Dunkin' Donuts is superior to Starbucks. There is really no […]

$SBUX is getting wrecked -- just the beginning?

Starbucks' Stock Slump: Missing the Forest for the Trees

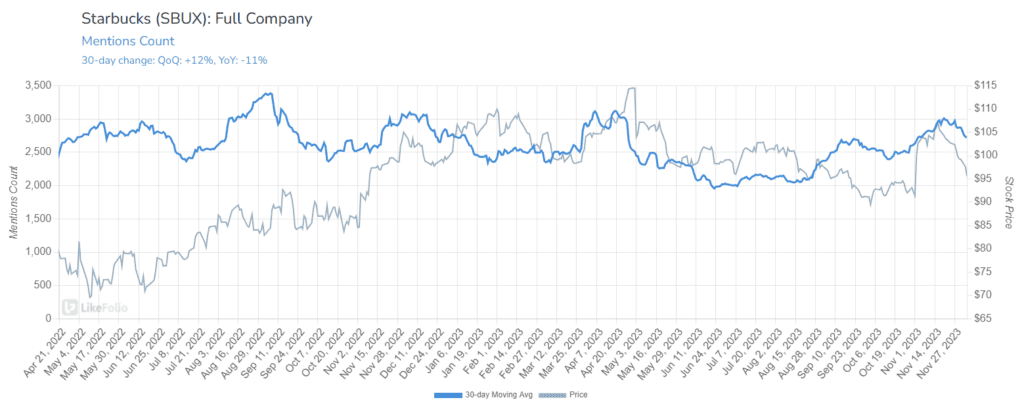

As Starbucks' shares plummeted for a record 12th consecutive day, dropping about -11% from their November highs, the market's hyperfocus on this losing streak may be overshadowing deeper, more systemic issues within the company.

While the immediate stock performance grabs headlines, our analysis suggests that Starbucks is facing more profound challenges that could shape its future.

Degrading Consumer Metrics

Data from LikeFolio paints a concerning picture for Starbucks. There's been a significant -11% year-over-year drop in drink mentions among English speakers, suggesting a sluggish kick off to the holiday drink season.

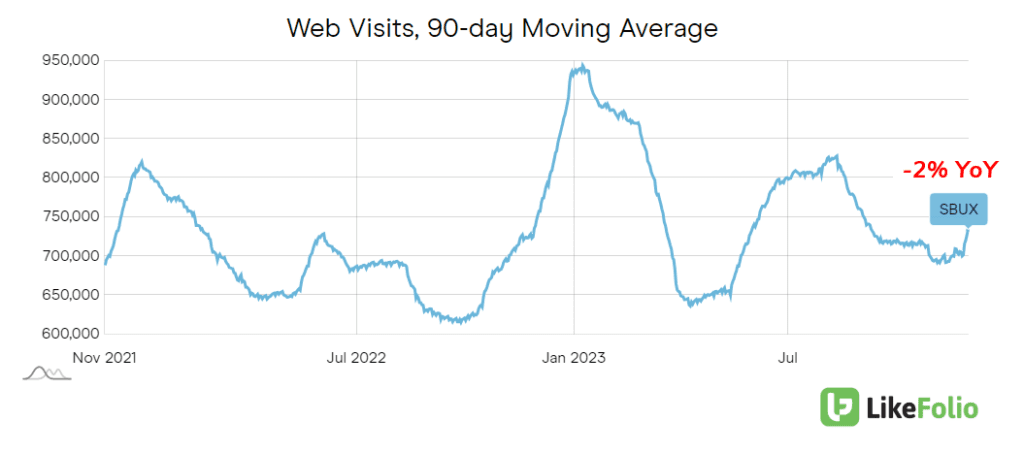

And web visits have declined by -2% year-over-year.

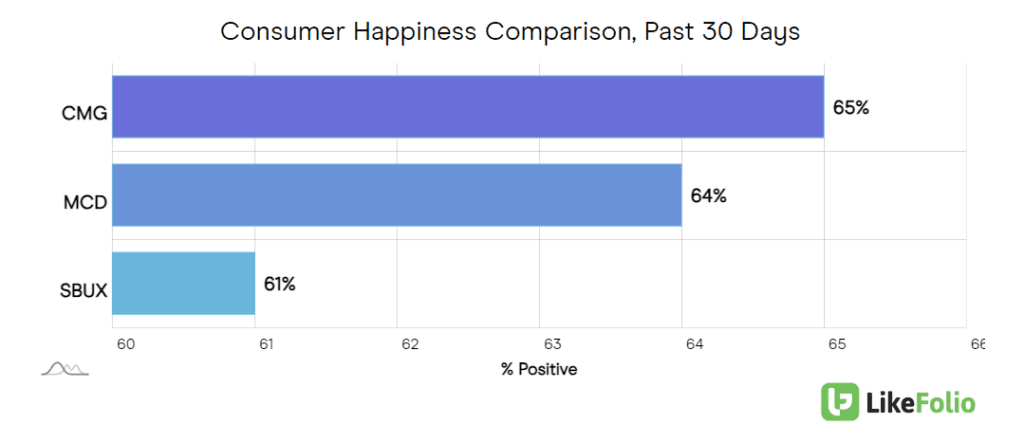

Although happiness levels are stable, they lag behind those of companies with more robust pricing power, like McDonald’s and Chipotle. This suggests a weakening grip on consumer engagement and loyalty.

Labor Union Challenges and Corporate Governance Shifts

Beyond the consumer, escalating labor union challenges, led by the Strategic Organizing Center (SOC) are causing turmoil. The SOC's bold move to nominate three directors to Starbucks' board amidst ongoing disputes over worker pay and conditions is more than a mere corporate skirmish; it's a significant shift in the company's labor relations.

With around 360 of its U.S. cafes moving towards unionization, Starbucks is not only facing legal and financial risks but also a potential overhaul in its corporate governance. This situation is further complicated by the leadership of new CEO Laxman Narasimhan and recent changes in proxy-voting rules.

Rising Competition in China

In China, one of Starbucks' largest markets, the company is losing ground to Luckin Coffee. With over 10,000 stores, Luckin has overtaken Starbucks, which operates 6,480 stores in the region. Luckin's rapid growth can be attributed to its aggressive expansion strategy, affordable pricing, and a business model centered around mobile ordering. This approach has particularly resonated with the mass market and younger consumers in China, a country traditionally known for its tea culture.

Financial Outlook and Pricing Strategy

Despite a strong performance last quarter, driven by higher-priced drinks, Starbucks' forecast for fiscal 2024 is cautiously optimistic, projecting a modest same-store sales growth of 5% to 7%. This is a slight dip from its long-term forecast, indicating a tempering of expectations. Additionally, the company's pricing strategy, which sees a grande (medium) holiday beverage priced around $6, might be contributing to consumer hesitancy.

Bottom Line

The current downturn in Starbucks' stock is not just a market reaction to a bad run; it's a recalibration reflecting deeper issues within the company. The combined impact of labor union challenges, increased competition in China, shifting consumer sentiment, and a cautious financial outlook suggest a need for a more measured approach to Starbucks' valuation.

While the company has demonstrated resilience in the past, the current landscape, as indicated by recent forecasts and market data, does not strongly support an overly optimistic outlook for Starbucks in the near term.