Drinker’s tastes and priorities are shifting in a major way. […]

Trick or Treat? Big Stock Swings Create Opportunity

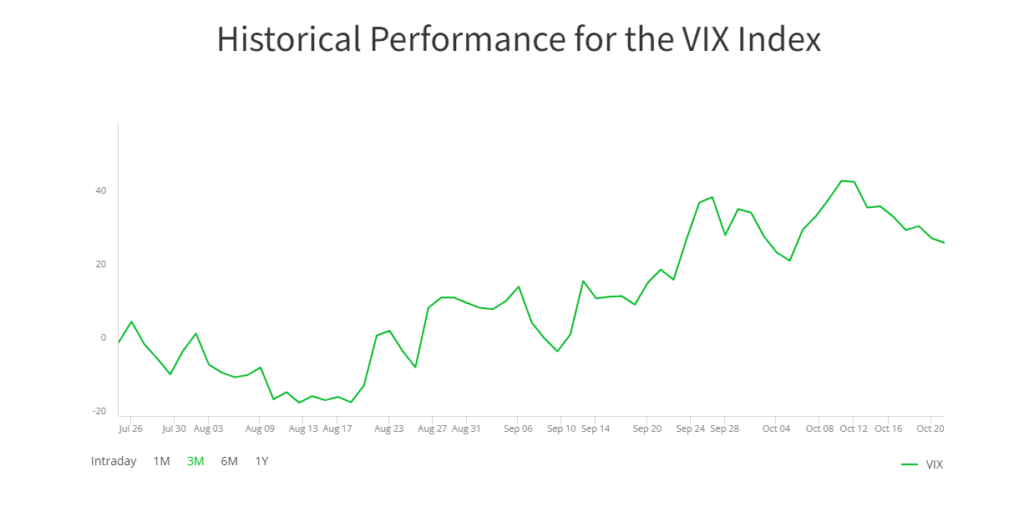

| The only thing spookier than recent Halloween movie releases is the return of volatility to the stock market. Since leaves began changing colors, the VIX has crept higher. |

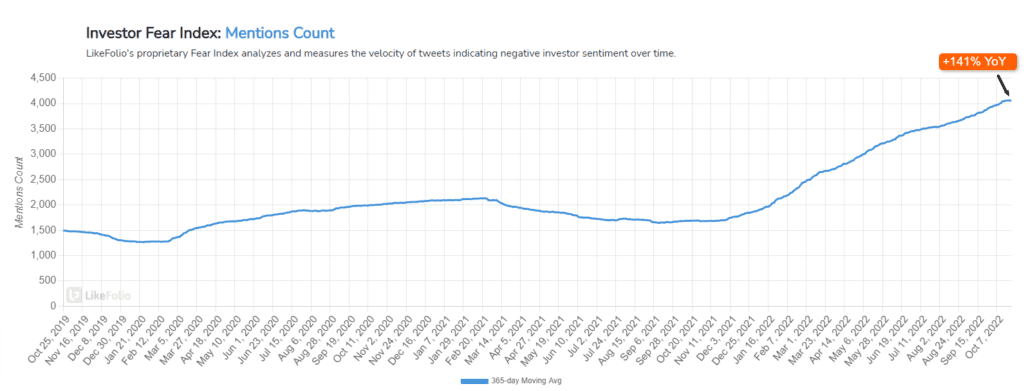

| Stock charts are changing too, getting decorated with oversized green and red candlesticks. Why now? Investors, already on edge about a frightening downturn, are seeing the Fed rev the chainsaw to another gear on rate hikes and related rhetoric. Toss in rising geopolitical tensions and corporate profit warnings and we’ve got a regular witches brew. Add one more thing to the mix. Historically, more bear markets have ended in October than any other month. Are investors positioning for a possible full moon recovery? Whether we’ve hit rock bottom or not, LikeFolio’s proprietary Investor Fear index reveals that people are scared. Negative mentions about the market are up +141% YoY on a 365-day average. |

| And with Q3 earnings season here, the volatility may very well last until the pumpkins and cobwebs come down. But there’s good news: With fear comes opportunity. The high volume gappers we’ve seen lately could continue—and create more chances for investors to pounce on overreactions. Warren Buffet famously advised investors to be “fearful when others are greedy, and greedy when others are fearful.” Is it time to be a greedy goblin? Selectively, yes. Some of our favorite overreactions involve wild swings in jeans, beer, and selfies. (Now there’s a magic potion!) But are they Tricks…or Treats? Let’s ask the LikeFolio Goblin. |

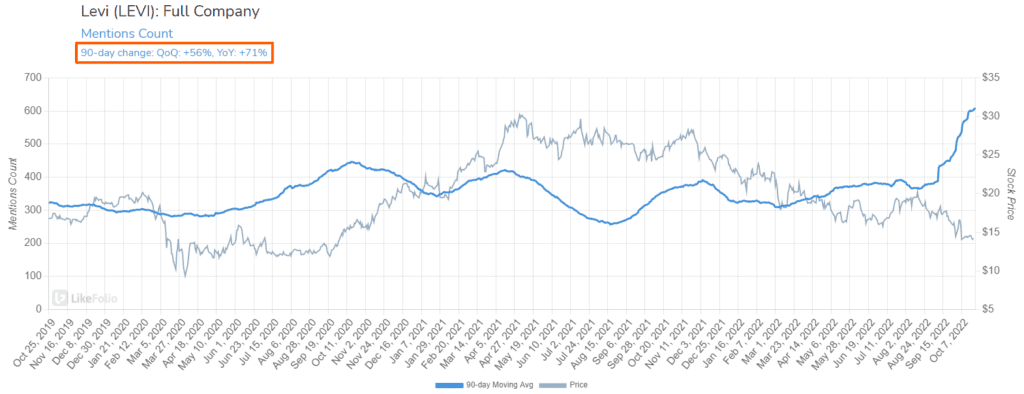

| 1. Levi Strauss & Co. (LEVI) Earlier this month, Levi Strauss reported Q3 results that were considered an ominous sign for retail stocks. Although earnings topped the consensus, inventories jumped 43% YoY. The Street took this to mean blue jeans shoppers will be getting holiday discounts—and the company, lower margins. Despite management’s assertion that discounts would be less drastic compared to other retailers, the stock gapped down to a fresh 52-week low. Reduced full-year guidance didn’t help. Now 50% off its May 2021 peak, is LEVI on the bargain rack? LikeFolio data suggests it is. |

| Comprehensive demand for Levi clothing is at its highest level since 2013. With consumer buzz up +71% YoY, Levi is making a fashionable comeback that has yet to be appreciated by the market. Even if discounts are necessary to move inventory, this will be a temporary process. And since people buy jeans year-round, huge price cuts to clear out winter gear won’t be necessary. Yes, the next couple of quarters could be choppy, but the long-term still looks good. The bigger picture is that Levi Strauss has successfully reinvented itself and yet stayed true to its All-American roots. It is finding favor with men and women who find the iconic Levi’s and Dockers brands fit their casual style and offer good value. Speaking of good value, the stock trades at 11x forward earnings. |

| LikeFolio Goblin says: TREAT |

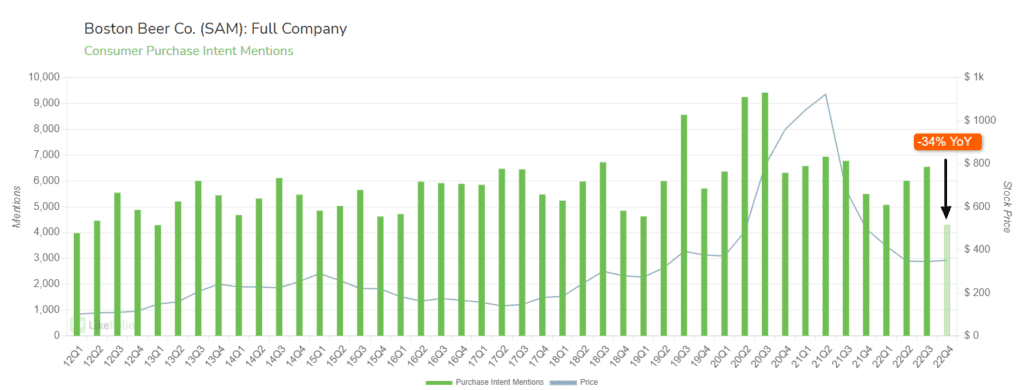

| 2. Boston Beer Co. (SAM) Boston Beer is up more than 20% since its Q3 report. The craft beer maker announced a return to profitability that Wall Street anticipated and yet traders celebrated like it was the Boston Tea Party. The top and bottom-line beats were impressive, but does 6% sales growth in a tough macro environment really warrant a 5x spike in buying volume? Our data suggests the market may have gotten ahead of itself on this one. |

In the current quarter, Boston Beer PI Mentions and down -34% YoY and are pacing at a 10-year low.

Part of the problem is hard seltzer, a category that again deteriorated in Q3.

As new non-beer products have entered the market, consumer interest in seltzer has fizzled out. PI Mentions of the company’s Truly brand hard seltzers are down -42% YoY. Management is tweaking its seltzer strategy by launching extensions like Truly Vodka, but it may be too late.

Hard cider has been a hard sell lately too. Angry Orchard PI Mentions have slipped -28% YoY.

In a positive twist, Twisted Tea demand is up…should SAM be doing more with this brand?

Another possibility is the trade-down effect. Inflation pressures may be causing beer drinkers to pass on the premium beers and go with the cheap stuff.

The $9 Sam Adams Octoberfest is out. A pint of Budweiser is in. Queue the holiday Clydesdale commercials, Budweiser mentions are up 29% YoY!

Meanwhile supply chain headwinds and higher ingredient, packaging, and energy costs are squeezing margins. Not even next year’s arrival of Hard Mountain Dew may help.

Yes, a swing to profitability is a positive, but investors have the beer goggles on here. Boston Beer still has a bunch of issues to overcome—not the least of which is waning consumer demand.

Too much froth in this move.

| LikeFolio Goblin says: TRICK |

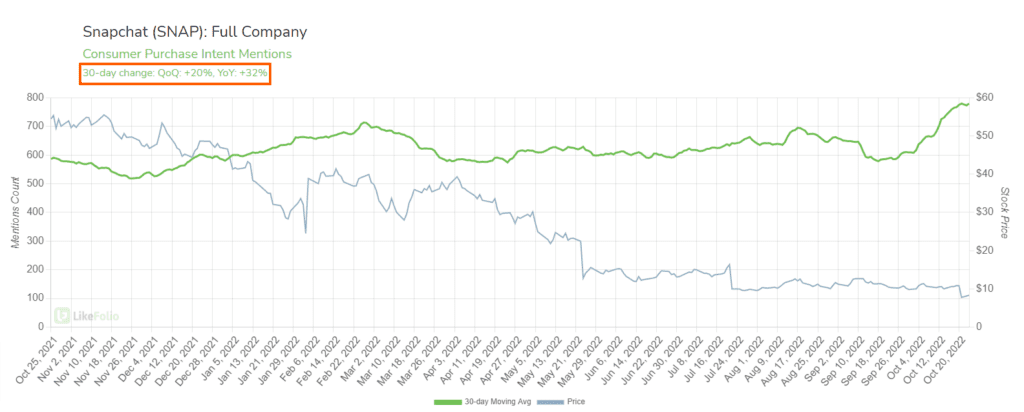

| 3. Snap Inc. (SNAP) Snapchat parent Snap was ghosted by investors after it released disappointing Q3 results. The stock plunged 28% on the news erasing the rest of its pandemic gains. With the outlook for digital ad revenue worsening, management opted to skip guidance for Q4, a historically strong holiday period. Let’s face it, SNAP faces tough comps to the pandemic boom anyway. The silver lining is that a mostly younger consumer base still loves the art of the selfie and SNAP’s expanding social media platform. Snapchat Purchase Intent Mentions are up 32% YoY. They are on pace to rise for the second straight quarter. It would be the first time this has happened since 2016. A turnaround may be in the making here. |

The divergence in Snapchat consumer interest and Snap’s stock price is widening.

Even as TikTok swipes social media users left and right, Snapchat is still a must-have app for the younger generations. The company continued to add users at a good pace in Q3. Daily active users rose by 57 million, or 19% annually.

Unfortunately, there are now more players competing for a shrinking pool of ad dollars, so monetization per user fell.

Nevertheless, people are embracing new features like Lenses, Dynamic Stories, and AR Shopping. As Snap evolves into 5 platforms in 1, Snap Map, Chat, and Spotlight have the potential to become bigger parts of the growth story.

In more than 20 countries, Snap reaches 90% of 13- to 24-year-olds. We think its growing base of future consumers will be hard for advertisers to ignore over time.

The likely scenario is that ad spending eventually picks up and gives way to healthy user engagement trends. In turn, SNAP’s financials and outlook should get brighter.

We’d add the bull horns filter to this one.

| LikeFolio Goblin says: TREAT |