COVID-19, like many previous American hardships, hit us in the […]

Not All Retailers are in the Same Boat

At LikeFolio, we're watching for indicators that the consumer is getting stressed:

- Inflation fears: +370% YoY

- Gas Price Concerns: +440% YoY

- Rising Interest Rates: +323% YoY

- Maxed out Credit Card: +9% YoY

- Paid off Credit Card: -45% YoY

Translation: Consumers are certainly aware of economic pressures...but they're still spending.

One area we have our eye on today is retail. Ralph Lauren Corp. (RL) and TJX Cos. (TJX) were recently downgraded by analysts who see challenges ahead of inflationary pressure in 2022.

But LikeFolio data suggests not all retailers are created equally...and consumers aren't feeling the burn quite yet.

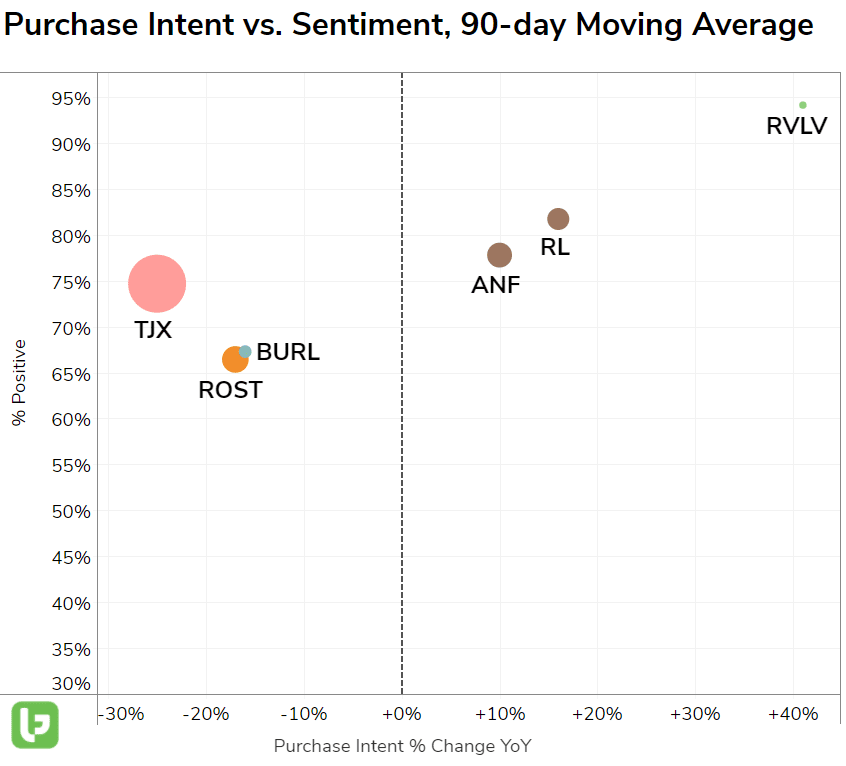

1. Higher quality brand names are outperforming discount retailers

In the last quarter, consumers have sought out higher-quality apparel from names like Ralph Lauren, Abercrombie & Fitch, and even higher fashion brands from Revolve Group's eCommerce site.

In contrast, discount retailers like TJ Maxx, Ross Stores, and Burlington are recording YoY weakness in consumer demand.

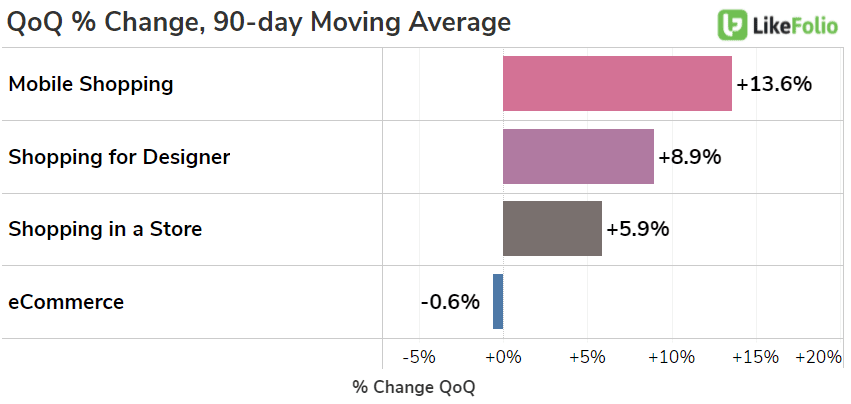

2. Consumer Shopping habits show consumers are still spending.

Perhaps it is all the trips and social events consumers are attending after 2 years stuck inside.

Mentions of shopping in a store and shopping for designer items have increased on a YoY and a QoQ basis. Meaning this behavior hasn't shifted.

These data points are powerful indicators for investors to have. When looking at retailers, there are likely to be over and underperformers.

- LikeFolio data does support a more neutral -- or trade adverse -- position for TJX due to its waning demand growth.

- In contrast, LikeFolio data suggests Ralph Lauren may end up surprising investors.

Keep an eye on both names moving forward to see if apparel spending begins to wane. But so far, Ralph Lauren and its high-quality peers are looking much stronger vs. its discount retail counterparts.