Nvidia (NVDA) Would you look at that?! It's no leg […]

NVDA: Time for a Pause?

In the high-speed lane of tech and AI, NVIDIA (NVDA) has been racing ahead.

The stock has surged a staggering 205% since the start of the year, propelled by high hopes around its AI prowess. But recent signals hint that this initial burst of excitement might be starting to lose steam.

The Numbers

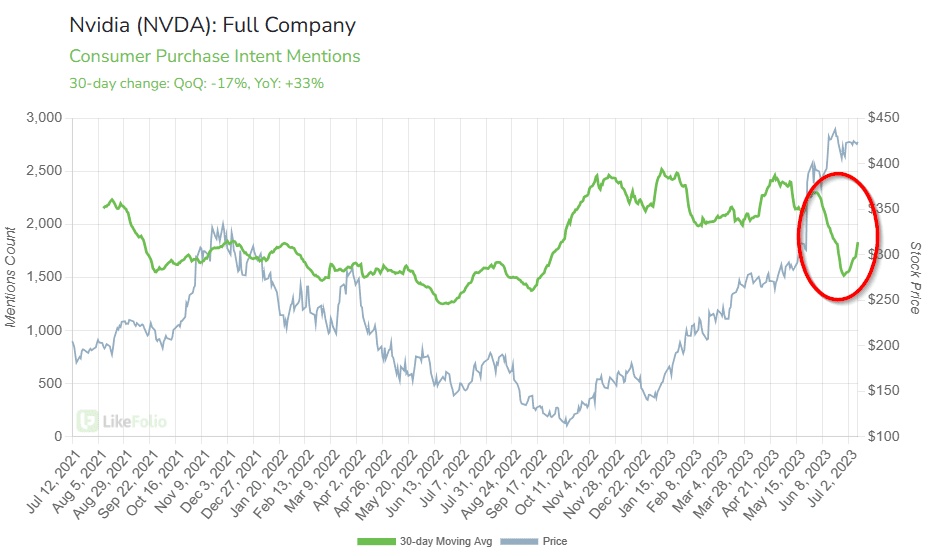

LikeFolio's data reveals a 17% quarter-over-quarter drop in NVDA purchase intent mentions. Even though they're still 33% higher year over year, this recent downturn could indicate a slowdown in the stock's momentum.

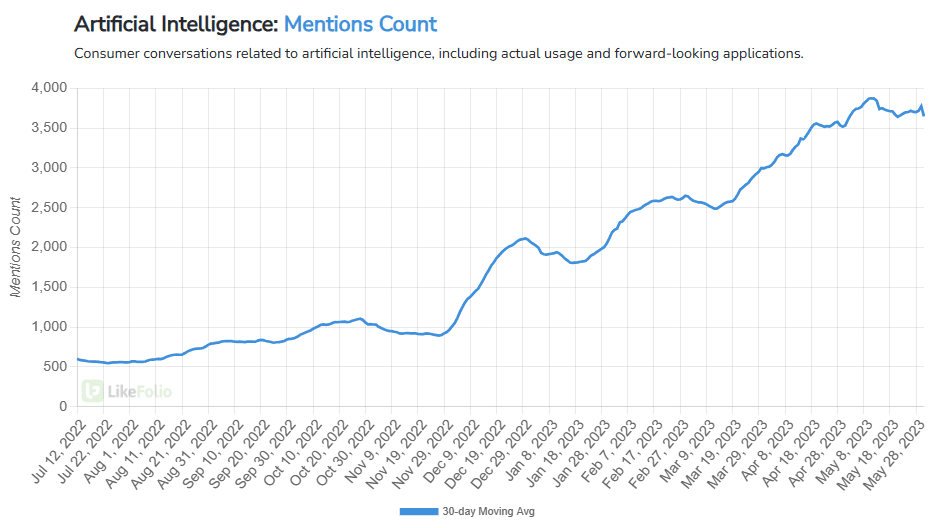

On the other hand, chatter about Artificial Intelligence has exploded, up 564% year over year and holding steady quarter over quarter.

This shows that the fascination with AI is still strong, but the spotlight might be moving away from NVDA.

Interestingly, this shift in focus is not unique to NVDA. Even AI giants like OpenAI's ChatGPT are experiencing a slowdown in growth.

After a period of rapid popularity gain, ChatGPT saw its first-ever user decline recently, according to data from internet analytics firm Similarweb. This could be indicative of a broader trend in the AI industry.

The Outlook

We're long-term bulls on NVDA and AI, but we think NVDA stock could retract by as much as 15% in the short term.

Why NVDA?

Why do we remain upbeat about NVDA for the long term?

NVIDIA is seen as the front-runner among chip makers for AI applications.

They've blazed a trail with GPU-accelerated computing, a novel computing approach where the GPU takes on many of the intricate tasks typically handled by the CPU.

This has positioned NVIDIA's GPUs as a vital player in the AI arena, as they're equipped to manage the colossal amounts of data and computations needed for machine learning and neural networks.

The Opportunity

If NVDA does see a pullback, we believe it would offer a superb long-term investment opportunity. The firm's dominance in AI, its trailblazing technology, and the escalating demand for AI applications make it a robust candidate for continued growth.

Wrapping Up

While we might witness a short-term dip in NVDA's stock price, the long-term forecast remains robust. Stay tuned to this space - a potential pullback could be your gateway to investing in a leader in the AI revolution.

Despite the recent slowdown in AI interest, the sector's long-term prospects remain promising.

As always, LikeFolio members will be the first to know when we spot a big investment opportunity in the AI space.