Tiffany's (TIF) will report quarterly earnings Wednesday prior to the […]

Lululemon -- executing very well right now...can it hold on?

Lulu is an incredible story --- the company is somehow managing to drive MORE sales amid an increasingly grim consumer macro environment.

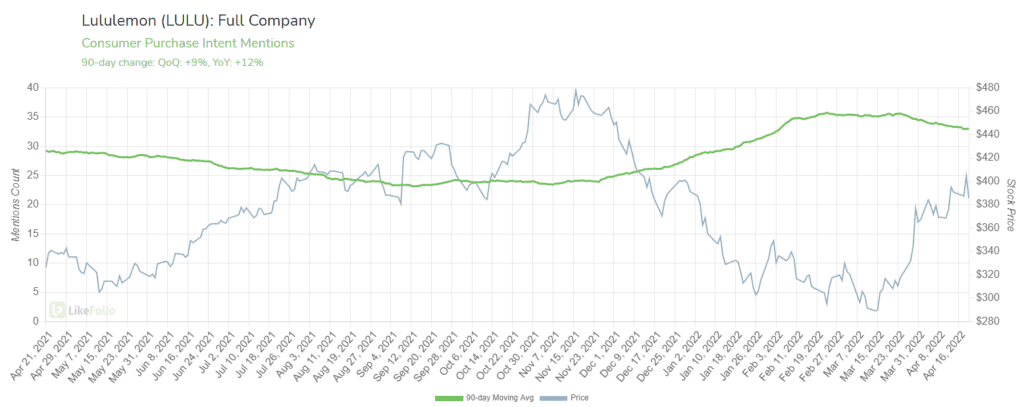

Consumer purchase intent for Lululemon products has increased by +12% YoY, even as inflation fears, gas prices, interest rates, and grocery costs remain extremely high.

How are they doing it?

Consumers returning to the gym (group fitness class attendance +30% YoY) are driving demand for a refreshed workout wardrobe.

And LULU is continuing to flex in the store (visits +23% YoY) and on the digital front (+14%YoY).

In addition, new products like the Blissfeel running shoe are pulling consumers back in the door.

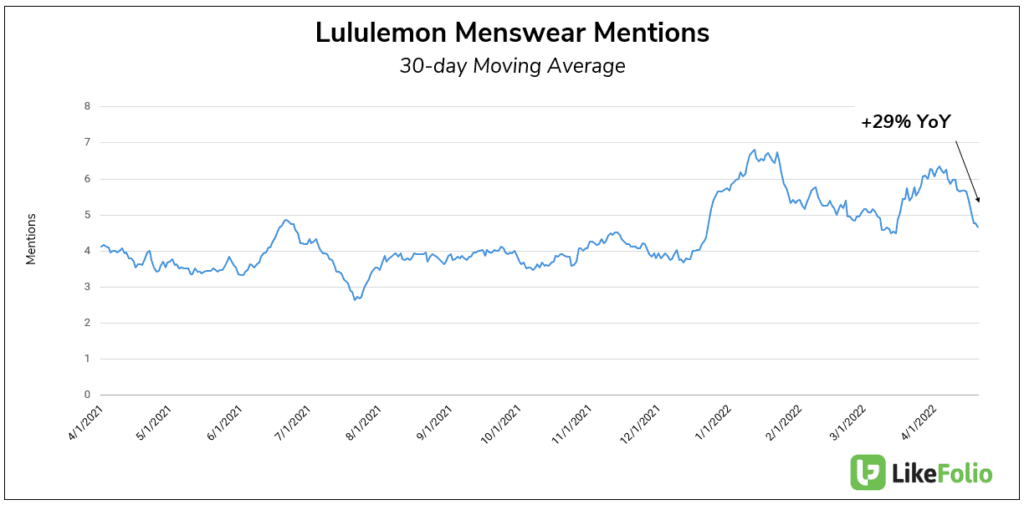

And menswear expansion is working. Mentions of menswear items have increased +29% YoY.

The question now: was this Spring a one-time pop as consumers refreshed wardrobes, or can LULU continue to grow?

Competition is mounting, especially from competitor Vuori (mentions: +41% YoY).

And consumers are indicating they are becoming more frugal.

So far, LULU is outperforming its peers. But we'll be watching for red flags very closely.