Airbnb (ABNB) AirbnB is set to report earnings for the […]

Is the Market is Sleeping on this Popular Travel Stock?

Last fall, things weren’t looking hot for Airbnb.

Even though travel was picking up as the pandemic waned, Airbnb mentions were stalling vs. peers.

It just didn’t have the level of growth/momentum as traditional names in the travel industry who were getting their wings back.

The market agreed.

ABNB shares sank alongside a market rejection of “growth” stocks, and currently trade -10% lower vs. where they traded in October.

But the best part about LikeFolio data is that it allows us to revisit in real-time to see if things are continuing as expected, or turning around when it comes to consumer demand and sentiment.

And based on our last check for ABNB, I’m impressed.

See for yourself.

Airbnb Demand is Surging in the Current quarter, Outperforming Traditional Peers.

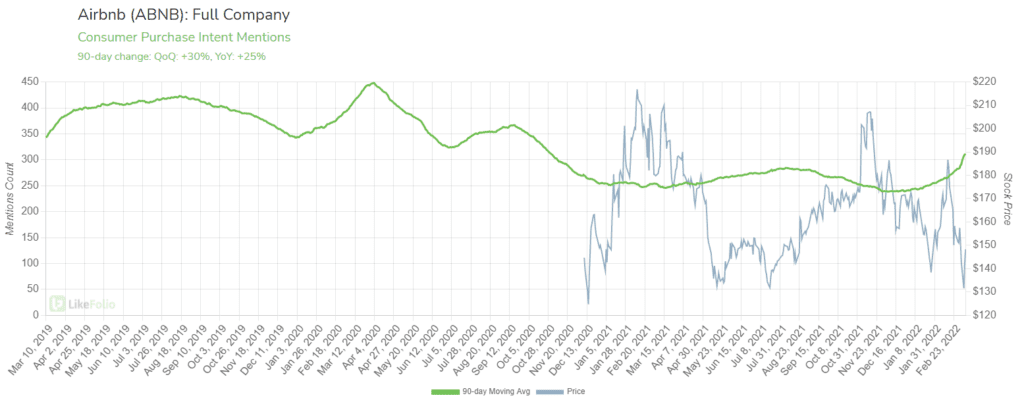

After comparative stalling for a year, mentions of booking a reservation via Airbnb have increased by +25% YoY and +30% QoQ.

When we tighten the moving average on that lens (look at a more near-term view) ABNB’s demand growth is even more impressive.

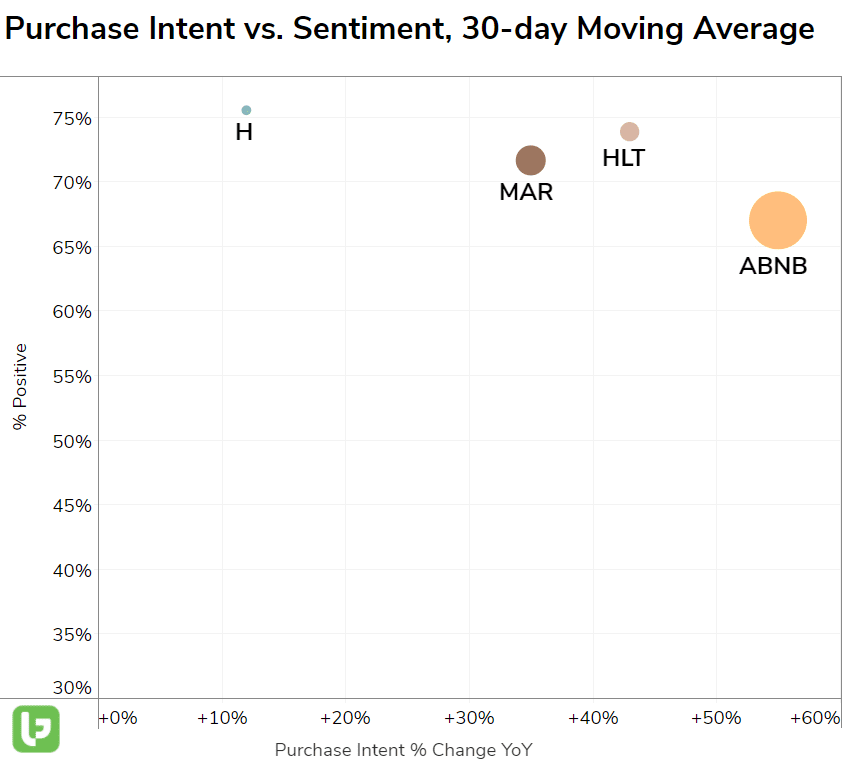

Take a look at how ABNB is performing vs. peers:

Do you see the acceleration ABNB is recording, even in the last month? To be fair, all traditional lodging sites are gaining steam on a YoY basis – but ABNB is gaining the MOST steam.

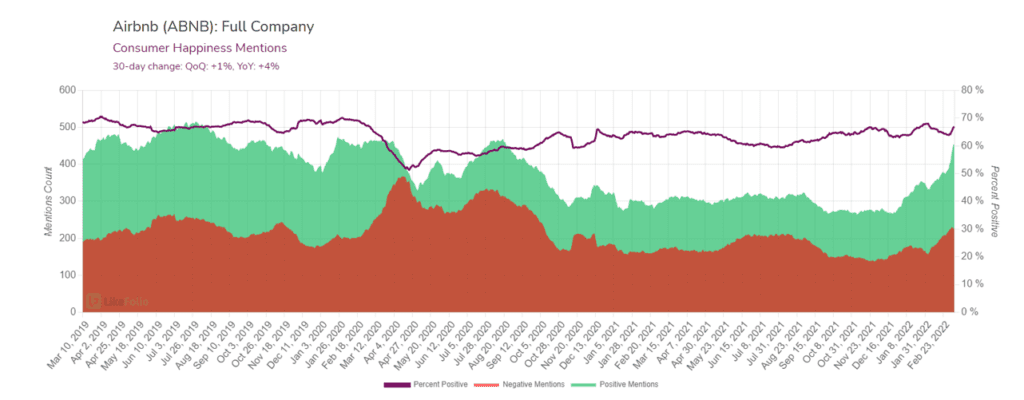

Airbnb Sentiment is Improving

But ABNB has the lowest sentiment, you might say.

True.

But the company is getting better.

Airbnb consumer happiness has improved by +4% YoY…and this is alongside an uptick in usage.

That’s definitely what you want to see.