Despite recent market volatility and some arguing for a bear […]

Three Stocks that Could Triple in 2023

At the end of last year, the LikeFolio executive team sat down to think strategically.

2022 proved to be a year of decades high inflation, soaring interest rates, and market uncertainty.

Time to dust off the ole’ Crystal Ball…or in our case, LikeFolio data.

We had a very specific objective: identify stocks that we believed could triple in 2023.

Our criteria for selection:

- Improving Consumer Demand Metrics

- High Levels of Consumer Happiness

- Macro Trend Tailwind

- Stock Trading at Low (Comparative) Levels

Essentially, we were looking for companies the market had overlooked and tossed aside.

Like finding a rare vintage baseball card at a garage sale.

Thanks to LikeFolio data, we have a real-time read on perceived value. So, it’s much easier to spot these diamonds in the rough.

Here are the three names we’re watching that could rally tremendously in 2023:

- Coinbase (COIN)

- Hims & Hers (HIMS)

- Pinterest (PINS)

You can even listen to a podcast of our team discussing each name in detail here.

We’re about a quarter into 2023 and already off to a tremendous start…

Andy’s Pick: Coinbase (COIN) – Max Gain: +78%

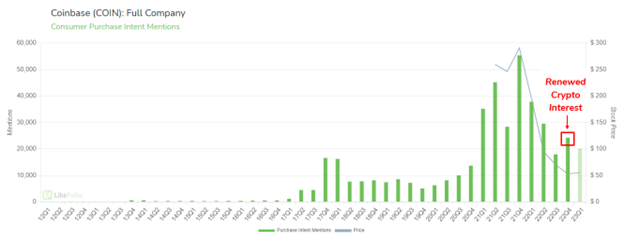

A resurgence in consumer interest in cryptocurrency is helping to drive Coinbase demand higher. Coinbase purchase intent -- mentions from consumers downloading and using the platform -- spiked in the 4th quarter, +35% higher vs. the quarter prior.

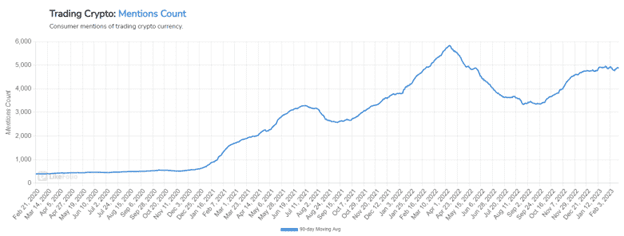

Mentions of trading crypto pushed +9% higher on a QoQ basis, outperforming mentions from consumers investing in crypto (-23% in the same time frame). This trading activity benefits a platform like Coinbase, which is the largest cryptocurrency exchange in the U.S. by trading volume.

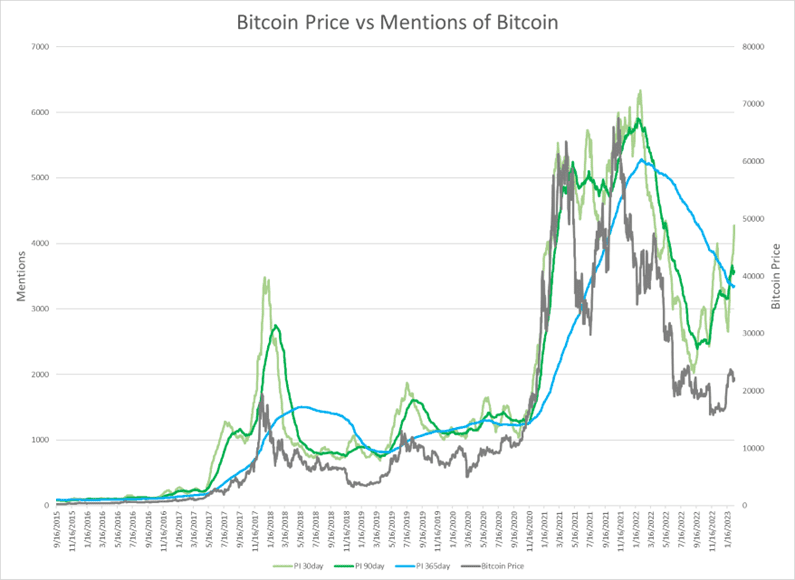

Bitcoin and Ethereum are the major drivers of trading volume and transaction revenue for COIN. In the third quarter, Ethereum accounted for 33% of COIN trading volume (an increase vs. 22% in the prior quarter), while Bitcoin accounted for 31%. However, Bitcoin is responsible for the highest percentage of transaction revenue, at 31% vs. Ethereum's 24%.

Recent Bitcoin trading activity suggests renewed interest in the currency may serve as a tailwind for COIN. Consumer mentions of buying or selling Bitcoin surged +31% QoQ in Q4, and are pushing even higher in the first quarter of '23. Yesterday (Feb. 21), COIN reported earnings that beat expectations but featured lackluster guidance. If underlying cryptocurrency interest remains elevated, it may prove to be a surprise to the market next quarter.

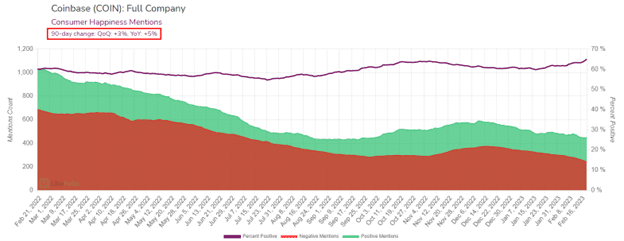

On a long-term basis, Coinbase looks to be a major beneficiary of skepticism born from scandals including the collapse of FTX. COIN happiness levels have improved by +5 points YoY as consumers increasingly view the platform as the most legitimate vs. peers, thanks to official review of its financial statements.

COIN Outlook: Bullish

COIN shares have rallied over the last month but already given back some of those gains. Based on renewed consumer interest in crypto and its best-of-breed positioning among peers, we think this stock is still on track for continued growth.

Landon’s Pick: Hims & Hers (HIMS) – Max Gain: +59%

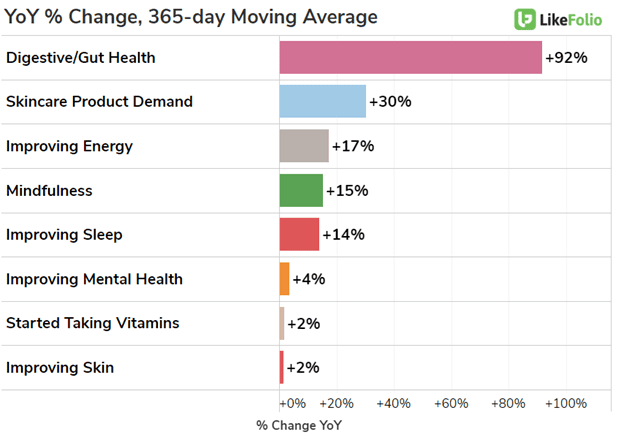

Hims & Hers is a direct-to-consumer “health” alternative provider gaining serious steam among consumers. The company specializes in health and wellness…think telehealth, skincare, gut health, hair loss, erectile disfunction, mental health, and dietary supplements.

Purchase Intent mentions in the first quarter (beginning Jan.1) are on pace for the highest level recorded to-date, driven higher by several consumer macro trends aiming to improve overall wellness and a strategic subscription model, keeping consumers coming back month after month.

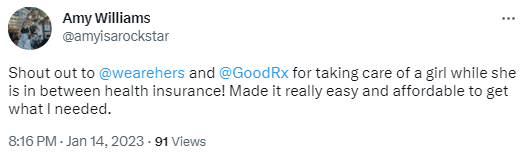

Qualitative review suggests consumers love the convenience and affordability HIMS brings to the table, especially when perceived health care costs are on the rise. Mentions related to the exorbitant cost of healthcare have increased by +19% YoY.

Last quarter, HIMS bucked a telehealth downward trend in 2022 when it raised its full-year outlook and logged explosive user growth (991,000 subscribers, +80% YoY). The company’s unique digital offerings for somewhat embarrassing personal issues are resonating with consumers, especially as inflation adds extra stress and anxiety on consumer plates.

"We're focusing on conditions and categories and services that are highly emotional, right? These really impact people's lives on a daily basis when they wake up in the morning, like things like mental health, how you feel in your own mind, how you feel in your own body, how you feel when you look in the mirror. So I think it's really the emotional nature of them, the high-sensitivity nature of these conditions that really impact people's lives. And that's something that even in recessionary times is proving to be incredibly meaningful to people," said Andrew Dudum, CEO and co-founder of Hims & Hers on the company’s last earnings call.

HIMS Outlook: Bullish

HIMS shares soared +25% after the company’s last earnings report shocked investors. Data suggests consumer demand has only accelerated since then. We expect continued outperformance and strong guidance in the current quarter. Still Bullish.

Megan’s Pick: Pinterest (PINS) – Max Gains: +16%

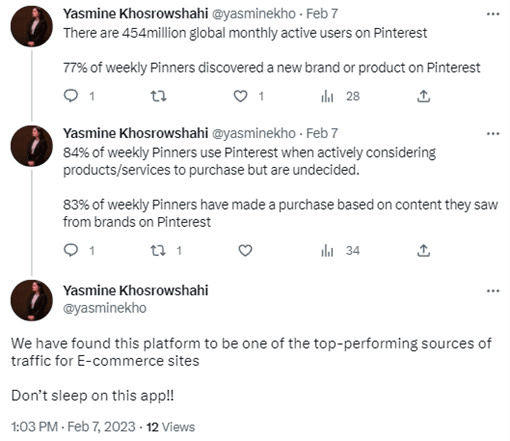

Pinterest is an often under-estimated “social” platform that specializes in personalized brand discovery and is comparable on an active user basis to platforms like Twitter and Reddit with 450 million monthly active users.

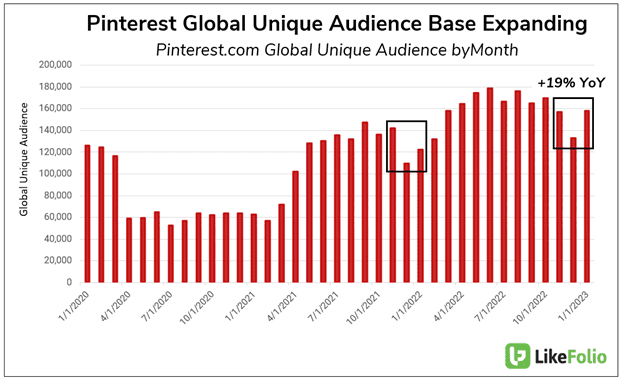

Digital metrics suggest Pinterest’s user base is growing at an accelerating pace: +19% YoY in the last 3 months vs. +6% in the 3 months prior. This is especially valuable because Pinterest’s global unique audience base growth (or decline) has proven to be highly correlated with company revenue, at .71.

Monetizing this audience will be critical for Pinterest’s future growth prospects. Last quarter, average revenue per user in its US and Canada region rose by +6% but was, “hampered by CPG advertisers as well as small and mid-market advertisers in the U.S. who faced headwinds from the macroeconomic environment” who didn’t lean into advertising as strongly this holiday season. Ultimately, revenue came in weaker that expected, and shares shed some of their recent gains.

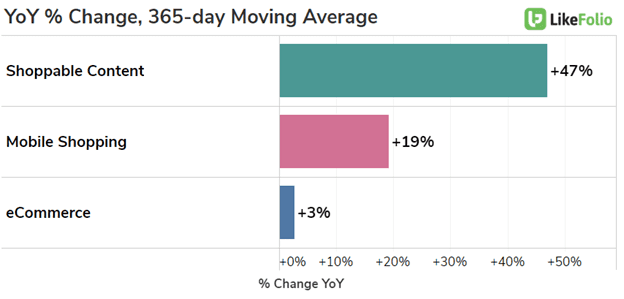

Advertising weakness is a headwind for social commerce companies across the board, including Snapchat, META (Facebook) and even Google. However, LikeFolio data suggests that consumers are still shifting toward this type of shopping. Mobile shopping and shoppable content are outpacing generic eCommerce mentions substantially.

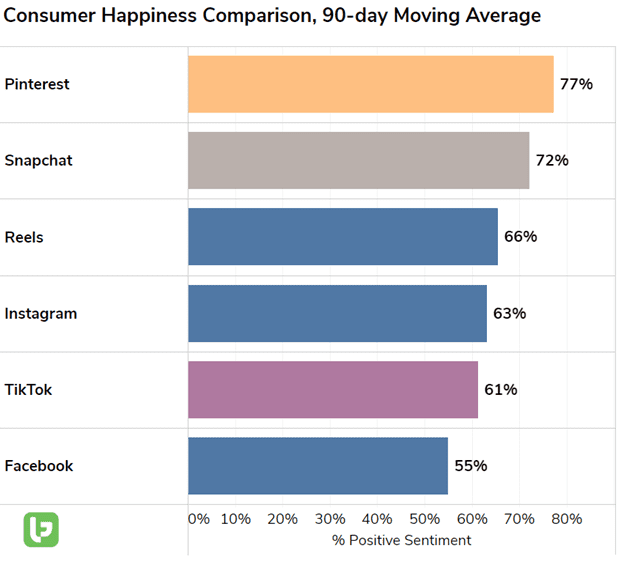

Long-term, Pinterest is well positioned to capture advertising dollars when macro weakness subsides. The company has the highest levels of consumer happiness vs. peers and is strategically focused on making its content more shoppable than ever.

“Over the long term, we also want to make every pin shoppable. To that end, we’re making video content on Pinterest more actionable using the same playbook we applied to static images. Over the course of this year, we’ll be deploying our computer vision technology across our video corpus to find products and videos and make them shoppable,” the company’s CEO Bill Ready said during the Q4 earnings call.

Current Outlook: Bullish

PINS suffered from industry-wide weakness in advertising in the 4th quarter. However, the company is extremely well positioned vs. peers to recapture this stream due to the nature of its platform and ease of product discovery. We think the company is likely to benefit in the coming quarters, especially considering the low bar it has to clear.