PayPal (PYPL) Last week we touched on a huge crypto […]

PYPL: Early 2023 clues are positive

PayPal (PYPL) Opening 2023 with Relative Strength

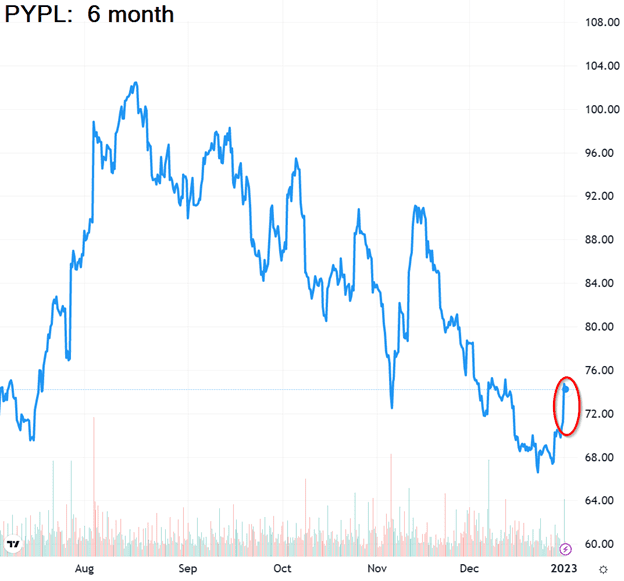

After a dismal end to 2022, PYPL was one of the leading gainers in the S&P 500 on the first trading day of 2023 Tuesday, despite the NASDAQ turning negative early in the day.

This could act as a clue that PYPL’s recent selloff is viewed as overdone by institutions, making the stock an attractive “value” play after being hit by tax-loss selling in late 2022.

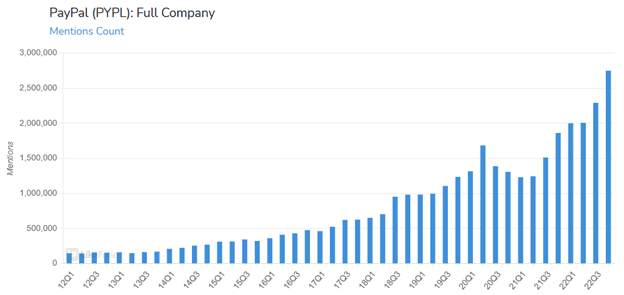

PayPal mentions surging to all-time highs

To be fair, PayPal buzz spiked in October when the consumers became aware of a PayPal policy related to the promotion of “misinformation” and subsequently imposed fees.

However, this chatter died down by early November, and sentiment normalized around the same time. Turns out this policy was a flash-in-the-pan reaction.

Now, consumers are talking about PayPal and its brands (venmo, etc.) at a growing clip, with mention volume up by +20% QoQ and nearly +50% year over year.

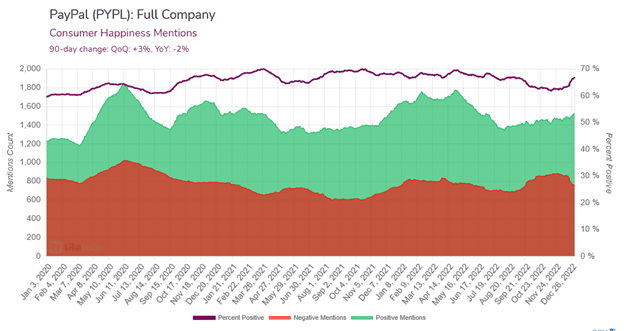

Users remain relatively happy with PayPal products

In the aftermath of the “misinformation” scandal, PayPal’s consumer happiness levels are reverting back to their old, fairly stable levels in the high 60% range.

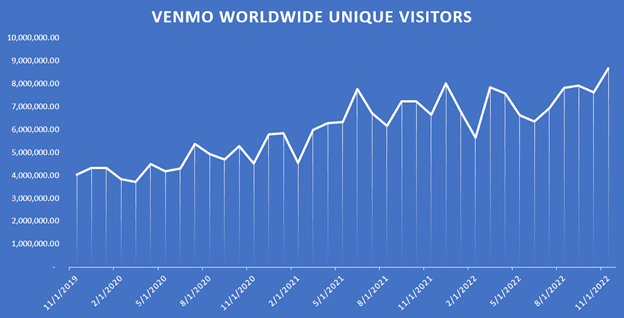

Venmo just keeps growing

Paypal’s Venmo brand continues to see worldwide growth as global unique visitors to its website reach new all-time highs in Q4 of 2022.

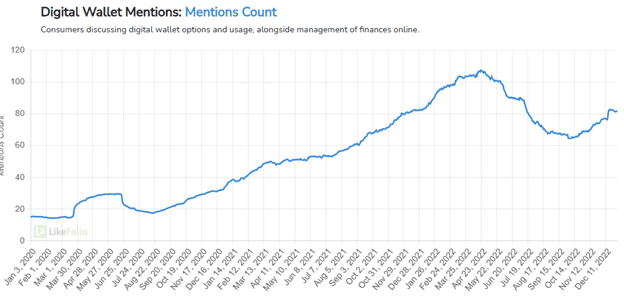

The “Digital Wallet” boom is taking a breather

Like many Covid-era trends, consumer interest in digital wallets has pulled back from early 2022 peaks but remains in a strong multi-year uptrend that should continue throughout the current decade.

Looking ahead: PayPal’s renewed consumer interest and rebounding sentiment is promising. The company reports 21Q4 earnings (ended Dec. 31) in about a month, and initial data is strong.