In regard to trading volume, Coinbase is the largest cryptocurrency […]

The SEC's Crackdown on Coinbase: A Desperate Bid to Defend the Status-Quo

In a world where traditional banking systems are showing their vulnerabilities, the U.S. Securities and Exchange Commission (SEC) has taken a surprising stance.

The SEC has sued Coinbase, one of the leading platforms in the decentralized finance (DeFi) space, alleging that the company was acting as an unregistered broker and exchange. This move is ironic and hypocritical, considering the SEC approved Coinbase's IPO based on the same business model just two years ago.

The Irony of the SEC's Actions

The SEC's actions against Coinbase come at a time when the traditional banking sector is under significant strain.

A wave of bank closures across the US has highlighted the vulnerability of the traditional banking system, prompting crypto industry experts to advocate for decentralized financial infrastructure as a more secure and reliable alternative.

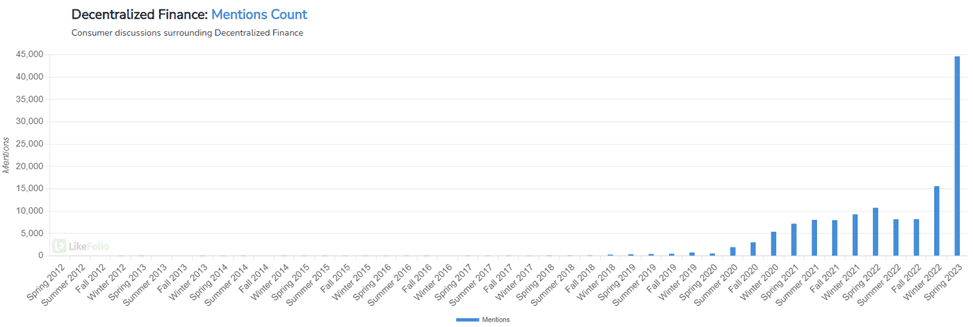

One look at the LikeFolio chart of interest in Decentralized Finance underscores the growing interest in DeFi amid the failures of traditional banks.

LikeFolio's Data Insights Amid the Chaos

At LikeFolio, we've been closely monitoring these developments.

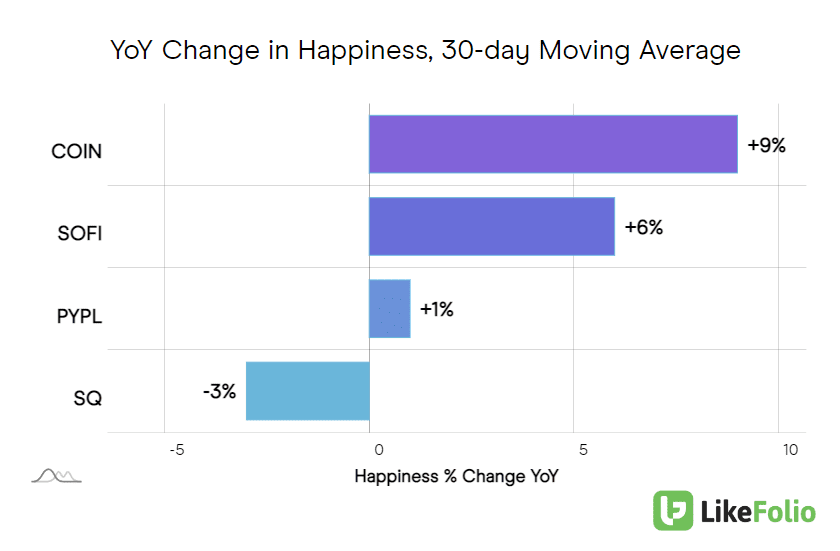

Our data shows that while Coinbase purchase intent mentions are down approximately -30% year over year, consumer happiness levels have risen by +9 points over the past year to 66% positive.

This suggests that despite the regulatory headwinds, users who are already on the platform are generally satisfied with their experience.

Moreover, our recent TRENDWATCH report highlights several macro trends in the crypto space. Despite a decrease in overall investment in crypto, the trend of trading cryptocurrency has increased by +42% year over year.

This suggests that while fewer people may be entering the crypto market as new investors, those who are already involved are becoming more active in trading.

The Silver Lining: Increased Regulation Can Create Moats

While the SEC's lawsuit against Coinbase may seem like a setback, history has shown that increased regulation can actually create moats of invulnerability for established players.

A prime example of this is Microsoft's antitrust lawsuit in the late 1990s. Despite the initial pain, Microsoft emerged stronger and more dominant, partly due to the barriers to entry the lawsuit created for potential competitors.

In the case of Coinbase, the SEC's actions could similarly create a moat.

By navigating these regulatory challenges, Coinbase could solidify its position in the market, making it harder for new entrants to compete.

Looking Ahead: A Bullish Outlook on Coinbase

Despite the current regulatory challenges, we remain bullish on Coinbase in the long term. The company's ability to navigate these issues, combined with the growing interest in DeFi and crypto trading, positions it well for future growth.

Moreover, the SEC's actions could inadvertently accelerate the shift toward decentralized finance. As traditional banking systems continue to falter, and as consumers become increasingly aware of the benefits of DeFi, platforms like Coinbase stand to benefit.

In these turbulent times, LikeFolio's data and insights provide a beacon of clarity. By closely monitoring consumer sentiment and market trends, we can navigate the chaos and uncover opportunities in the rapidly evolving world of finance.

LikeFolio members can expect many potentially huge opportunities in the coming months in the DeFi space.