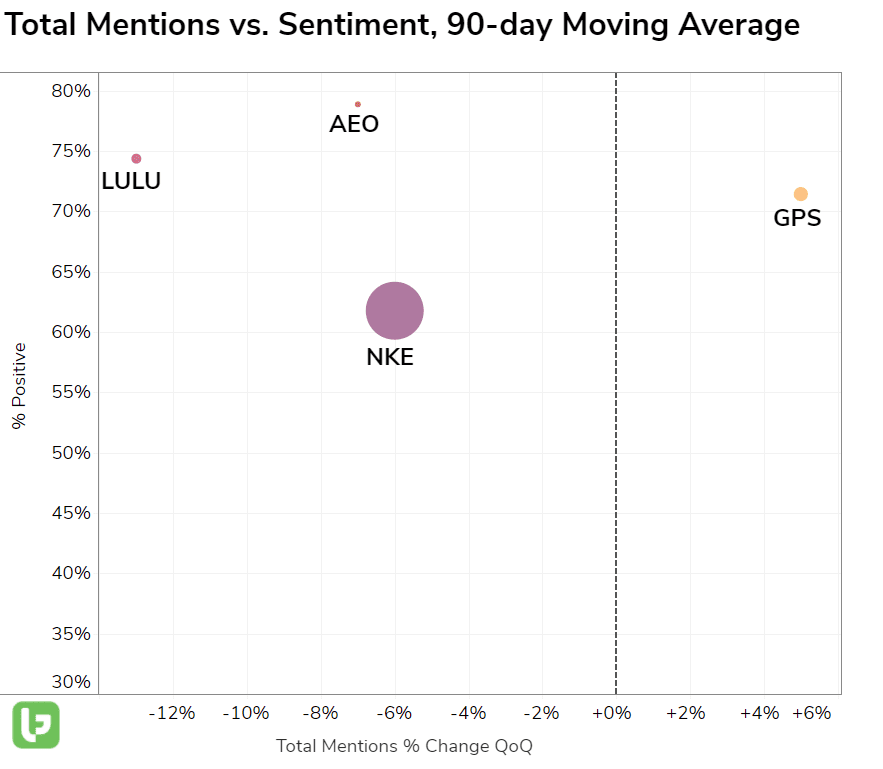

What is the quality of Lululemon's apparel? From a Consumer Happiness perspective, Lululemon continues to excel. Happiness is 74% positive and has increased by 2 points YoY. Tweets highlight the comfort, stretch, and soft feel of the company's apparel.

Omni-guest Experience

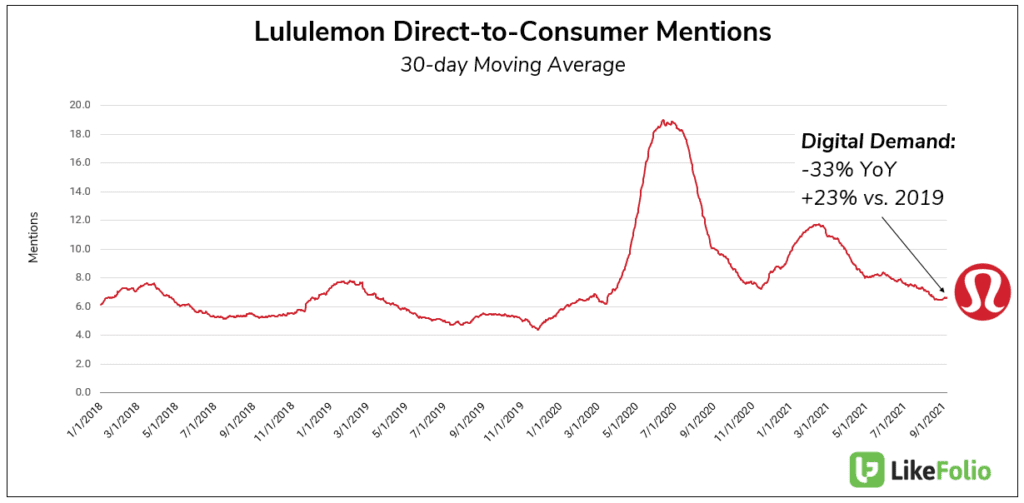

Last quarter, Direct-to-Consumer revenue increased +55% YoY, comprising ~44% of sales...down from 54% a year prior, when many stores were closed.

LikeFolio data shows Direct-to-Consumer mentions remain higher vs. 2019, but are normalizing: -33% YoY, +23% vs. 2019. It's a positive sign to see some stickiness here. But will it be enough?

Market Expansion

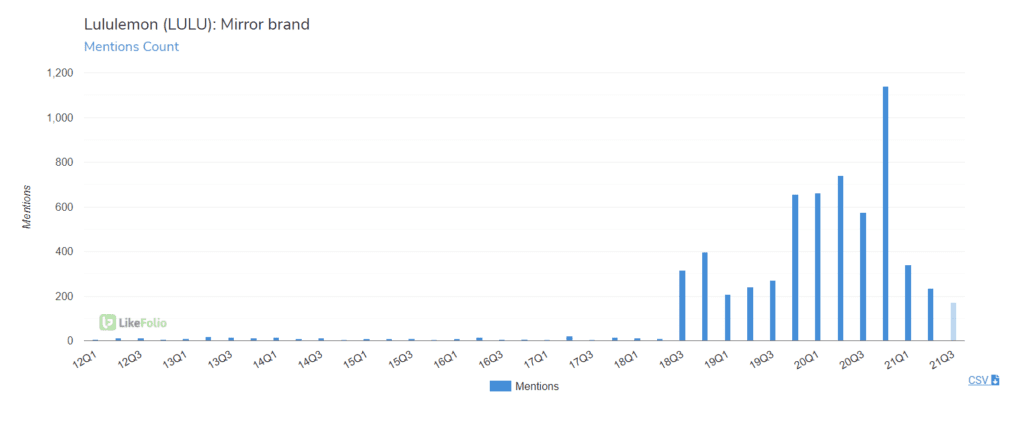

Lululemon placed a large bet when it acquired Mirror, a virtual fitness "machine" last year. LikeFolio data shows that Mirror mentions are falling off.

Mention volume is actually lower vs. 2019 levels, pre-LULU acquisition. Based on the slow down in PTON growth, this definitely isn't in the PRO column for LULU.

In addition, competition is proving to be more competent vs. prior quarters...specifically from Athleta. The chart below shows relative near-term outperformance from GPS, driven by the Athleta brand.

Athleta launched a line with Allyson Felix in August that is driving demand.

So, 2/3 Lululemon growth goals checked. Not bad, but plenty of room for improvement.