Despite recent market volatility and some arguing for a bear […]

Uber and Lyft are in Different Leagues

Uber and Lyft are in Different Leagues

When it comes to ridesharing services, sentiment matters most.

At least according to correlation metrics. LikeFolio analysis confirms Consumer Happiness is the most predictive metric when correlating to company revenue for both Uber and Lyft.

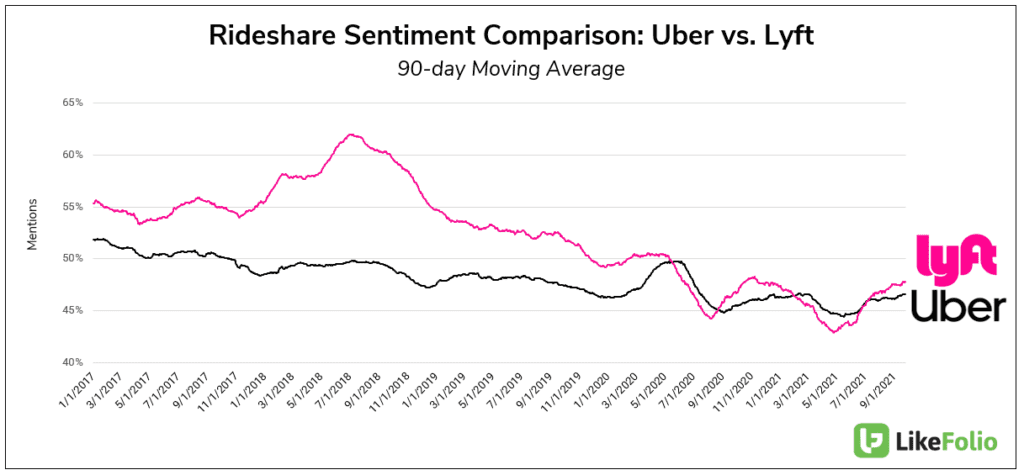

Right now, Lyft is displaying a short-term edge vs. peer, Uber.

While sentiment levels are very close, Lyft's overall happiness is just over a point higher than Uber's and is gaining traction, quicker.

Both companies have recorded downturns in overall consumer happiness vs. 2019, mostly attributable to driver availability and ride price increases.

In fact, mentions of ridesharing service prices rising or being too expensive AND mentions of consumers reporting no cars available have increased ~23% YoY.

Both companies are also facing an uphill battle regarding the classification of drivers as freelancers vs. full-time employees.

A judge in California struck down a ballot initiative exempting Uber from classifying its drivers as full-time employees, a classification that would cost gig companies an estimated extra $7,700 per driver per year in payroll taxes and workers' comp insurance premiums.

In the near term, Uber is expected to appeal this ruling. Long-term, Uber retains a stake in Aurora (its previous in-house autonomous driving start-up). Autonomous vehicles would certainly solve the labor disputes.

So what are we watching from here?

Neither Uber nor Lyft reports Q3 Earnings until November, but data suggests Lyft is flexing a reopening edge.

LYFT Purchase Intent Mentions and Consumer Happiness levels reveal YoY improvements on a 30day Moving Average. The ride-sharing-only business model is benefitting more on a comparative basis as consumers resume entertainment activities and travel.

UBER Consumer Happiness is improving, but not as quickly as LYFT, and overall demand is muted YoY. The company's Uber Eats food delivery helped to retain consumer demand during the pandemic, but continues to fall in second place to industry leader, DoorDash. Uber Eats Purchase Intent mentions have declined -39% YoY vs. DASH at -18% YoY.

While Lyft has secured a short-term edge, its narrow focus on transportation vs. Uber's expansive logistics services may stunt long-term growth.