The Buy Now Pay Later Industry is Booming Consumer preferences […]

Affirm (AFRM) Reports Staggering Sales Growth

Affirm (AFRM) Reports Staggering Sales Growth

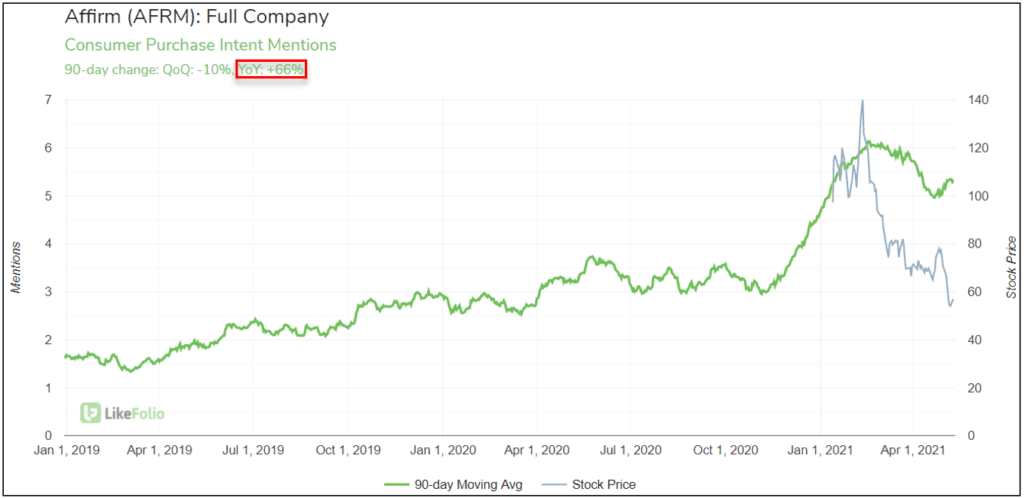

LikeFolio recently issued a bullish alert for Affirm Holdings (AFRM), citing strong growth in underlying Consumer Demand. Affirm’s Purchase Intent Mentions have maintained their upward trajectory, currently up +66% YoY on a 90-day moving average.

That Demand growth was on full display yesterday, when AFRM reported impressive results for 21Q3 (ended 3/31/21):

- Gross Merchandise Volume (GMV): +83% YoY (vs. +77% in 2020)

- Active Consumers: +60% YoY (vs. +92% in 2020)

- Transactions per Active Consumer: +10% YoY (vs. +5% in 2020)

- Revenue: +67% YoY(vs. +89% in 2020)

Despite topping sales growth expectations and raising guidance for the remainder of the 2021 fiscal year, AFRM shares are trading down -4% today after bouncing off an all-time low this morning.

The reason? Affirm posted a record GAAP Operating Income loss, roughly -$169M for the quarter. Additionally, a few institutions drastically lowered their price targets this morning.

Buy-Now-Pay-Later’(BNPL) Showing Relative Strength

Despite AFRM’s near-term profitability concerns, we’re maintaining a bullish outlook for the 'Buy-Now-Pay-Later' (BNPL) space at large.

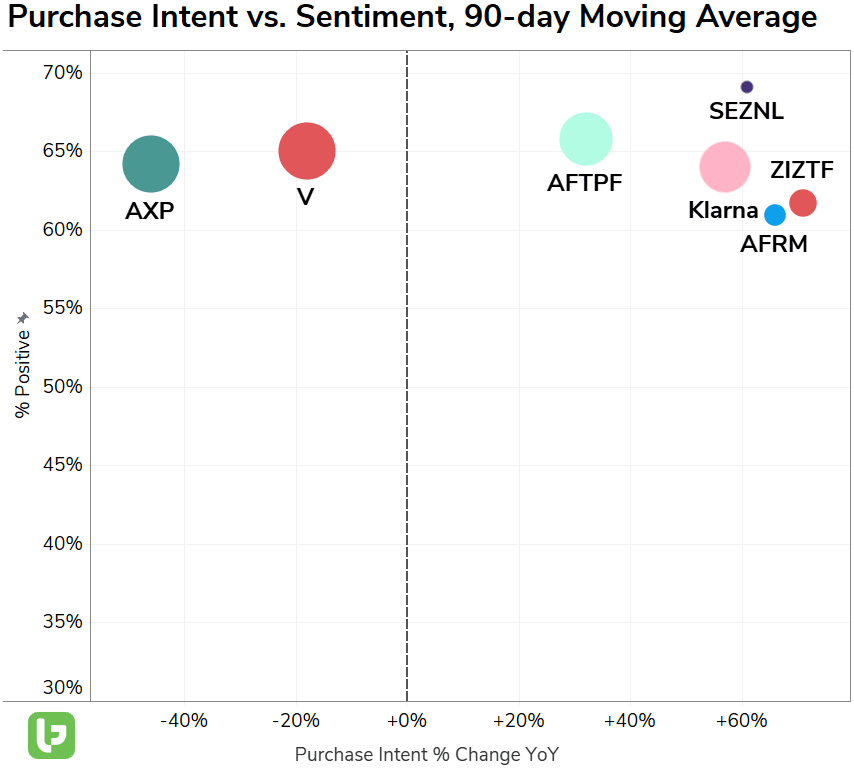

Point-of-Sale loan specialists, such as Affirm, Afterpay (AFTPF), and Sezzle (SEZNL) are experiencing rapid consumer adoption.

Comparing YoY Purchase Intent Mention growth for the BNPL companies against that of traditional competitors highlights their current edge.

Millennial and Gen Z consumers have shown a lasting preference for BNPL.

During the 21Q3 earnings conference call, Affirm’s CEO noted that, “Priceline shared with us… that Affirm helps them expand their reach among millennial and Gen Z consumers.”

As the purchasing power of this younger cohort grows, we’ll be watching to see if the current preference for BNPL solutions persists over time.