PepsiCo (PEP) The quarantine 15 didn't materialize out of thin […]

Pepsico (PEP), Coca-Cola (KO) are leaning into Health and Wellness

Pepsico (PEP), Coca-Cola (KO) are leaning into Health and Wellness

When it comes to Coke and Pepsi, a future growth target may surprise consumers: Health and Wellness.

Seriously.

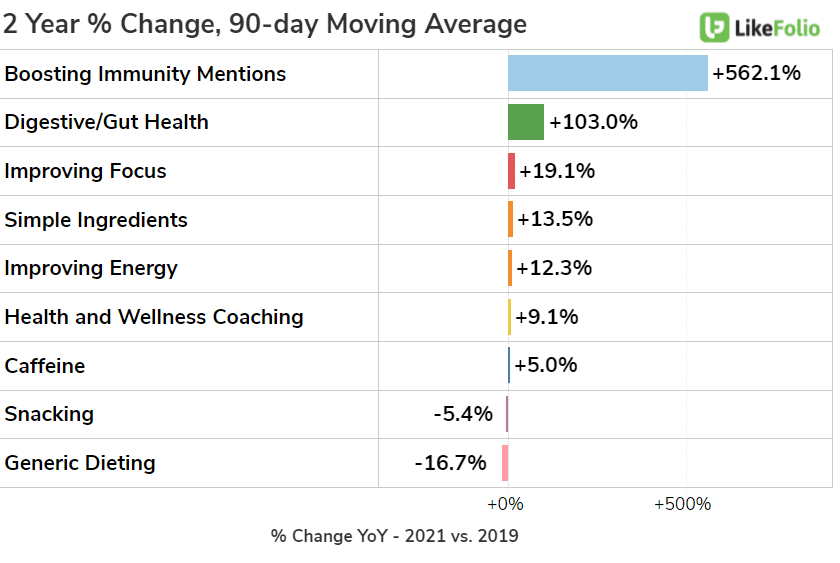

Check out some of the top growing consumer macro trends on the chart below.

Common themes: Consumers are increasingly seeking overall wellness functional benefits like Improved Gut Health, Immunity, Focus, and Energy vs. dieting.

And the big players in the beverage (and snack) game know this.

How does Pepsi have a dog in this fight? Through many brands, actually.

Pepsi's snack options are getting leaner.

While many associate the snacking giant with the "eetos" (Cheetos, Doritos, Fritos, etc.), the company has made strategic acquisitions to beef up its "better for you" options, alongside its functional benefit segment via brands PopCorners, Muscle Milk, and Evolve, to name a few.

Just check out the company's "Everyday Nutrition" offerings -- KeVita probiotics drinks tap into the growing consumer demand for gut health, and healthy snacking options from Sabra hummus, to Off the Eaten Path (real veggie chips), expand Pepsi's potential snacking audience...and we'd bet many consumers have no idea the same company pumping out Hot Cheetos is also placing Bare Apple Chips on the shelves.

While Pepsi's healthy snacks appear to be holding traction with consumers, Coke is flexing its healthy beverage segment.

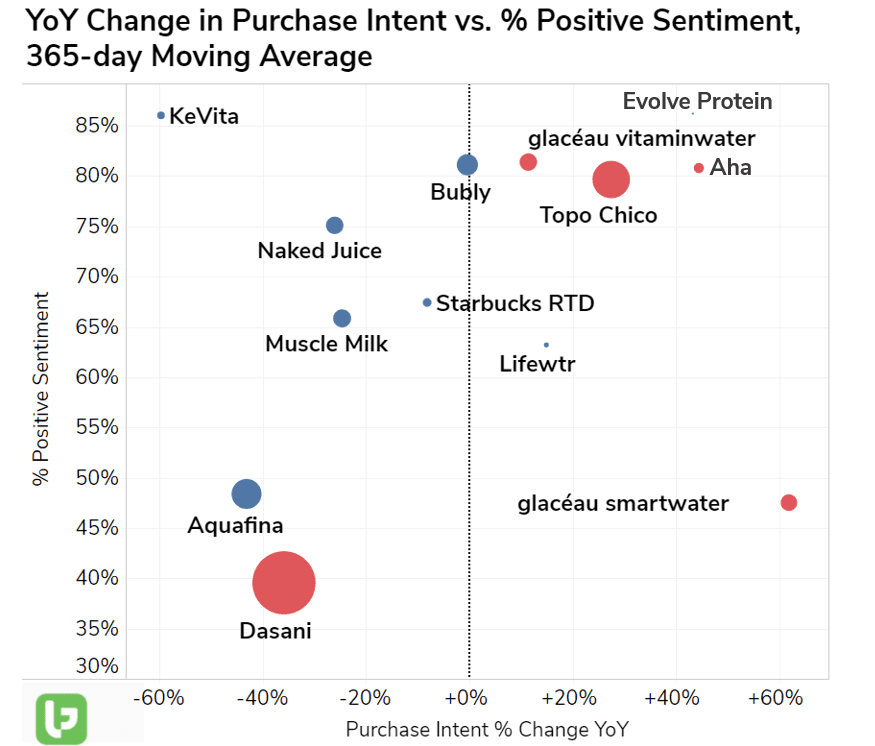

The chart above showcases KO vs. PEP non-soda brands. Note the significant growth of Coke's Smartwater segment. What's going on?

Coke is leveraging functional benefits (and strategic ingredients) via its Smartwater brand.

While Pepsi's strategic acquisitions expanding the company's audience base is a strong long-term vision, in the near term the Eetos and traditional soft drinks remain the majority of company mentions...and revenue.

We'll be watching to see if reopening beverage strength can help temper any normalization in snacking trends.

PEP reports 21Q3 results on October 5 before the bell.