United Parcel Service (UPS) After two quarters of explosive demand […]

Precious Metals: Looking Ahead

Precious Metals: Looking Ahead

LikeFolio data reveals a few interesting things about the state of financial markets in the U.S.:

- Fear and uncertainty regarding inflation continue to loom large: Mentions relating to concern about inflation are up +59% YoY and rising to new heights on a 90-day moving average.

- Retail investors are flooding into unregulated cryptocurrencies and other digital assets: Mentions of consumers purchasing of Non-Fungible Tokens (NFTs) averaged ~2300 per day in the past week vs. just ~73 Mentions at the beginning of the year.

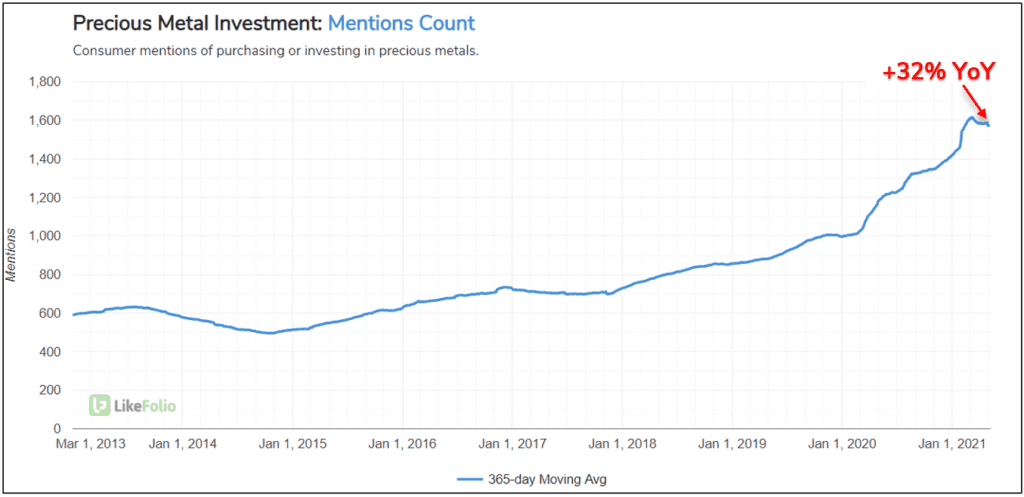

- The popularity of precious metals as an investment vehicle has not diminished relative to last previous year: Consumer Mentions of purchasing or investing in precious metals are holding at +32% YoY on a 365-day Moving Average.

This long-term trendline highlights 2 interesting phenomena:

- The number of new investors entering this realm in the 7 years prior to 2020 could be described as ‘a trickle’ at best.

- The phenomenal surge in interest that began last year, has continued to new heights in 2021.

Gold Showing Strength

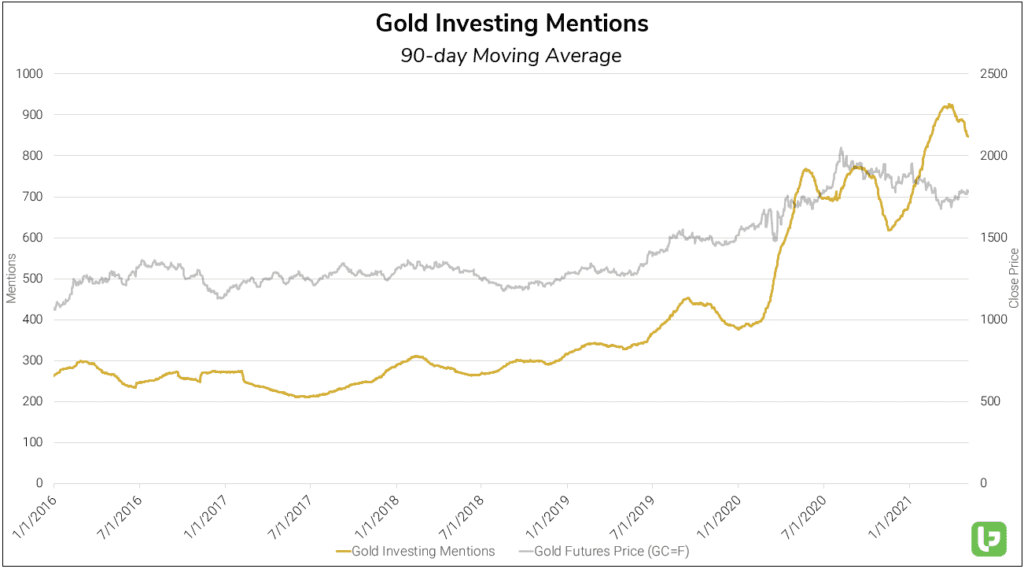

In recent months, we’ve focused on rising Silver Demand as key driver for the Precious Metal Investing trend, but now it's the undisputed king of the metals time to shine.

Retail Investment Mentions relating to the purchase of Gold are near an all-time high level, +19% YoY and +157% vs. 2019

The recent surge in gold-related investment chatter comes just as the gold futures price has started to rise. Back above $1800 per ounce for the first time since February.

Considering all of the current market factors and forces, there's a bullish case to be made for precious metals as a long-term investment.