SoFi has Huge Upside Potential ($SOFI) LikeFolio recently established a […]

Ally, watch out! $ALLY $SOFI

Gone are the days of making a trip to the bank to physically deposit cash or transfer funds.

Essentially all traditional banking institutions have some form of mobile or online banking now.

The world has moved digital and there’s no turning back from it.

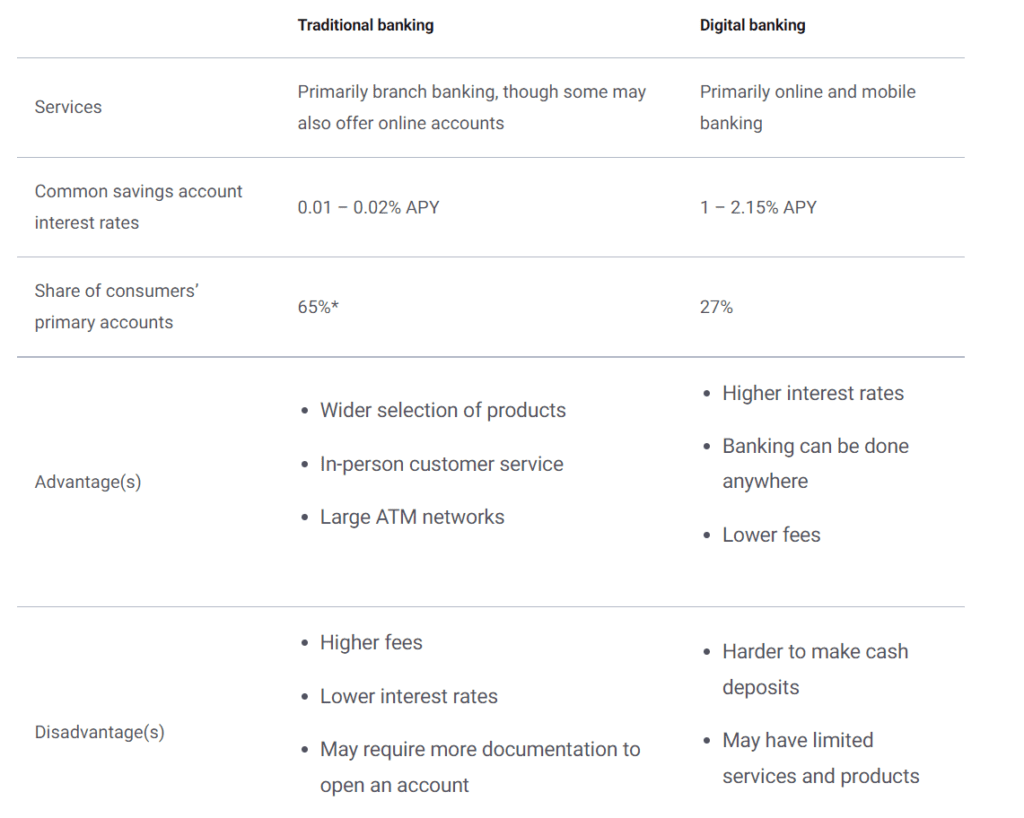

This breakdown of Traditional Banking vs. Digital Banking from Bankrate gives insight into why 57% of millennials and 64% of Gen Z have financial accounts with a nontraditional banking institution…

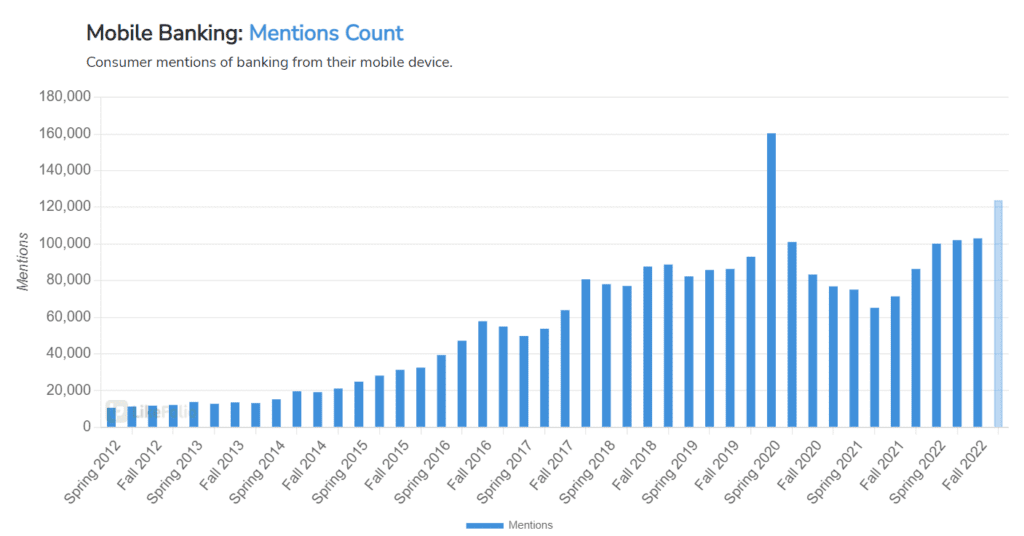

Mobile Banking is Growing

According to LikeFolio data, mentions of consumers banking on a mobile device have increased +40% YoY and +12% QoQ, continuing to pace higher.

Convenience is key here.

Who needs a bank teller when you can take care of all your banking needs with just a few taps on your smartphone?

Which nontraditional institution is winning?

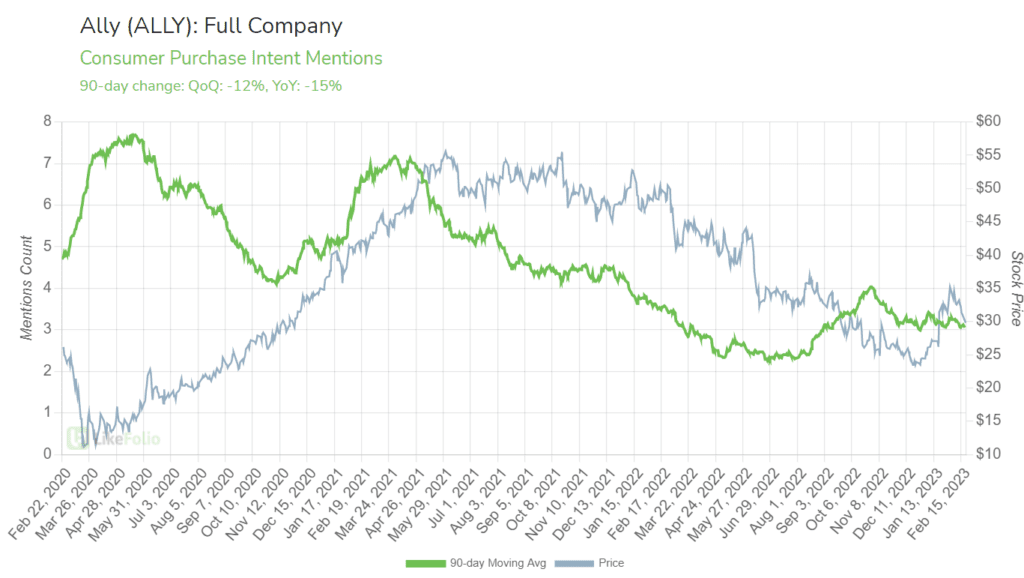

Ally (ALLY) seems to be in a slump.

LikeFolio data confirms that metrics are slowing for the digital banking platform.

Mentions of consumers utilizing the digital banking platform have decreased -12% QoQ and -15% YoY.

Demand is slowing and the stock is still hovering at ~$30, close to its IPO price of $25 back in 2014.

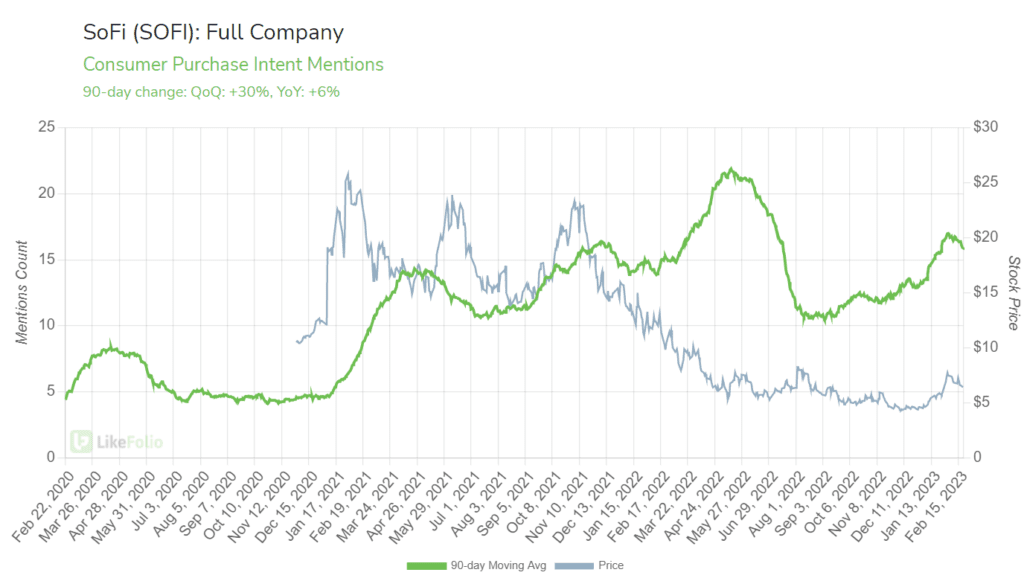

Simultaneously, SoFi (SOFI) is getting a boost:

Demand for SOFI is sporting a +30% QoQ and +6% YoY increase.

After its IPO in late 2020, SoFi’s stock surged to an all-time high that it hasn’t quite reached since.

However, with shares leveling around the $5 mark since the spring of last year, the LikeFolio team thinks it could just be on sale.

Andy noted SoFi as one of his favorite stocks in a LikeFolio podcast episode, “3 Beaten Down Stocks we LOVE” last October.

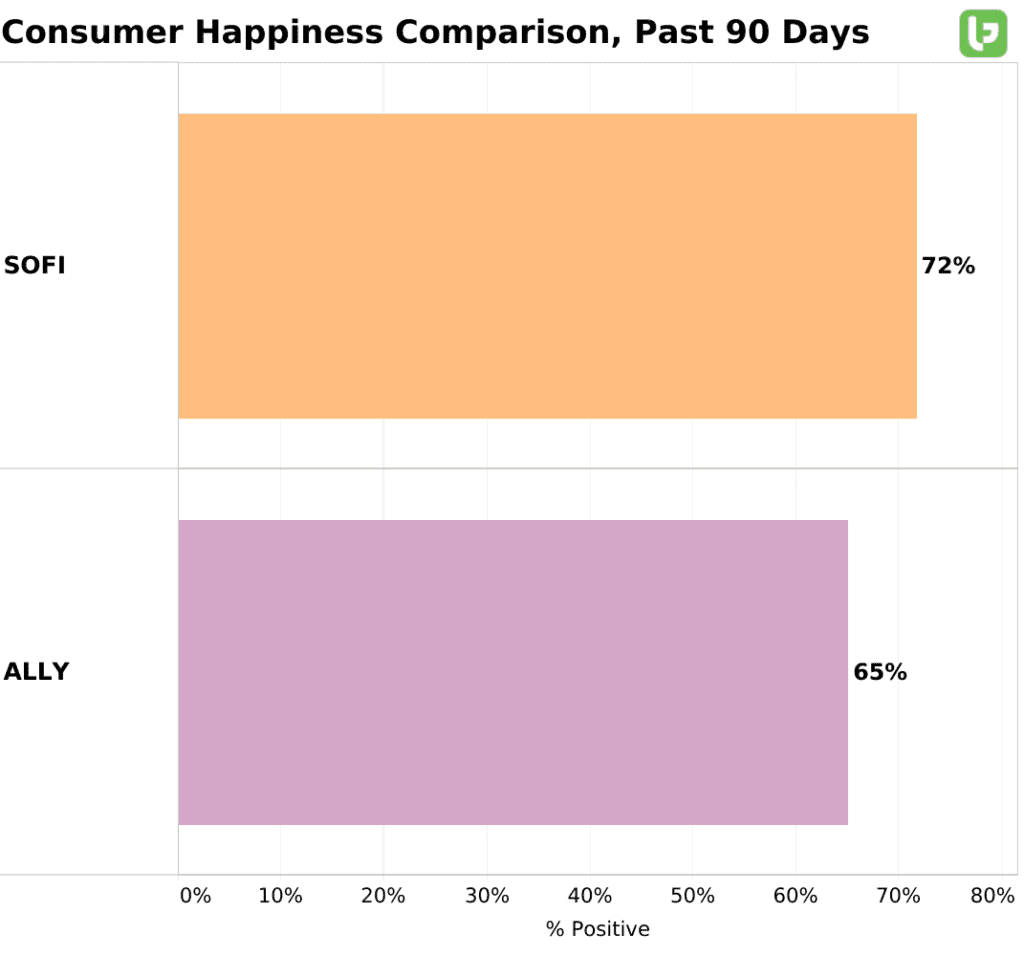

Additionally, SoFi customers are happy, and taking a 7-point sentiment lead over Ally.

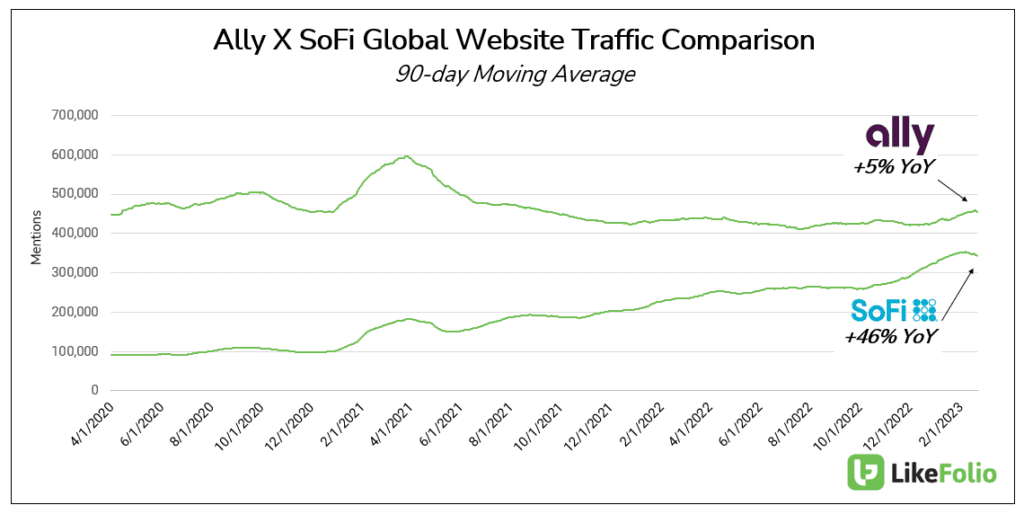

On top of that, LikeFolio website traffic data remains consistent with the other LikeFolio data points…

SoFi is on Ally’s tail.

Global Web data confirms that SoFi is gaining popularity. Fast.

The number of visits to SOFI’s website are soaring, +46% YoY, and on track to close the discrepancy on ALLY’s lead of +5% YoY.

Bottom line: SoFi is still an underdog in this fight, but LikeFolio is fascinated to see where this name is going in the long term. We are viewing through an optimistic lens.