Tesla reports earnings after the bell on Wednesday. After last […]

To EV or not to EV ($TSLA)

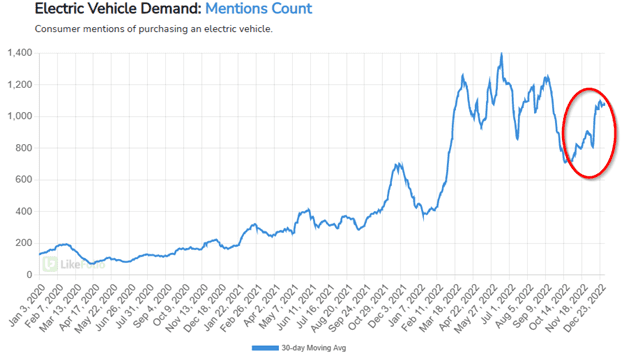

EV Demand showing signs of life after Fall collapse

Consumer mentions of purchasing an electric vehicle have moved up by 20% over the past quarter following a steep decline in demand at the beginning of Q4 2022.

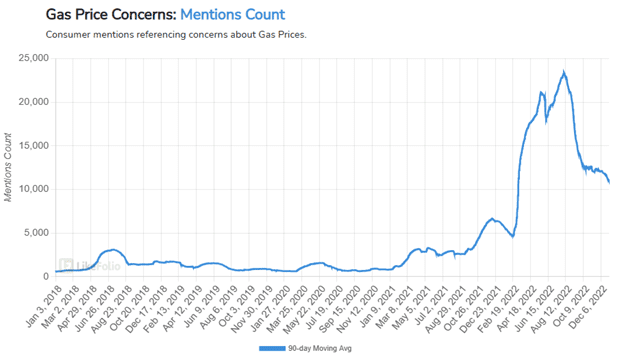

Gas price fears fuel demand

Consumer concerns around gas prices peaked in early August and fell sharply through the end of 2022.

This coincides almost perfectly with the Fall 2022 drop in EV demand, as consumer interest in alternative power sources is directly correlated with the pain they are feeling at the pump.

Once gas price concerns started to stabilize in late 2022 (at much higher levels than a year ago), EV demand once again began its upward march.

From a long-term perspective, EV demand is clearly headed higher as price and performance begin to compete favorably with traditional gas-powered vehicles.

Future oil/gas price surges will continue to accelerate this baseline demand growth.

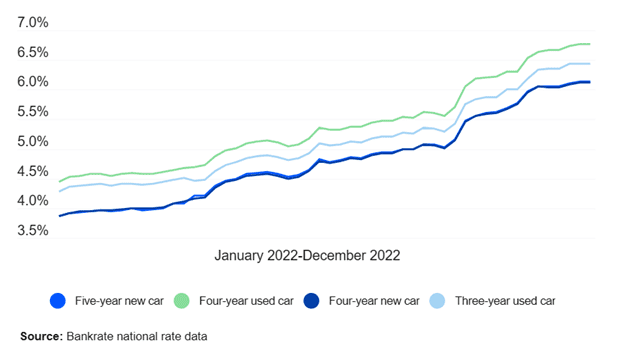

Auto loan rates aren’t helping

Data from Bankrate shows that the cost to finance a new car has risen from under 4% to over 6% in the past year, putting pressure on car buyers to move down-market in order to keep payments in the budget.

Could EV Credits “Accidentally” Stimulate Q1 Demand?

Consumers are being forced “off the fence” when it comes to EV purchases in Q1 2023 thanks to loopholes and implementation decisions around changes to the $7500 tax credit for EV purchases and leases.

This could “pull forward” a significant portion of 2023 EV demand into Q1, creating a surge of buyers (and corporate revenues) in the first part of the year that is unsustainable for the remainder of the year.

“Hands off” driving becoming a reality

You can sense Tesla’s growing confidence in its Full Self Driving (FSD) product. At $15,000 per download, this could turn out to be a goldmine of additional revenue for the company in 2023 and beyond.

Is Musk in financial trouble?

There's much speculation around Musk’s financial condition after Tesla’s 2022 freefall in value, and his massive overpayment for Twitter.

We see this noise in the same light we saw “TSLAQ” a few years ago when TSLA stock was fractions of today’s value – it’s nonsense.

Just yesterday one of Musk’s other companies, SpaceX, announced it was raising $750m at a valuation of over $135 billion.

With Musk as 48% owner in that company, we think Elon’s got plenty of time and money to subsidize his Twitter experiment without leaning too heavily on TSLA shares into the future.