More than one year ago, in late February 2021, LikeFolio […]

Fed Up with the Fed!

2022 was all about inflation, and 2023 is naturally shaping up to be the Year of the Rising Rate.

No, it doesn’t have the same flair as Year of the Dragon, Ox, or even Rising Sun, but it is expected to have a major effect on U.S. economic activity.

How much Americans spend in the new year will largely depend on the availability and cost of credit.

Big ticket items may be out and smaller packages in. A growing preference for experiences over things could also persist in the face of higher interest rates.

We already know that rising rates are taking their toll on market sentiment. Since the Fed launched its rate hike campaign to combat rampant inflation, stocks have floundered. The S&P 500 has slumped -13% from the initial St. Patty’s Day hike.

Talk about a lasting hangover!

But are rising rates really weighing on consumers’ psyches?

Absolutely!

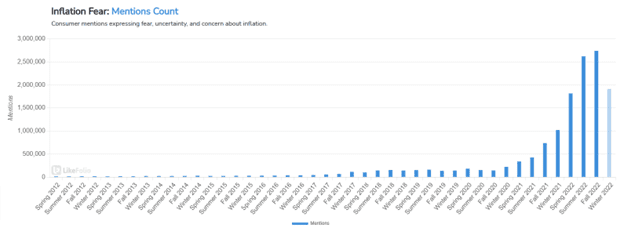

LikeFolio mentions of interest rate increases are up +358% YoY on a long-term average. Inflation mentions are also up big YoY but have dropped significantly in Q4.

Make no mistake, inflation is still a major concern. But rates are becoming as, if not more, pressing.

Move over ‘inflation fear’, ‘rising rates’ is the new buzz phrase for 2023.

Here’s how they’re already impacting consumer behavior:

Homebuying Activity is Cooling

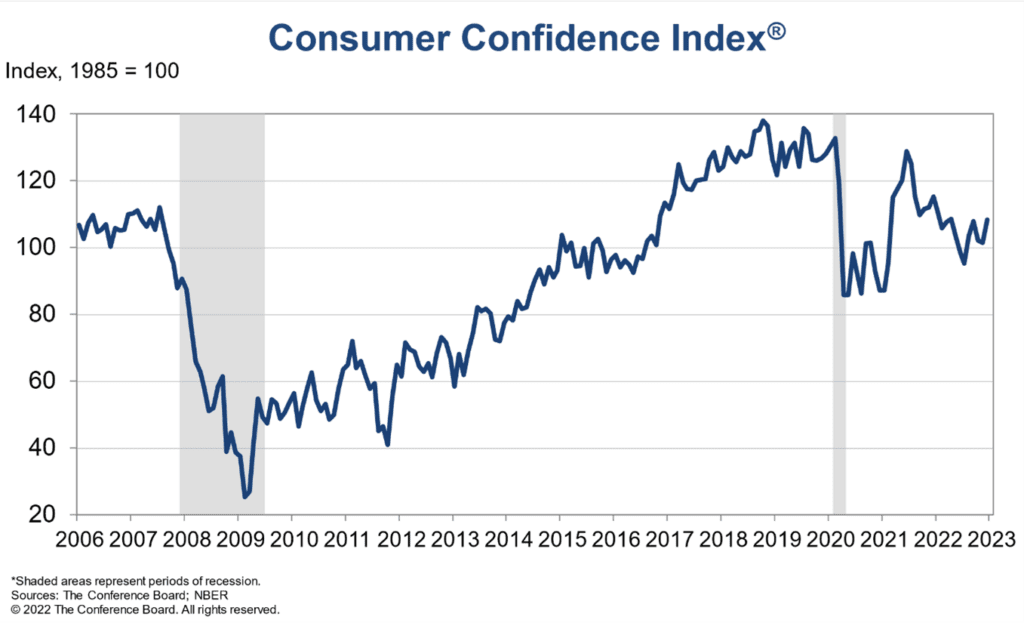

In December, the Consumer Confidence Index bounced back to its highest level since April 2022. Falling gas prices were a big factor.

One area that kept confidence levels well below pre-Covid peaks, however, was housing. More prospective homebuyers continue to stay on the sidelines because of higher mortgage rates.

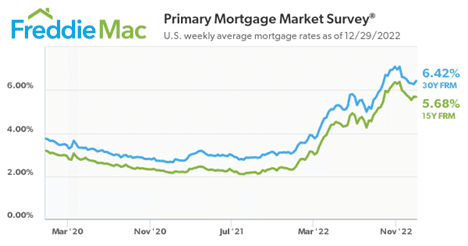

A recent Freddie Mac survey revealed that the average rate on a standard 30-year fixed mortgage rose to 6.42%. It marked the largest increase in any calendar year after the 30-year mortgage began the year at around 3%.

Long lines for open houses and insane bidding wars are in the past.

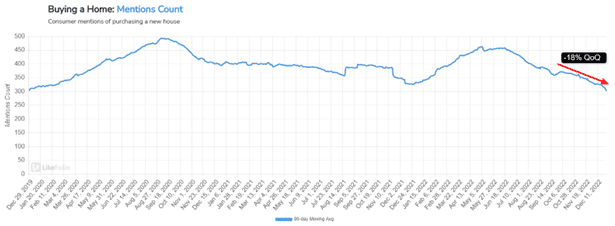

In sharp contrast to the hot housing market of 2021 (before rate hikes began), consumer mentions of purchasing a new home have slid to post-pandemic lows. They are down -18% QoQ.

Not surprisingly, refinancing mentions are also down.

What a difference a year makes!

Auto Buyers Hit the Brakes

The auto industry is finally getting a reprieve from semiconductor shortages and supply chain snags. Production volumes are improving.

There’s just one problem. Consumers no longer want them.

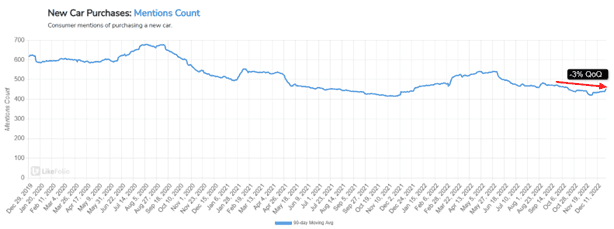

Prices and borrowing costs are too high—and expected to drive a decline in U.S. new vehicle retail sales for December.

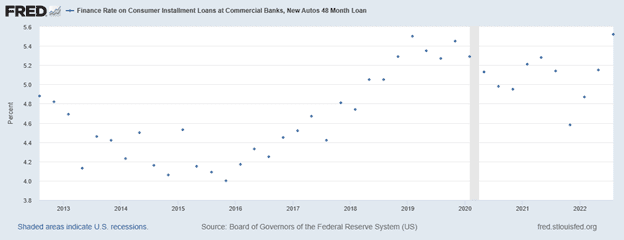

New car loan rates are at a 10-year high.

As dealers attempt to clear out inventory with year-end holiday deals, the consumer response has been less than festive.

Mentions of purchasing a new car are down -3% QoQ and hovering near 7-year lows.

As for the classic salesman’s pitch, ‘What do I need to do to put you in a new car today?’, the answer is nothing. With rates where they’re at, many Americans are likely to hold back on buying a new set of wheels regardless of dealer incentives.

Rising rates on homes and cars—the two largest purchases for most—exemplify the current consumer spending cutback.

Big and Bulky are Out

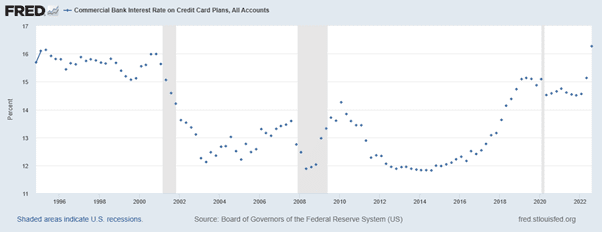

It’s not helping matters that average credit card interest rates are at record highs.

With most U.S. cards tied to the prime rate, increases in the Fed funds are flowing through to the prime rate and credit card rates.

People with lower credit scores are getting hurt the most. It’s tough to dig out of debt when prices are high and credit card rates are north of 20%.

Households across the credit score spectrum are cutting back on expensive items. With savings down from inflation, buying a TV, stove, or couch on credit is a pricey endeavor these days.

Why compound inflation pressures by taking on high-interest debt?

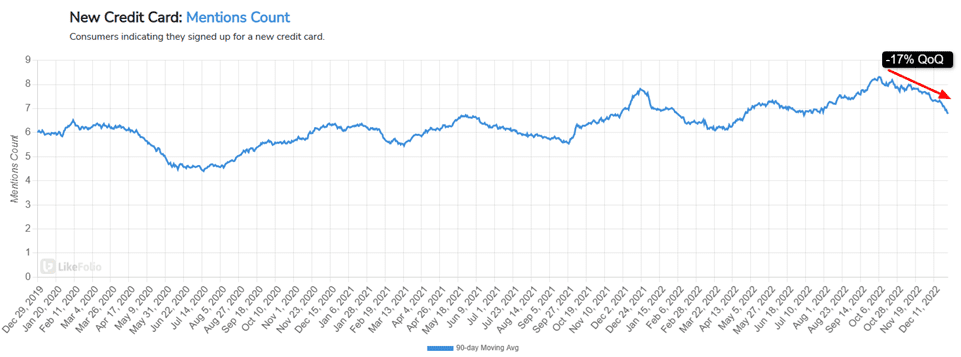

This mindset seems to be deterring consumers from signing up for new credit cards. New credit card mentions are down -17% QoQ.

The Conference Board’s latest confidence reading came with a warning that a “shift in consumers’ preference from big-ticket items to services will continue in 2023”.

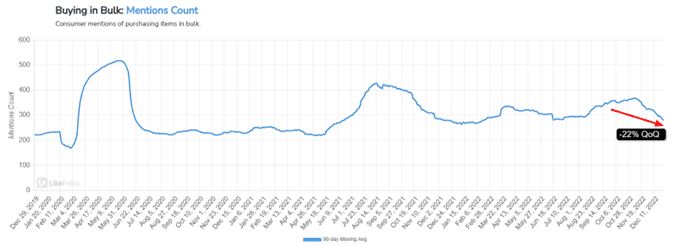

Another likely change in consumer behavior is avoiding bulk purchases. Buying in bulk mentions are down -22% QoQ. Stockpiling has given way to getting by.

Getting by with smaller package sizes and orders is helping some households weather the current economic storm and will probably remain a popular strategy if we do indeed enter a recession.

Many consumers who can afford it ARE buying in bulk to save money – especially on food items.

But lower earners don’t have this luxury, and many are reporting scaling down. You can see this trickle into large-scale macro themes:

One area where Americans are refusing the cut back: vacations.

Pent-up demand for R&R is manifesting itself in several ways:

- Booking a Cruise mentions are up +59% YoY

- International Travel mentions are up 42% YoY

This also relates to a growing consumer willingness to spend on experiences over things.

Travel aside, until rates come down, expect big-ticket purchases to be a big no-no for many U.S. consumers.

While easing gas and grocery prices suggests the Fed is solving one problem, as feared, it appears to be at the expense of creating a new problem—crippling rates.

Households that grew accustomed to adjusting their budgets to higher prices are now coping with higher rates.

Given Chairman Powell’s recent comments, hopes for a Fed ‘pivot’ are fading and expectations of ‘higher rates for longer’ growing.

Buckle in, rising rates will be a key consumer theme in 2023.

We’ll be watching closely.