Here are some stocks that LikeFolio is watching this trading […]

The Trade-Down Effect is Real -- BONUS

If you already perused your February MegaTrends report, you already know: the trade-down effect IS real.

Consumers with stretched budgets are making tough decisions when it comes to where they spend their money.

Here’s what we’re watching, and the companies we expect to suffer from this defensive shift in consumer behavior…

Consumers are Maxing out Credit, Depleting Savings to keep up with Inflation

First, let’s break down the underlying macro pressures facing consumers.

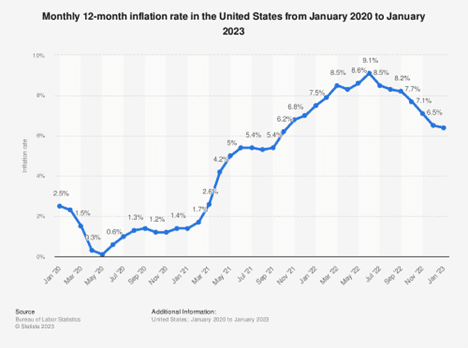

Inflation, while tempering, is taking a toll on the consumer psyche.

The U.S. annual inflation rate was 6.4% for the twelve months ended Jan. 2022 – lower vs. prior levels of 9.1%.

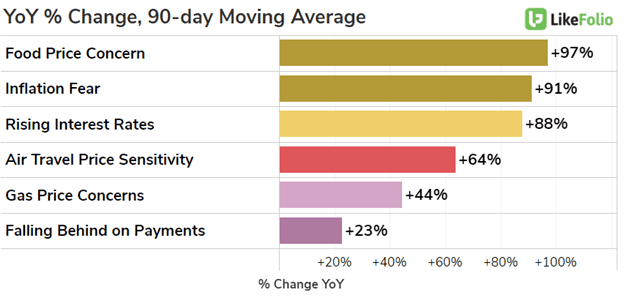

But food price concerns and inflation fears continue to weigh heavy on the Average Joe’s mind.

More and more consumers are living paycheck to paycheck.

This impacted demographic includes more than half of the Americans who make more than $100,000 a year…an amount many of us may have considered “safe” from inflation’s grasp.

Naturally, consumers are compensating to stretch their dollars in a variety of ways.

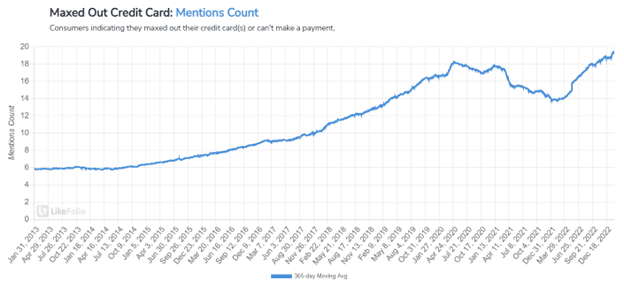

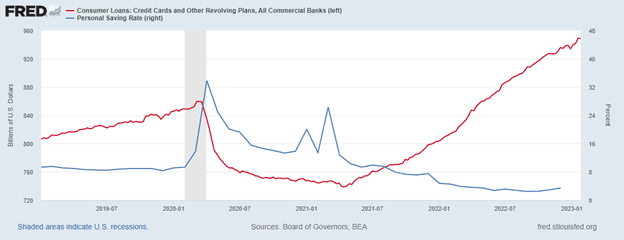

1) Consumers are Maxing out credit cards

Mentions from consumers maxing out credit limits are at all-time highs.

| Credit agencies confirm LikeFolio’s macro-trend findings. In early February TransUnion reported that U.S. credit card debt rose nearly +18.5% YoY to a record high of $930.6 billion..with a B. |

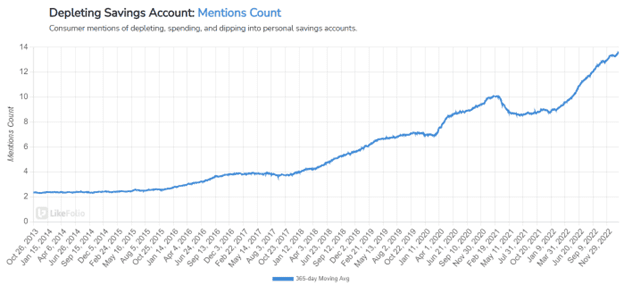

2) Consumers are Depleting Savings Accounts

Consumers built up healthy savings during Covid, padded by government stimulus and rising wages and incentivized by fear of the unknown.

But that behavior has shifted. Mentions from consumers depleting savings accounts are also at all-time highs.

According to the Federal Reserve Bank of St. Louis, the personal savings rate for Americans fell to 3.3% -- this is the lowest personal savings rate since the Great Recession.

You can see both trends at play in the chart below:

The bottom line: consumers are more vulnerable than they’ve been in years.

And they know it.

While they may not have capital to pay off credit cards or re-fill savings deficits, consumers are making strategic purchasing decisions.

Average consumers are trading down for more affordable brands and products

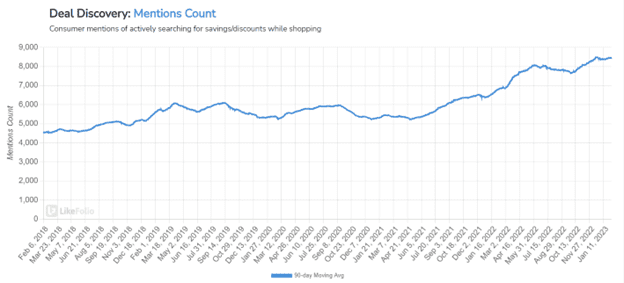

Macro trend data reveals some interesting behavior shifts over the last year.

Deal hunting is at all-time highs…meaning many companies are forced to mark down precious inventory to get consumers to pull the trigger.

This is impacting some upper-middle-class brands with high price points.

Especially companies operating in discretionary segments, like apparel and décor.

Here are some names LikeFolio expects to continue to feel the pain in the short term…

Nordstrom (JWN)

Two weeks ago Nordstrom said weak sales and numerous markdowns hurt its results in the Holiday season, noting, “While we continue to see greater resilience in our higher income cohorts, it is clear that consumers are being more selective with their spending given the broader macro environment."

You can see this rejection of Nordstrom’s offerings in consumer purchase intent levels, down -33% on a YoY basis.

While its stock as rallied on hopes that interest from an activist investor and a potential board shakeup could re-inject life into the high-end department store brand, LikeFolio data reminds us that there are larger issues at hand…like consumer spending budgets.

Nordstrom isn’t the only high-end brand to feel the pain of tighter budgets.

Lululemon (LULU)

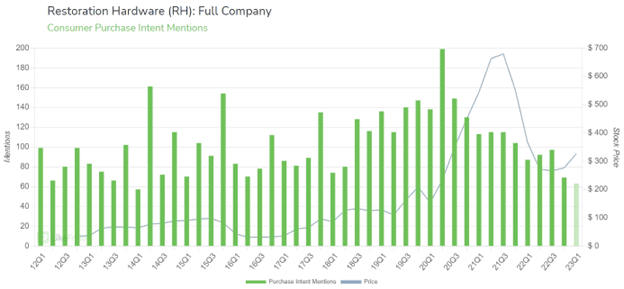

Check out demand for Lululemon in the first quarter, highlighted in red:

While still very early, demand mentions have slowed drastically vs. two quarters ago.

In 22Q3, demand grew by +18% YoY. In the 4th quarter, this growth rate slipped to +4% YoY. In 23Q1, the demand growth rate is pacing -16% lower YoY…talk about a massive shift.

This slow-down makes sense.

Despite the brand’s prowess, consumers are making tough decisions, especially regarding non-essential items like apparel.

On a macro level, consumer mentions of seeking out off-brand or generic brand clothing items have increased +13% YoY.

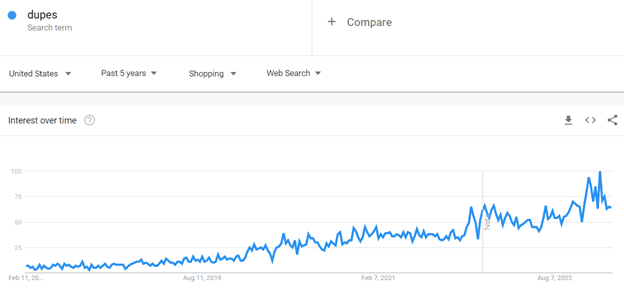

On google trends, this phenomenon surfaces as searches for “dupes.”

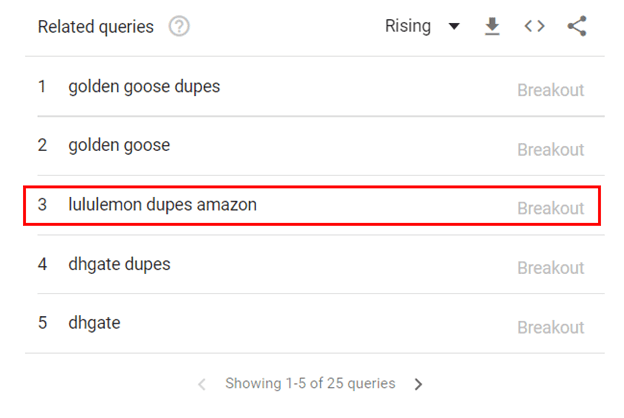

Consumers hunting dupes – or lower-priced products – have risen significantly vs. prior years, and Lululemon is one of this trend’s top victims.

Consumers are curating a list of options more affordable than Lululemon and sharing it with their peers.

Last quarter, Lululemon shares dropped the most since the start of the pandemic, attributed in part to a pile of inventory the company couldn’t move.

LikeFolio data suggests the company hasn’t made headway in clearing this inventory yet and is likely to continue to feel the burn of reduced spending among lower-earning consumers.

But clothing isn’t the only arena impacted by tighter consumer spending.

Restoration Hardware (RH)

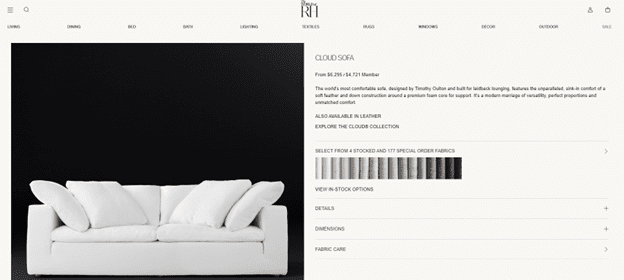

Fans of Restoration Hardware love the company for its plush furnishings and “cloud-like” products.

But they also know its price tag is no joke.

Its dreamy cloud sofa starts above $6k.

Data suggests the company may be pricing out a large cohort of consumers.

Consumer mentions of shopping with Restoration Hardware have slipped significantly since October – dropping -34% YoY in 22Q4 and on trending -28% lower YoY in 23Q1.

Instead, many consumers are opting for a comparable brand at a lower price-point.

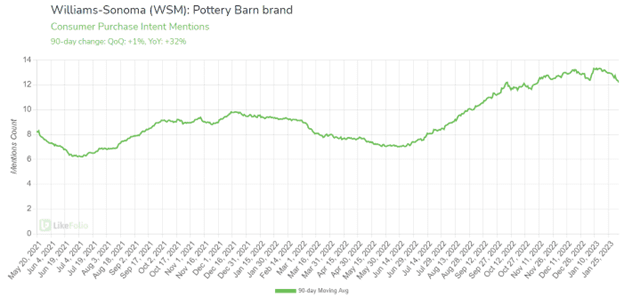

Check out consumer demand for Williams-Sonoma-owned Pottery Barn:

Pottery Barn is a furniture and home-décor store that you can think of as “Restoration Hardware Light”. Very nice stuff, quality stores… and significantly lower prices than you’ll see at RH.

The evidence is clear. The consumer is trading down.

It is critical as an investor to understand what brands are vulnerable…and which brands are benefitting in a big way.

And it certainly helps to have the consumer-driven power of LikeFolio on your side.

We’ll be tracking this in real-time for opportunities as they develop…in fact we’ve got our eyes on 5 names in particular that are MAJOR WINNERS of the massive consumer trade-down.

We’ll share those soon…