Tesla reports earnings after the bell on Wednesday. After last […]

TSLA Earnings Preview

Naysayers are starting to count EVs out.

Despite the growth in 2023, EV sales are not increasing as rapidly as anticipated, even with the introduction of new models, price reductions, and substantial tax incentives aimed at making them more affordable.

Ford has scaled back its production and postponed significant investments in EVs,

General Motors has delayed several model launches, and Honda has withdrawn from a joint EV development project.

And, Toyota, which has emphasized hybrids over EVs, has voiced skepticism about the current readiness of consumers to switch to EVs, despite available tax credits.

But we think the market is heating up for the ultimate winner in this space: Tesla (TSLA).

Here’s what we’re watching…

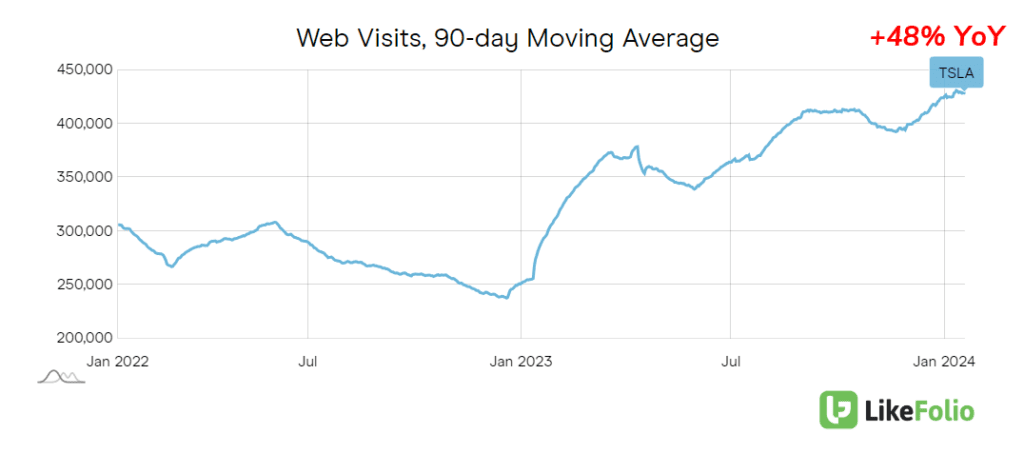

Web visits are up +48% YoY, even as the company enters a phase of tough comps.

In January 2023, Tesla began slashing prices globally (as much as 20%) in an aggressive effort to undercut growing competition. To give scale for mounting competition, in 2022 two-thirds of EVs sold in the US were Teslas. In 2023 that figure was closer to half.

Tesla's strategy to make its EVs the highest quality and most affordable is a strategic long play -- and necessary for domination. And it looks like it's working...

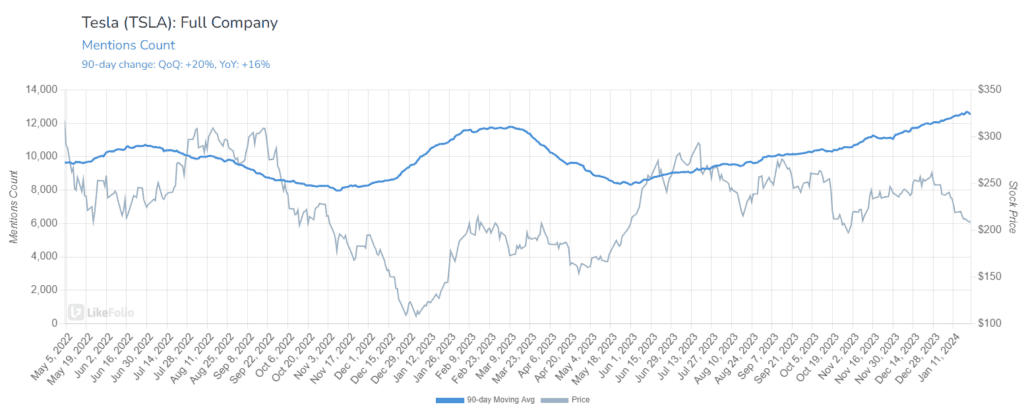

Mentions are also powering higher, up +16% YoY and displaying increasing divergence with TSLA's stock price.

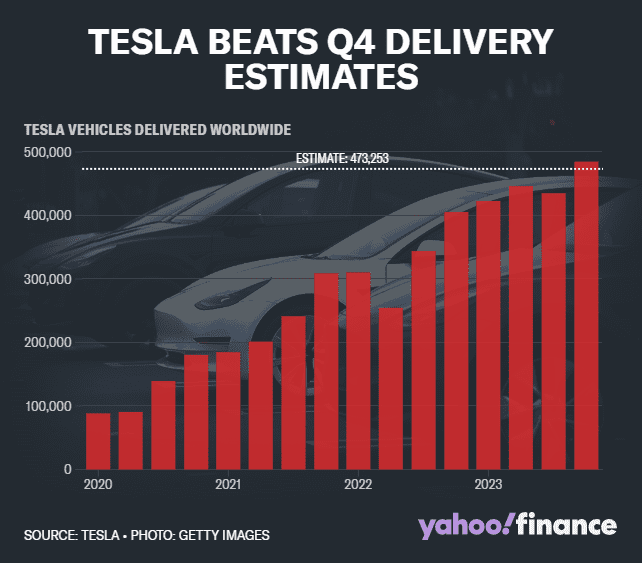

We already know that Tesla experienced a significant sales increase in the last quarter of 2023, selling 484,500 cars, up from previous quarters, boosted by price cuts and customers seeking to benefit from electric vehicle tax breaks before they become less accessible in 2024.

This surge in sales, which puts Tesla on track to potentially overtake major carmakers like Mercedes-Benz and Renault in 2024, helped alleviate investor concerns about Tesla's market dominance amidst growing competition from other car manufacturers.

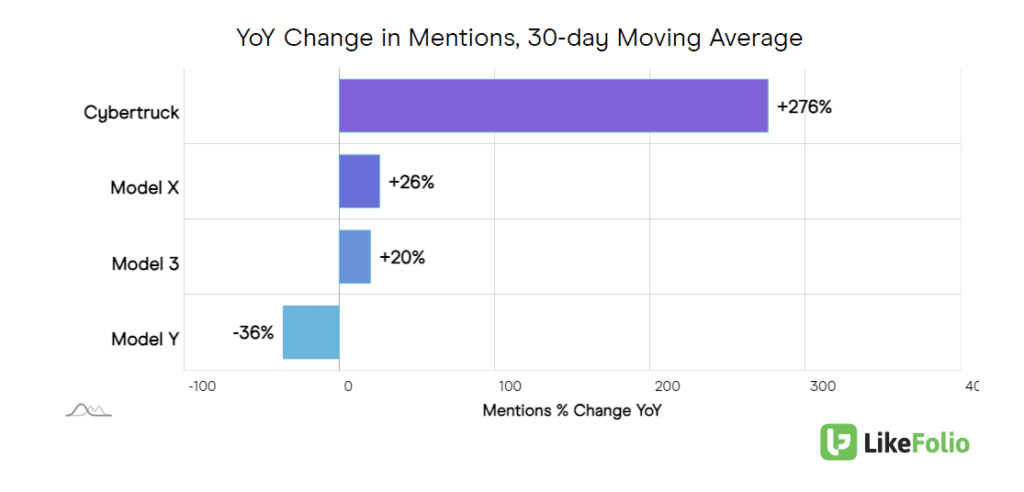

Tesla mentions are powered by its Model 3 sedan (+20% YoY) and its Cybertruck (+276% YoY), with these models commanding 90% of model-specific mentions from consumers.

It is also nice to see traction for its higher-end Model X. Mentions show consumers anxiously waiting to pounce on the upgraded 2024 model.

Our only pain point: Cybertruck headlines are flowing in a bit negative and consumer sentiment mirrors this, down -9% YoY and -3% QoQ, even as initial buzz settles.

For example, the average charge is coming in lower than expected (200 miles per charge vs. 320-mile figure touted) an a viral cybertruck fail of an off-road course that a Subaru mastered with no problem. We see room for (and expect) improvement here, and investors will certainly be listening for updates from Musk on this front.

The tank can't lose to a Subaru.

Investors will also be honing into profitability.

The company has faced margin pressure as it slashes prices (which remain above EV industry standards). The Street is expecting a ~36% drop in net income, so anything better than this would be a nice surprise.

One thing we DO know: Musk is on a tirade to make Tesla the most powerful and affordable EV on the market, and he is thinking long-term.

Tesla is rumored to launch a new entry level model in 2025 costing $25k -- cheap even by non-EV standards. Musk has spoken about a model like this for going on 6 years. The company's lowest priced model is currently ~$38k (Model 3).

Bottom Line

Heading into this report we are Bullish, thanks to growing consumer interest, increased affordability and a low bar -- TSLA shares are trading -16% lower in the last month alone. Any dips on earnings in the near-term are accumulation opportunities in our view.