The stock surged higher on the news, initially gaining nearly […]

SoFi has Huge Upside Potential ($SOFI)

SoFi has Huge Upside Potential ($SOFI)

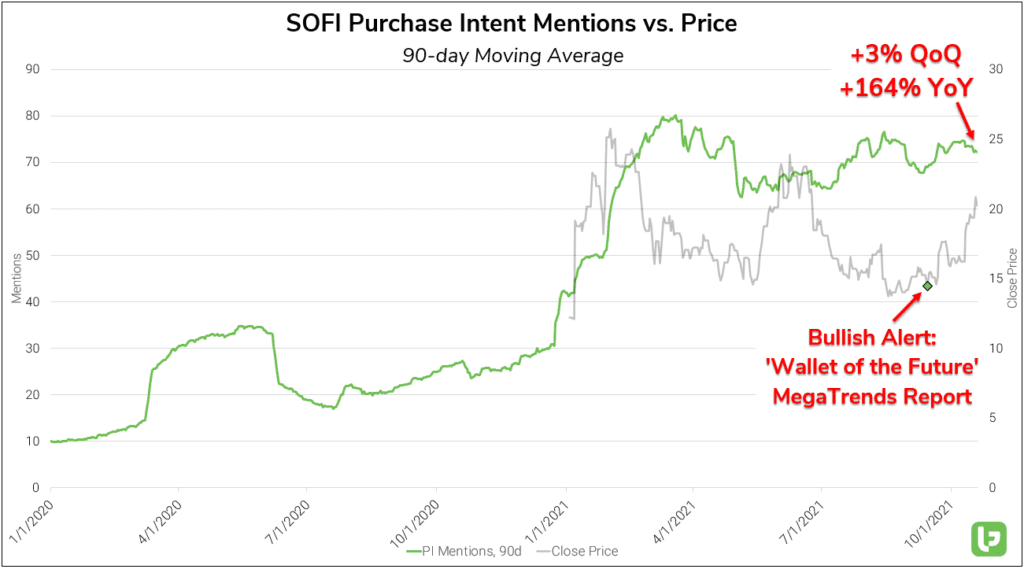

LikeFolio recently established a bullish outlook on SoFi ($SOFI) as part of the ‘Wallet of the Future’ Megatrends report. Shares have already surged +45% from our initial entry, but underlying consumer data suggests that this disruptive newcomer has the potential to continue to a new ATH price and beyond.

SoFi neatly packages investing, loan, and credit services into a centralized, user-friendly “digital wallet.” Consumer Mentions of downloading SOFI’s digital wallet and utilizing its services show a promising uptrend in adoption: +3% QoQ and +163% YoY on a 90-day moving average.

The company’s first official earnings report (21Q2) confirmed the strength seen on the chart above, with a +113% YoY increase in membership corresponding to a +101% YoY improvement in net revenue. The most impressive part? SOFI demonstrated robust growth across its extensive mix of services and products. The 'Lending' Segment, which accounts for the meat of the company's current income, grew revenues by +66% YoY. Revenue from the ‘Financial Services’ segment improved by a whopping +602% YoY but accounted for less than 10% of total revenue for the quarter -- This represents a massive avenue for growth as users continue to integrate into SoFi’s all-in-one financial ecosystem.