Trend Watch: Learning to Trade Over the past year, LikeFolio […]

Our take on Reddit (RDDT)

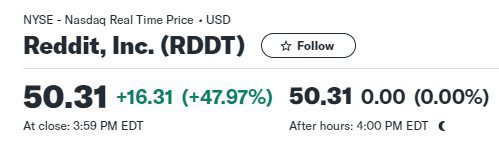

Reddit shares (ticker symbol RDDT) soared 38% above the offer price on its trading debut, opening at $47 each and valuing the company at $8.87 billion.

After popping 70% immediately following its debut, shares settled and closed just above $50.

This name is of special interest to us at LikeFolio. After all, it does help to power our proprietary signals.

What is Reddit?

A social network sometimes called the "front page of the internet".

That means lots of users having lots of conversations. Which means lots of data for AI and machine learning companies to tap into.

In fact, Reddit's data stream has become an important part of LikeFolio's own research process.

We added the company formally to our ingestion process last year after testing its stream of messages for quality and quantity.

So – just how often are users chatting about products and services of publicly traded companies on reddit?

Often.

We processed 1,230,030 items – or positive matches to our brand mapping database – in the last 24 hours alone, and nearly 30 million in the month of February.

The company is successfully attracting more eyeballs to its site.

GoogleTrends shows consumer searches at all-time highs:

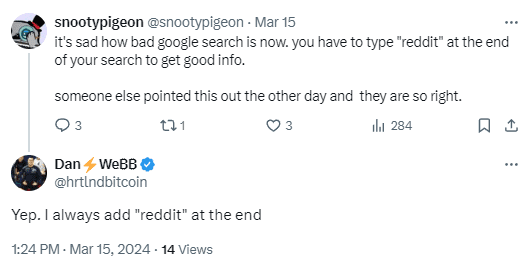

And qualitative review from mention on a competitive peer’s site (X) show users often trust Reddit more than they trust Google when trying to get to the REAL search query result.

Despite its significant cultural impact since its 2005 launch and its role in the 2021 meme stock frenzy, Reddit acknowledges it is in the early stages of monetizing its platform and has not yet turned an annual profit.

What should investors take away from this?

Reddit's IPO performance could influence the broader IPO market, especially for tech companies eyeing public debuts. A strong showing might embolden other companies to move forward with their public offerings, while any weakness could lead to hesitation and reevaluation of market conditions.

So far, the market looks receptive of RDDT and its growth potential.

- Reddit is eyeing data licensing as a key revenue driver, having secured deals worth $203 million over two to three years, and expects to recognize $66.4 million from these arrangements this year.

- Additionally, an expanded partnership with Google aims to further monetize Reddit's vast data trove by enhancing AI models and Google's product offerings.

But expect some near-term hiccups as Reddit gets its sea legs.

Volatility in store?

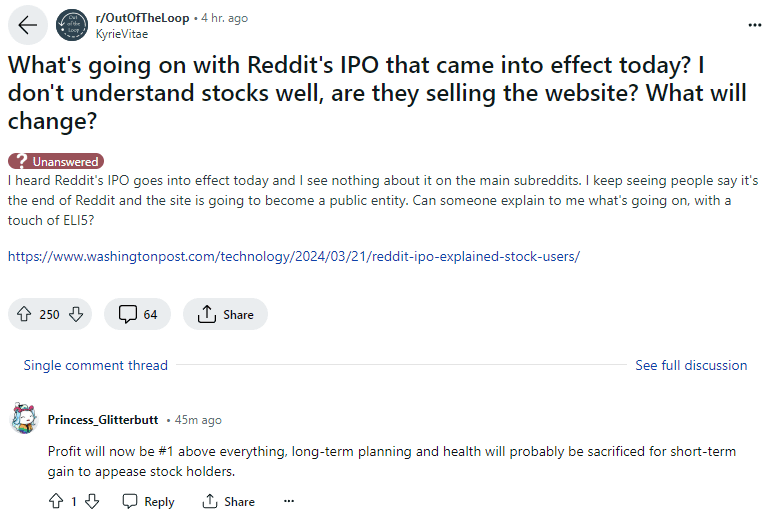

As a publicly-traded company, Reddit will be subject to greater scrutiny from investors, regulators, and the public. This could lead to increased transparency and accountability, but it may also put pressure on the company to prioritize short-term financial performance over long-term growth and user experience.

Some of its most zealous users view Reddit’s IPO as caving to ‘The Man’ and corporate profits.

Trading RDDT from Here

From a trading perspective, Reddit has some unusual risk exposure.

The company’s decision to offer shares to its most loyal users as part of its IPO is a unique strategy aiming to deepen the sense of ownership among its community, particularly among those who significantly contribute to the platform's content and management.

This approach could foster even greater loyalty and generate positive public relations by aligning the interests of Reddit's user base with the company's long-term performance.

However, this move also carries risks, notably if the stock price falls post-IPO, potentially leading to dissatisfaction among these new investor-users, even sparking panic selling.

Internally Speaking

On our end, we’ll be watching for platform adoption and expanded audience segments.

As it stood at the end of the third quarter (2023), nearly 64% of Reddit’s users were male.

Widespread efforts for growth may place the platform more in the mainstream and attract a larger sample size and range of discussions, which only stands to improve the quality of our data and signal.