PayPal (PYPL) Last week we touched on a huge crypto […]

Will PYPL Really Shock the World?

PYPL is buzzing after some bold statements from company leadership have investors betting on a turnaround.

The company's CEO promised to "shock the world" at an upcoming innovation day event on Jan. 25 after acknowledging there "hasn't been a lot to celebrate in the last few years".

PYPL is trading nearly 80% below 2021 highs -- nearly in tandem with digital wallet peer, Block (SQ) -- as eCommerce growth cooled and the company struggled a bit to regain its footing after completing its breakup with eBay.

But the CEO's comments have sparked some near-term momentum for the payment giant.

Is this a question of buy the rumor sell the news?

First, let's see what LikeFolio data says:

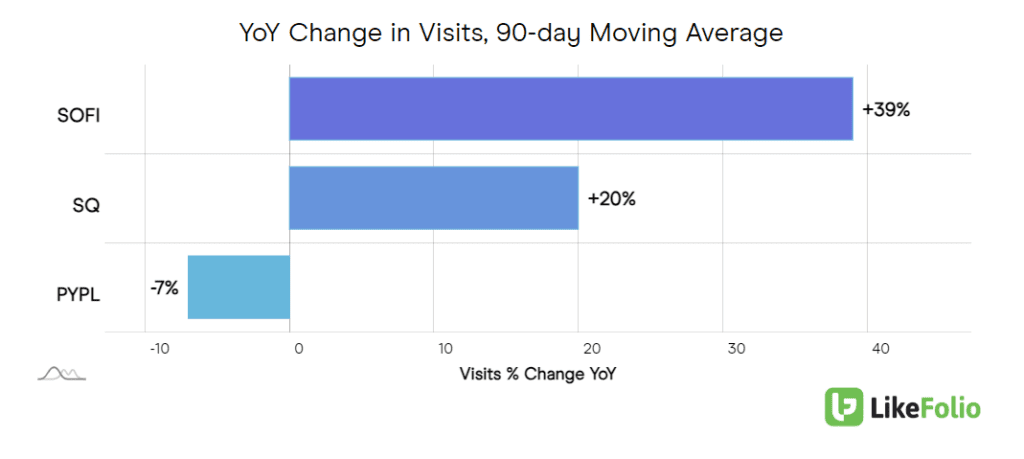

PYPL web visits look concerning.

Not only have visits slipped by -7% YoY, but the company is trailing peers in a similar space -- namely, Block and SoFi.

Even PayPal's golden child, Venmo is witnessing a digital traffic drop (though this may be more app-focused than web focused, to be fair). PayPal is failing to generate interest and spark engagement on the consumer front.

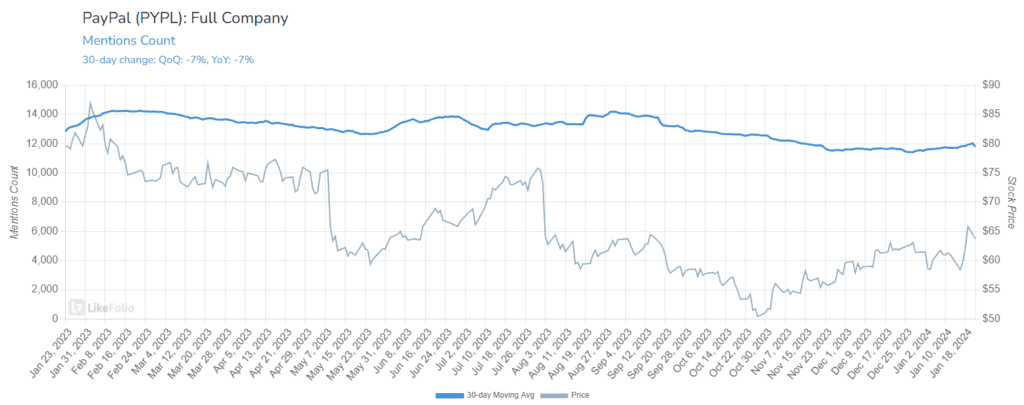

PYPL mentions reveal a slight slope downward, dropping -7% YoY, albeit under-pacing the stock move lower.

The positive news here: much of this drop is from its namesake PayPal brand. Venmo buzz is flat YoY and sentiment is stable.

PYPL happiness levels DO provide a glimmer of hope.

Sentiment has risen by +2% YoY to 64% positive, fully recovering from the woke blunder from 2022. (Remember its policy to fine users for 'misinformation?')

Last quarter PayPal demonstrated the first signs of a potential turnaround. Q3 earnings in 2023 exceeded analyst expectations, with adjusted earnings per share rising 20% year-over-year to $1.30, surpassing the anticipated $1.23. Revenue increased by 8% to $7.4 billion, meeting forecasts. The company also raised its full-year earnings forecast and appointed a new CFO, Jamie Miller. Despite a decline in total active accounts, total payment volume grew by 13%. This performance indicates a positive trend in PayPal's business for the first time in several quarters.

So, what could this big news be?

On PayPal's last earnings call, CEO Alex Chriss described himself as "maniacally focused" regarding innovation, execution, and value delivery for customers. He's thinking globally, leveraging AI where possible (think consumer profile and payment data), and noted that moving forward, "we will make it abundantly clear why choose PayPal."

Some analysts speculate a true super app, combining PayPal and Venmo -- others are focused on the global expansion possibilities, or potential developments regarding AI.

We aren't speculating here, and instead are relying on real-time insights to understand if the company is gaining traction with consumers -- a powerful tool for investorsregardless of what news is released.

Looking ahead, we note the bar for PYPL is LOW and opportunity for improvement is high. Venmo is leading positive momentum -- its new teen account is a great way to get the younger generation in the door. And company-wide happiness improvements are positive for long-term growth. But less-than-exciting mention buzz and declining web traffic give us room for pause in the near-term.

On the horizon, we do see building tailwinds on the macro front: digital wallets are the future. But it looks like PayPal is the third-place horse in this race at the moment, so it has some catching up to do.