Snapchat's IPO timing was...well... incredible. They literally took the company […]

Social Media Blitz $FB $PINS $SNAP

Social Media Blitz $FB $PINS $SNAP

What's your social media platform of choice? If you're like other users, you have an account on many social sites.

You can see a really neat chart of social media overlap here. But the key takeaway: +98% of users with at least one account use other platforms.

In this massive landscape, what should investors know? Here's what we're watching at LikeFolio:

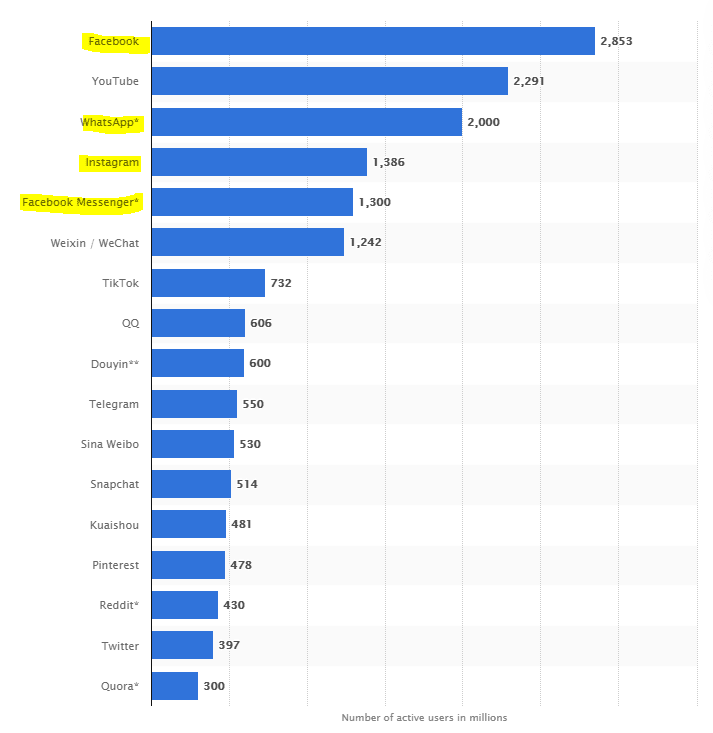

Facebook is the dominant player

4/5 of the most popular social networks worldwide (through July 2021) were owned by FB, with Alphabet's YouTube being the only outsider to crack the top 5.

LikeFolio data confirms Facebook's user growth is driven by its messaging platform WhatsApp and Instagram of late, both recording levels higher vs. 2019: +19% and 7% respectively.

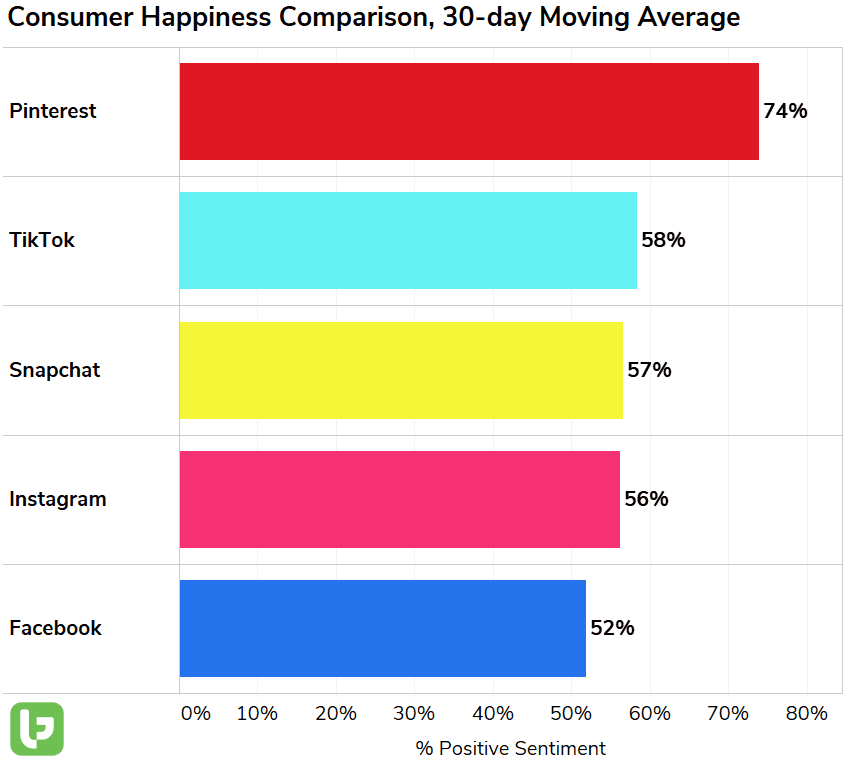

Pinterest boasts the happiest users

Pinterest sentiment is 74% positive and leads the pack vs. traditional "social" sites.

Why? Pinterest was made for brand and product discovery, so advertisements aren't viewed as intrusive. In fact, this type of "you might like this" placement is welcome.

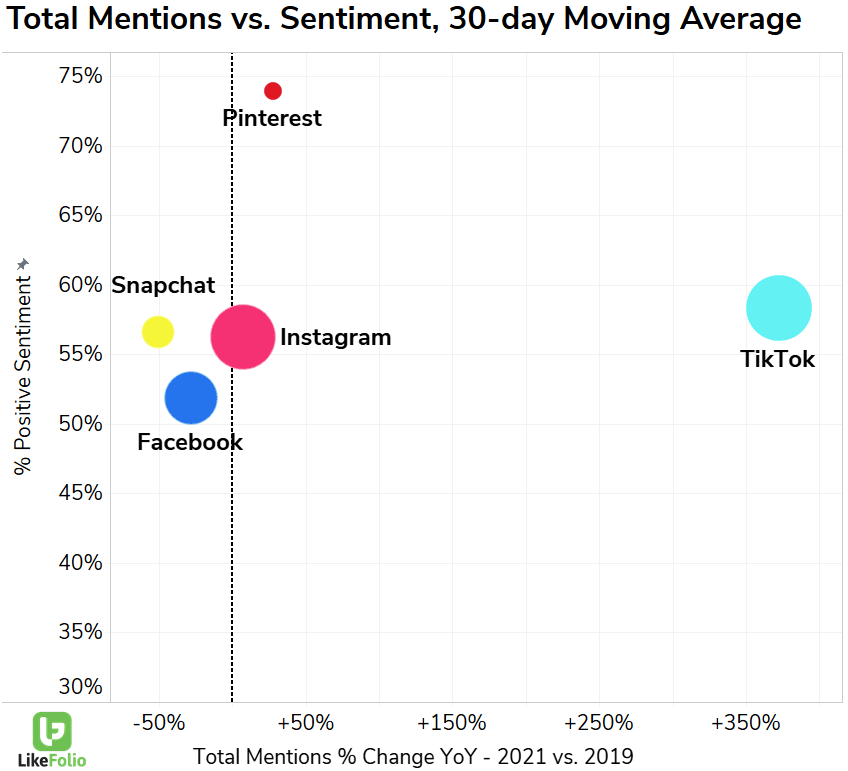

Pinterest platform mentions remain above 2019 levels, but growth is slowing. This was cause for concern after the company's last report that sent shares tumbling -18%.

However, long-term investors are sticking around due to monetization potential and international growth. Last quarter, U.S. active users declined by 5%, but International active users increased 13%. Building on that, international ARPU increased +163% YoY. Even with this rate of growth, international ARPU was $0.36 vs. $5.08 in the U.S. On one hand, this displays why U.S. users are so valuable. On the other hand, it supports the enormous growth opportunity argument.

TikTok user growth is exploding

TikTok mentions have increased more than +370% vs. 2019, dwarfing growth rates of more established peers.

Earlier this week, TikTok surpassed 1 billion global monthly active users. Even at this rate of growth, TikTok sentiment remains high (and higher vs. "camera-first" peers like Snapchat and Instagram).

Snapchat users are loyal, but Spotlight retention is key for continued ad revenue growth

After a disastrous redesign burned sentiment levels in 2018, Snapchat consumer happiness has recovered and continued to improve: 55% positive, +2 points YoY.

However, the company may be struggling with user-generated content creation.

Creators have indicated they are leaving the platform's "Spotlight" feature in favor of TikTok and Instagram after the company ramped down its payment policy in June.

LikeFolio data shows user Spotlight mentions remain high but have dropped -32% QoQ. Keep an eye on this, as this discovery segment is the ideal placement for advertisements vs. inside personal messaging and friend stories.

Big picture, it does appear the Spotlight discovery feature has helped move the needle for SNAP. On a near-term basis, Snapchat's Purchase Intent (downloading and using Snapchat) has increased +5% QoQ.