When social-data and stock price are moving sharply in opposite […]

NFLX Cracked the Whip…and it worked

Netflix management's decisive action in curbing password sharing and integrating ads into its platform is yielding significant results, reestablishing the streaming giant's dominance in a fiercely competitive market.

This strategic pivot reflects a timely response to evolving consumer behaviors and market trends(namely, affordable over-the-top streaming and recovery ad spend), positioning Netflix as a frontrunner in the streaming wars.

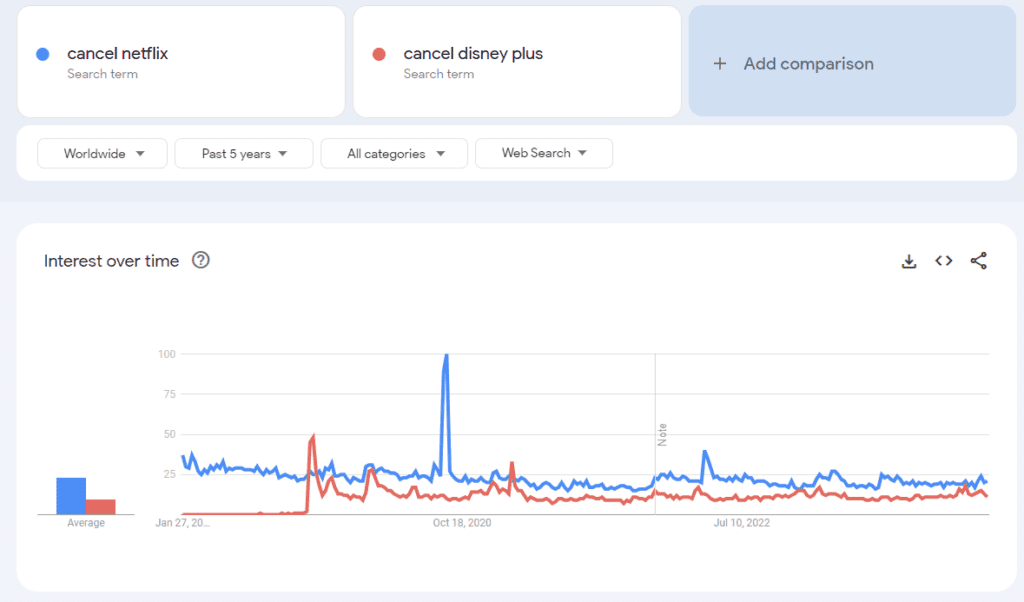

Data from GoogleTrends reveals a telling story: while lower-tier streaming services like Disney+face increased cancellation searches, Netflix's cancellation rates are notably lower than the historical average.

Translation: 2nd tier subscription services are failing…and we see this across multiple industries.

Netflix strength during a time when many consumers look to trim unused subscription weight suggests that consumers prioritize Netflix over other subscriptions, indicating the high value they place on its content and service.

And the company's performance in the last quarter was nothing short of remarkable. Netflix added 8.76 million global subscribers, far exceeding the 5.49 million anticipated by Wall Street. This surge marks the largest quarterly increase since the height of the pandemic in 2020, flexingthe effectiveness of recent strategic decisions, including the launch of an ad-supported tier and stricter password sharing controls.

Notably, Netflix's ad plan membership has seen a dramatic 70% increase from the previous quarter, signaling its growing relevance in the ad market, particularly ahead of a politically charged year. This growth trajectory is not just a short-term win; it positions Netflix to benefit from the broader recovery in advertising spend.

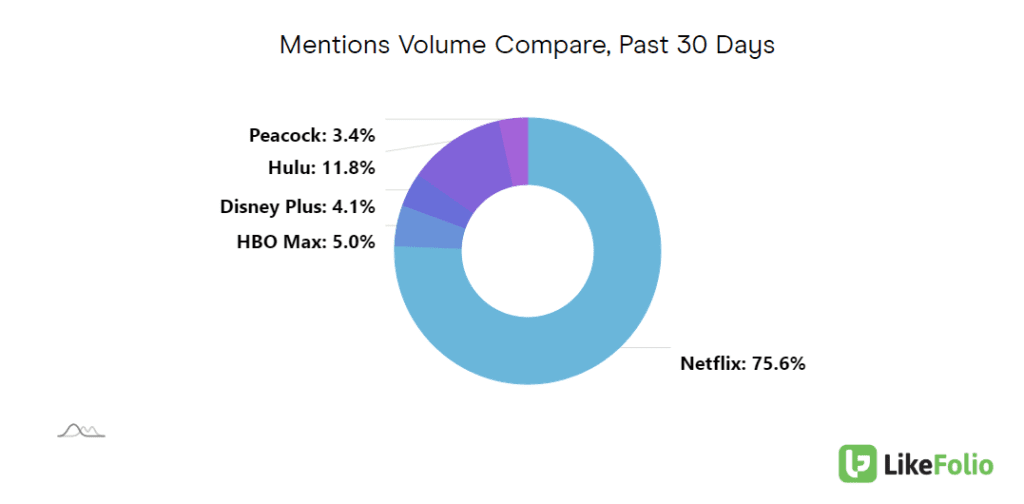

Dominance in non-live streaming content is another feather in Netflix's cap.

The platform has captured more than 75% of consumer mindshare over the past month, an increase from its already impressive 67% in the larger quarter. This spike in popularity, especially during family-centric holiday periods, underscores Netflix's appeal across a wide range of demographics.

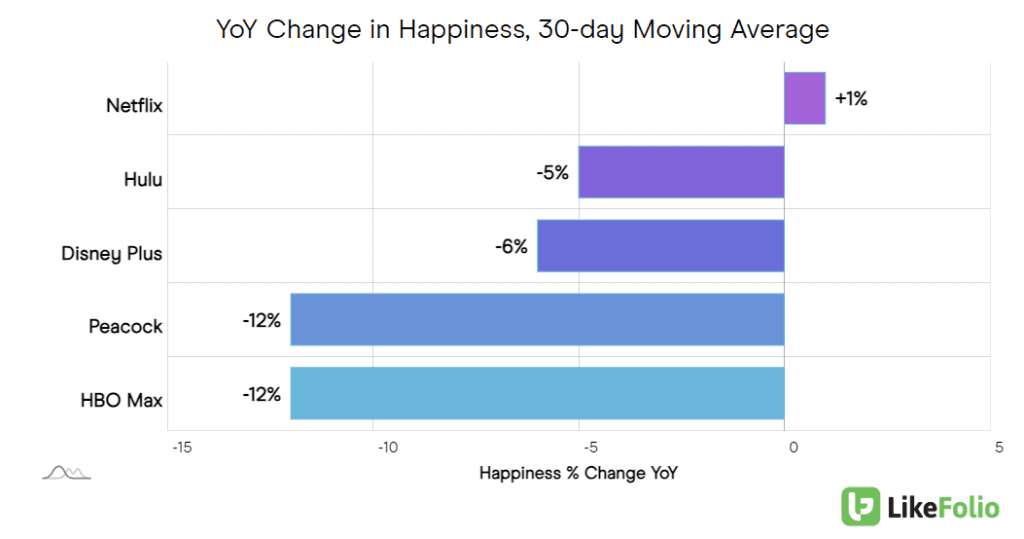

Beyond market share and subscriber counts, Netflix's ability to balance pricing power with customer satisfaction is noteworthy. Even with a slight increase in subscription costs, the company has maintained a 65% positive happiness index – a slight improvement…a feat its competition can’t tout.

NFLX;s diverse content offerings, ranging from legal dramas to feel-good movies, play a pivotal role in this sustained customer satisfaction.

Netflix's straightforward approach to its business model, likening itself to a "focused passion brand" akin to companies like SoFi and Southwest, reinforces its commitment to a clear and uncomplicated strategy. This focus differentiates Netflix from generic video providers, cementing its status as a specialized movie, TV series, and games entertainment service.

As Netflix heads into its earnings report, expectations are high, fueled by its previous quarter's success and a 20% increase in its stock price over the last three months.

With its innovative subscription model, new revenue streams, and clear focus, Netflix is not just poised for growth but potentially significant market disruption.

While its valuation is yet to reach the heights of the pandemic peak, the company's trajectory and strategic initiatives suggest a strong potential for outperformance. The anticipation now hinges on the magnitude of subscriber growth and whether Netflix can deliver a beat that satisfies heightened investor expectations.