When social-data and stock price are moving sharply in opposite […]

Starbucks announces plans for massive expansion

Starbucks (SBUX)

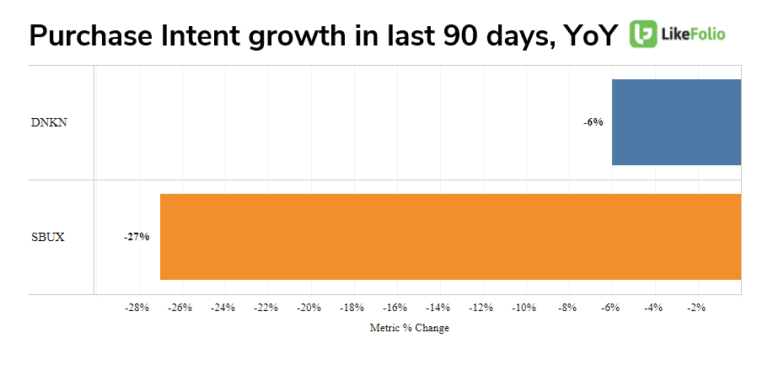

Starbucks shares surged to an all-time high yesterday after the company revealed aggressive growth plans for the next decade (including expanding global footprint by more than 66%) during its investor day. LikeFolio data shows some signs of weakness recently, especially when compared vs. peer Dunkin' (DNKN).

The chart above showcases Purchase Intent mention growth in the last quarter and is heavily tilted to in-person store visits. This trajectory makes sense. (Starbucks U.S. same store sales fell 9% YoY last quarter vs. Dunkin' same store sales +1% YoY). At first glance, that chart appears alarming for SBUX. But that's why it's important to understand the entire picture. Two key elements come into play:

- Digital Presence

- Average Ticket Size

Starbucks has robust omnichannel offerings. Not only are consumers flocking to its app, the new stores noted above will consist of Drive-Thru and Starbucks Pickup locations. LikeFolio data reveals Starbucks Drive-Thru and Pick-up mentions specifically are pacing +14% QoQ. In addition, Starbucks has proven to be really good at getting loyal customers to ante up. Even though comparable global transactions decreased 23% last quarter, this weakness was partially offset by a 17% increase in average ticket size. We're monitoring these digital mentions for continued adoption.

Trend Watch: Streaming (NFLX, DIS, T)

Last week, WarnerMedia set the entertainment world ablaze with its decision to release all 17 of its scheduled 2021 films directly onto the HBO Max streaming platform.

Today, Disney fired back, announcing plans to launch at least 35 new series and a host of feature films directly on its ‘Disney+’ service.

LikeFolio data shows that both services are...