Tiffany's (TIF) will report quarterly earnings Wednesday prior to the […]

Lululemon's Holiday Hustle: Boom or Bust

As the festive season rolls around, just like last year, I find myself ticking off nearly everyone on my Christmas list with a single, crowd-pleasing destination: Lululemon.

It’s honestly a treat to shop – which is increasingly appealing vs. hitting a Target or browsing through a department store. Lululemon, a brand synonymous with the buttery soft fabric that's versatile enough for the gym, the office, or a casual day out, is a premier destination this time of year.

The catch? The market is catching up to Lululemon's charm.

With the stock soaring about 40% year-over-year, the question looms: Is there more room for growth, or has the stock hit its peak for now?

Here's what's on the radar ahead of Lululemon's earnings, in list form just as Santa would have it:

LikeFolio’s Most Compelling Insights

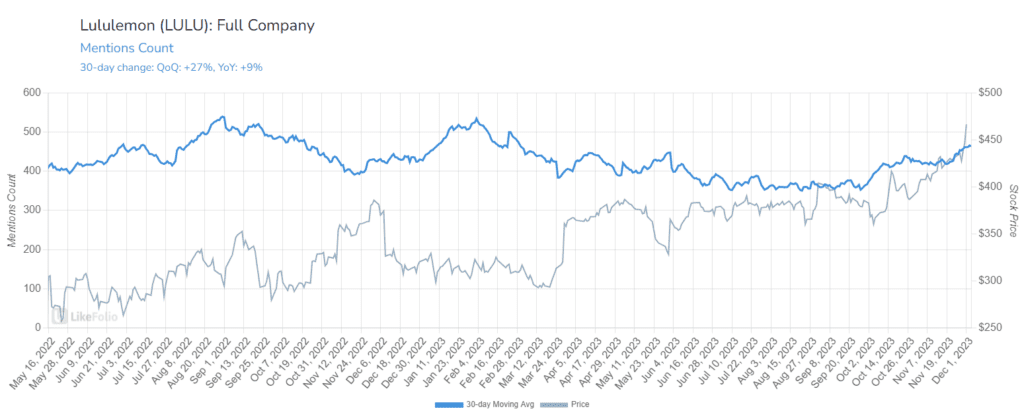

- Rising Mentions: As the holiday season kicks off, Lululemon mentions have risen by 9% year-over-year on a 30-day moving average.

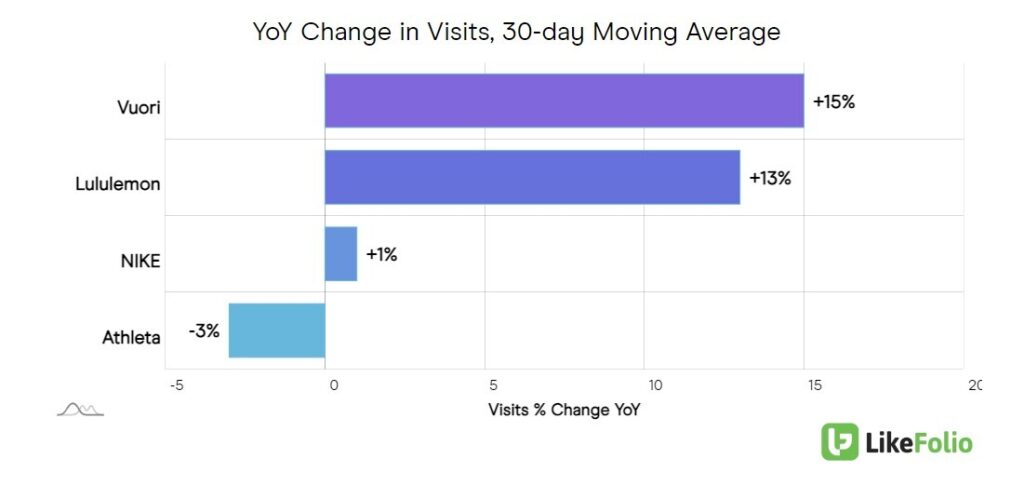

- Web Traffic Analysis: Lululemon's web traffic has increased by 13% year-over-year, outperforming competitors like Athleta and even Nike, though trailing behind the luxury brand Vuori.

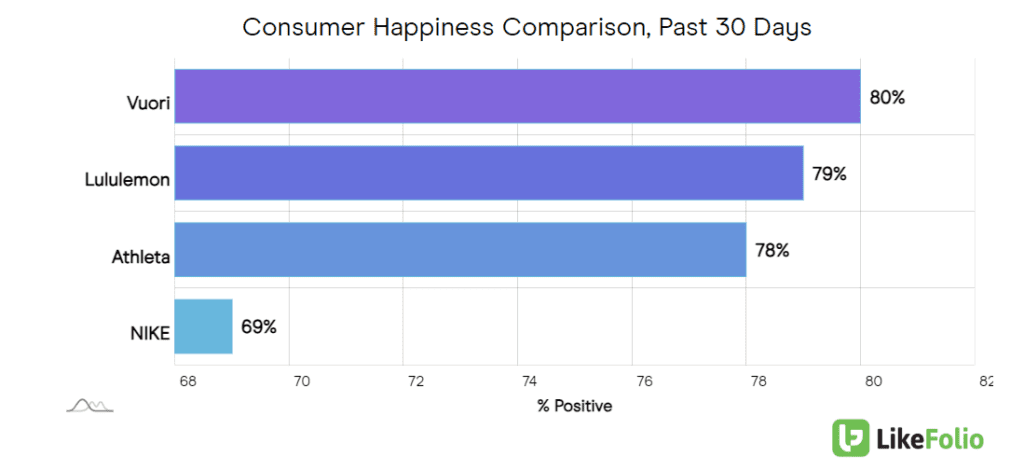

- Customer Happiness: Standing strong with a 79% positive rating, Lululemon is only second to Vuori in customer satisfaction.

- Google Trends: Lululemon has been hitting all-time highs in Google searches, especially during Black Friday week.

- Viral Products: The restocked viral belt bag and the scuba half zip are shaping up to be this season's hottest items.

- Unexpected Boost: An interesting twist comes from the rising use of weight loss drugs like Ozempic. This trend is likely to increase demand for Lululemon's premium athletic wear, as those experiencing weight loss revamp their wardrobes, aligning well with Lululemon's affluent target market.

Strategic Growth and Competition

- Ambitious Growth Plan: Lululemon's "Power of Three x2" strategy aims to double its sales to $12.5 billion by 2026, up from $6.25 billion in 2021. This involves expanding physical stores and doubling revenue from men's and direct-to-consumer segments.

- Competition Heats Up: While Lululemon is on a promising track, the intensifying competition in the athletic wear market cannot be ignored.

Bottom Line

Ahead of earnings, we're positioned on the bullish edge, but with a note of caution due to the high expectations and the significant reliance on the Chinese market for growth. While Lululemon's trajectory is promising, the competitive landscape suggests there might be more attractive upside opportunities elsewhere.

Lululemon continues to be a strong player in the athletic wear market, but as we approach earnings, it's a game of balancing high expectations with market realities and emerging competition.