The Buy Now Pay Later Industry is Booming Consumer preferences […]

One company is winning BNPL (buy now pay later)

I went to the mall on Black Friday. The high-end mall in our town, with big-name banners.

And I've never seen it this crowded since the 90's.

Velvet ropes formed queues outside Kendra Scott. Sephora. Lululemon. Even the lego store.

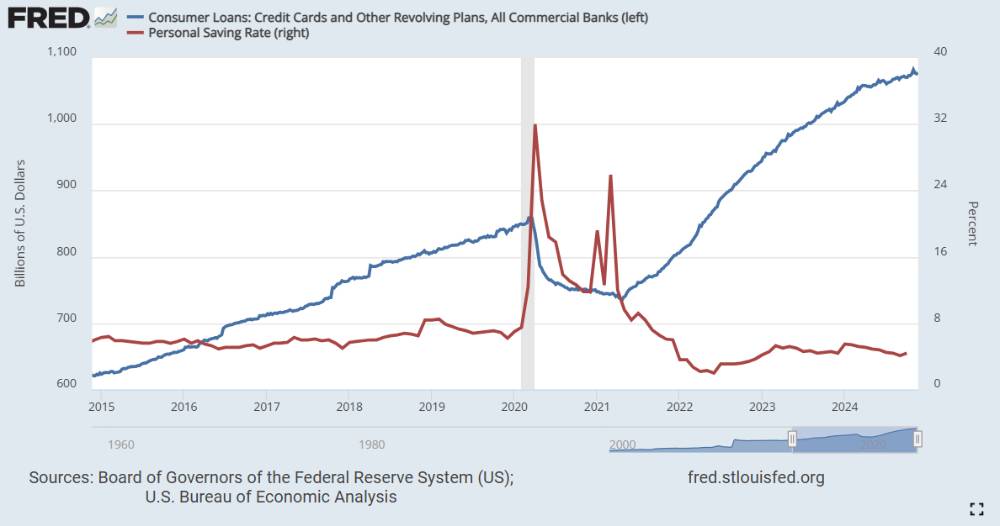

At a time when consumer finances are more levered than ever (check out consumer loans vs. personal savings rate below), how is this level of consumerism possible?

Aside from credit cards, which are carrying avg. rates of 20.42%, consumers are leaning into buy now pay now methods to help space out payments and increase spending power.

Adobe Analytics projects U.S. shoppers to use BNPL financing for $18.5 billion in holiday spending this year, an 11% increase from 2023.

At LikeFolio, we see a clear leader in this growing space...

This section is restricted to LikeFolio Pro Members only.