iRobot (IRBT) Last quarter, iRobot posted strong results: revenue increased +43% […]

The Biggest Beneficiary of the “Urban Exodus” ($TSCO)

In Q1 of 2021, we identified the ongoing “Urban Exodus” as one of the strongest prevailing trends in consumer behavior – Americans were leaving the cities in droves in search of living space and natural beauty.

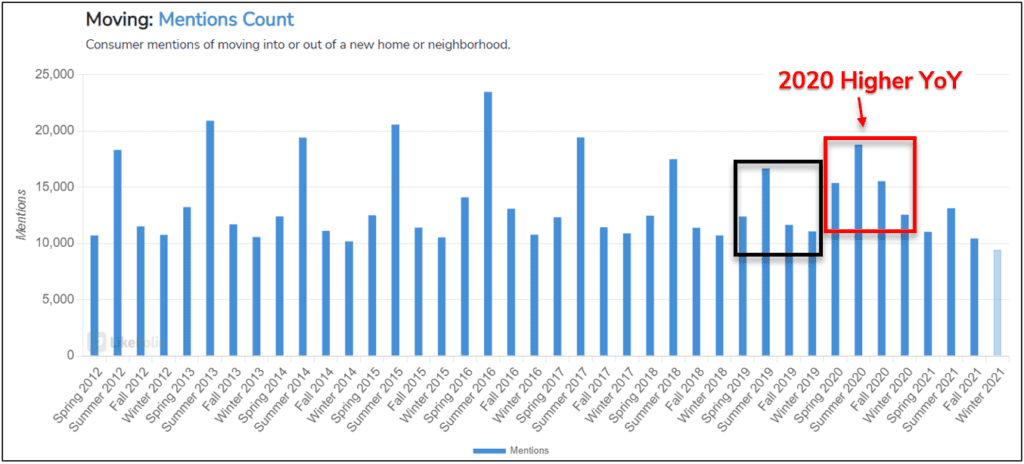

In fact, 2020 was a huge year for all kinds of relocation — Consumer Mentions of moving to a new home or neighborhood put on substantial YoY gains in every quarter.

A significant number of Americans took the pandemic as an opportunity to start a new chapter somewhere a bit more…peaceful.

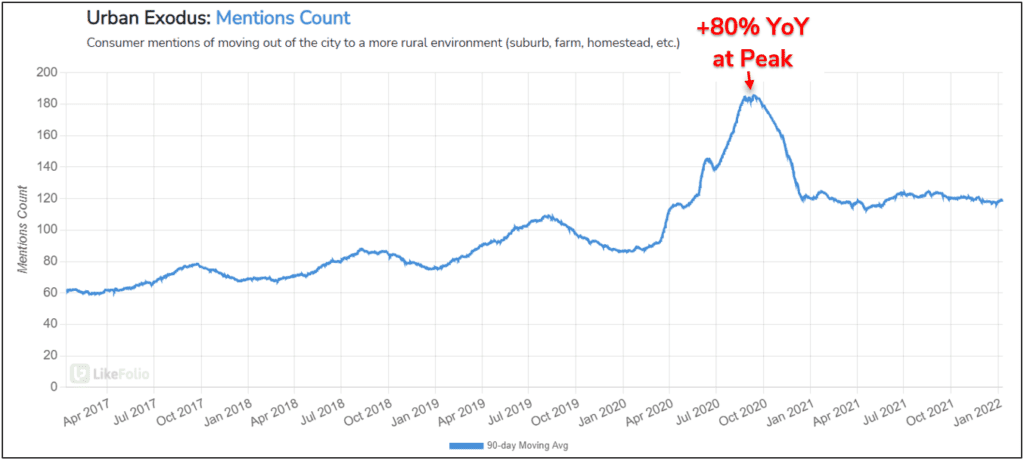

Consumer mentions of moving out of the city to a more rural environment surpassed the growth seen in generic moving mentions.

Moving mentions (and mentions of moving-related companies like UHAL) typically reach peak volume in the summer months, and 2020 was no different.

At the 2020 peak, the “Urban Exodus” trend showed a +80% YoY increase on a 90-day moving average.

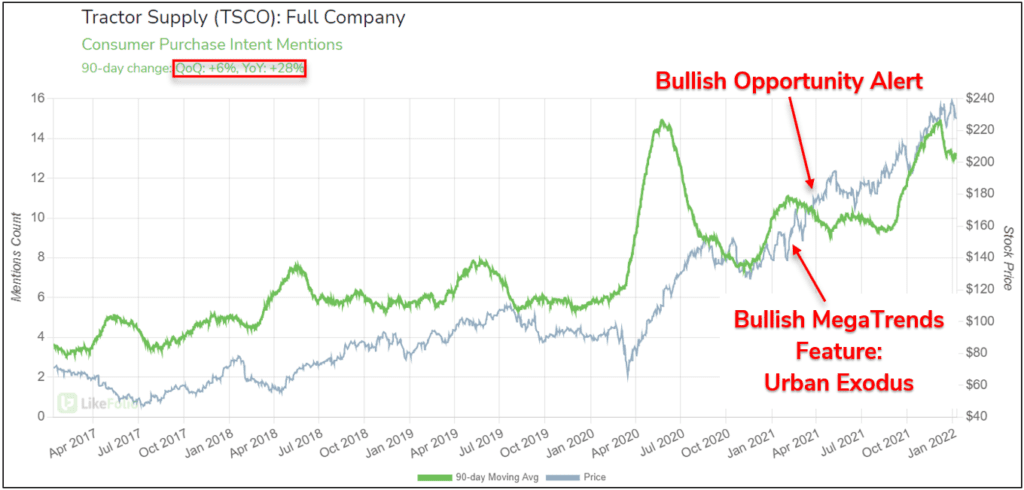

The corresponding MegaTrends report, released on March 8th, 2021, featured 3 bullish recommendations.

Although the entire report produced gains in 2021, 2/3 of the bullish picks have pulled back significantly in recent months.

Upwork ($UPWK): Max gain from entry +53% on 7/13/21, now down -27% from entry (still bullish)

Zillow ($Z): Max gain from entry +28% on 3/11/21, now down -53% from entry

(neutral)

However, the 3rd bullish recommendation has consistently outperformed the market since then: Tractor Supply Company ($TSCO)

We initially selected TSCO based on its exposure to the Urban Exodus trend, of course, its strong underlying data gave us additional confidence.

Consumer Demand continued to impress, which resulted in us doubling down with a bullish opportunity alert in early April 2021.

Both positions have performed phenomenally since then, bolstered by impressive earnings results.

TSCO shares hit a new ATH level on the final trading day of 2021: +49% from our initial entry — Considering the state of the market at large, the stock has barely pulled back, and underlying Demand has also continued to plow higher.