Consumers are Stocking Up on New Clothes LikeFolio data confirms […]

The Turnaround of a Century $ANF

The company we are talking about today is charging higher on the back of perhaps the biggest turnaround we’ve seen in decade.

Abercrombie & Fitch (ANF) has transformed its brand image and financial performance dramatically, outpacing its competitors with remarkable vigor.

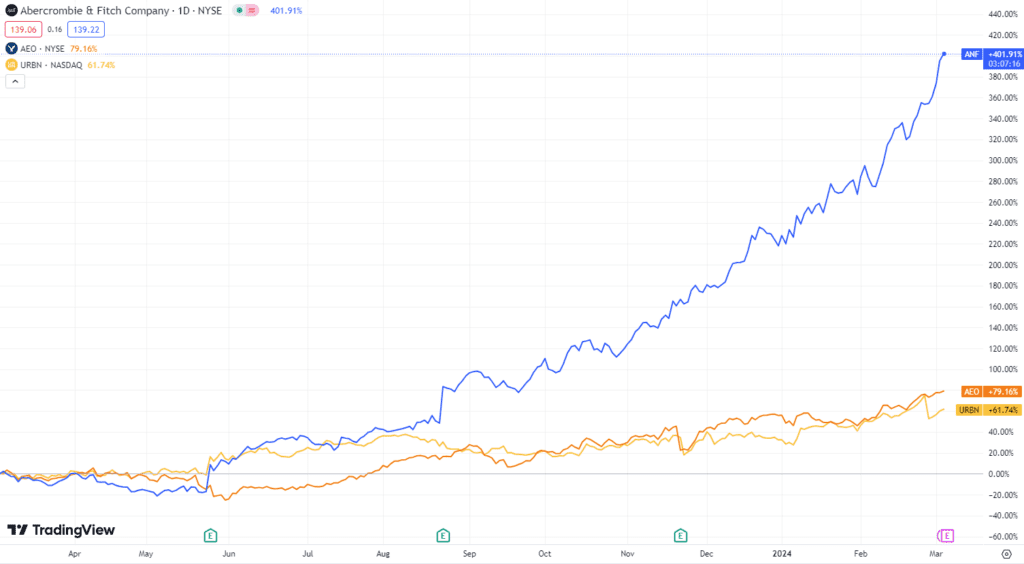

With the stock currently trading over 400% higher year-over-year, it starkly overshadows Urban Outfitters' (URBN) 60% gains and American Eagle Outfitters' (AEO) 80% increases.

This move is a direct result of the brand's renaissance we forecasted two years ago—a prediction that has emphatically borne fruit.

The revitalization of Abercrombie & Fitch stems from its successful overhaul, shedding any toxic elements that once marred its reputation while retaining its appeal among the youth. This strategic shift has not only rejuvenated the brand but also solidified its "cool" status, a feat that many of its contemporaries are still striving to achieve.

Despite the impressive gains, we STILL believe ANF still holds bullish potential.

The foundation of this optimism?

Accelerating buzz growth, resilient web traffic, and high customer happiness levels.

Check it out…

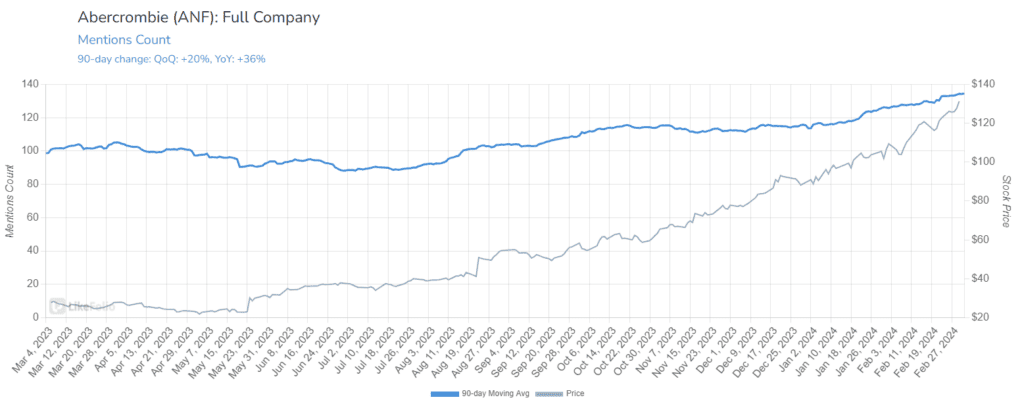

Buzz growth, a critical indicator of brand momentum, has shown a significant uptick, accelerating by 41% year-over-year on a 30-day moving average, up from 36% on a 90-day moving average. This increase suggests that conversations and interest around ANF are not just growing—they're accelerating.

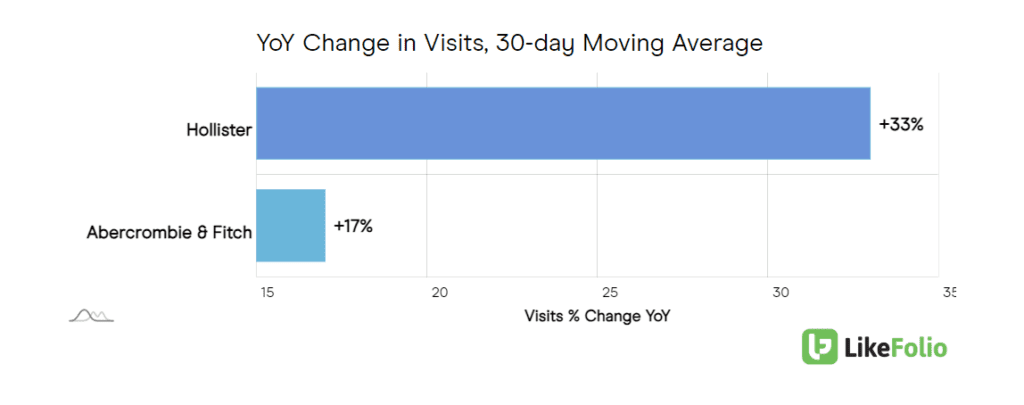

Web traffic analysis showcases the brand's resilience, boasting a 22% year-over-year increase company-wide, a continuation of its previous growth trajectory. Notably, the Hollister brand has been a leading contributor to this traffic surge, highlighting the strength of ANF's diversified brand portfolio – and likely an improvement the market doesn’t see coming.

Customer satisfaction remains robust, with happiness levels hovering around 75% positive. This metric is particularly encouraging, given the competitive nature of the retail landscape and the rate at which ANF has exploded back on the “cool kid” scene.

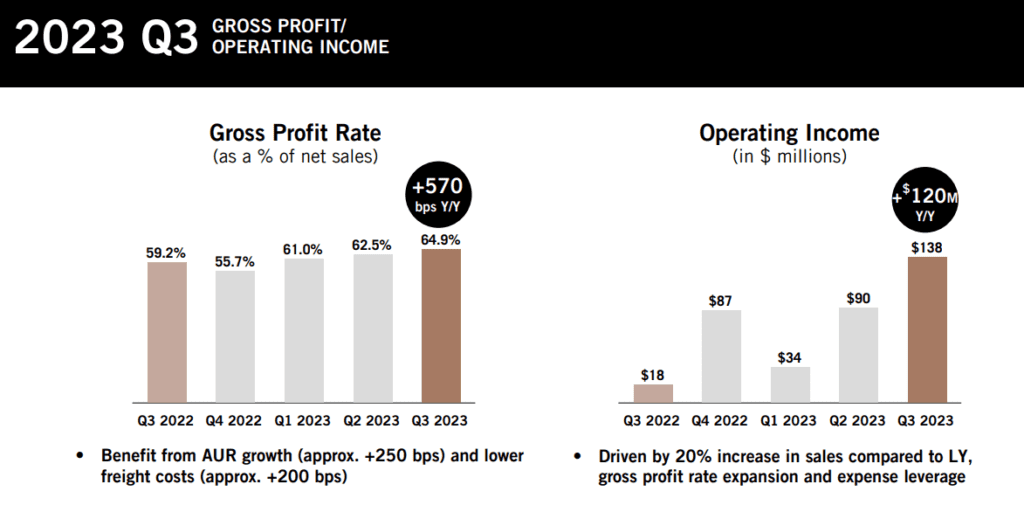

Last quarter's performance was buoyed by a strong back-to-school season, a rejuvenated Hollister brand, improved margins from lower freight costs, and the ability to command higher price points.

And we see the gears still turning.

The brand is capitalizing on key trends that resonate with its audience, such as the shift away from denim. This evolution from a "jeans and a t-shirt brand" to a broader lifestyle brand reflects ANF's adaptability and its eye for the changing dynamics of fashion and consumer preferences. Additionally, the brand has successfully tapped into nostalgia, expanding its addressable market to include older millennials who fondly remember shopping at ANF during its peak years.

As we approach the earnings release, our analysis remains bullish, acknowledging the lofty expectations set by the company's recent performance. The key for investors and enthusiasts alike is to stay informed and manage risk appropriately, given the high bar ANF has set for itself.