PayPal (PYPL) Last week we touched on a huge crypto […]

How to Spot Real Consumer Red Flags $PYPL

October 28, 2022

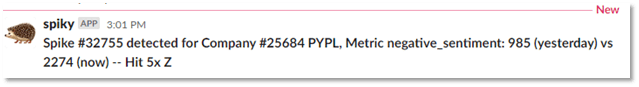

| Einstein is often credited for coining my favorite definition of insanity: Doing the same thing over and over and expecting different results. This mantra seems easy enough to grasp, but according to LikeFolio data, it can be tough to abide by. And it’s one of the reasons a major tech company caught our research team’s eye (and our volume checker) for the second time in a month: PayPal (PYPL). PayPal broke Consumer Trust…Again Earlier this week, LikeFolio’s trusty volume checker, Spikey, issued a Negative Sentiment alert for eCommerce platform and Venmo parent, PayPal. |

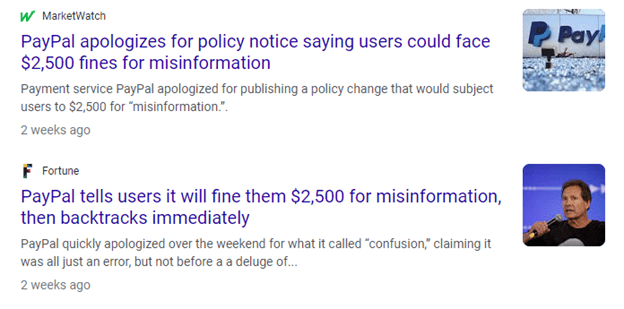

| Oh boy. Here we go again. Two weeks ago, PayPal came under fire for a note in its terms of service that allowed it to fine users up to $2,500 for using its service to “promote misinformation.” PayPal was forced to issue a statement, calling the language “an error”. |

| Landon talked about PayPal’s decision and its impact on consumers in detail the first time around: |

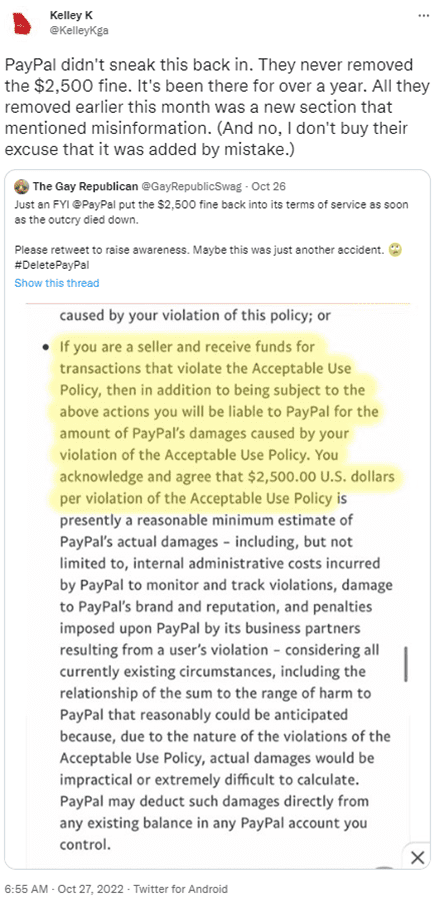

| Now, it looks like the company didn’t learn from its initial mistake…or maybe it didn’t understand why consumers were so upset in the first place. (Hint: Users prefer to “own” their own money.) This week, a user called out PayPal for sneaking language BACK into its terms of service related to the same fine. And another user pointed out this has been company policy for some time now… |

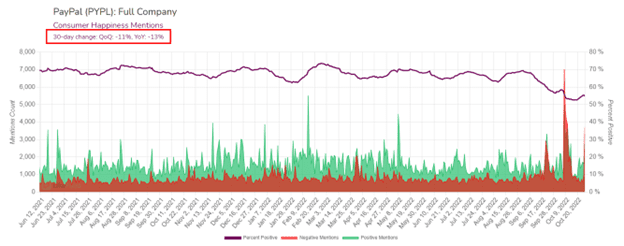

| But for investors, it’s important to understand exactly where consumers stand. Is this an instance of a single upset Tweeter…or is it something bigger, and potentially harmful for future company growth? That’s where LikeFolio data provides unique insight. LikeFolio Records Massive Consumer Sentiment Plunge for PayPal PayPal sentiment took a major hit when the “misinformation fine” was first uncovered, sinking more than 30 points lower in a matter of days. Then the company got some good news: soon users can PayPal-owned Venmo to check out on Amazon… This appeared to bolster sentiment. Consumers thought, maybe that PayPal language WAS a big misunderstanding. But new data suggests that the realization that the misinformation fine is, in fact, real -- and not an oversight – may have permanently damaged customer trust. |

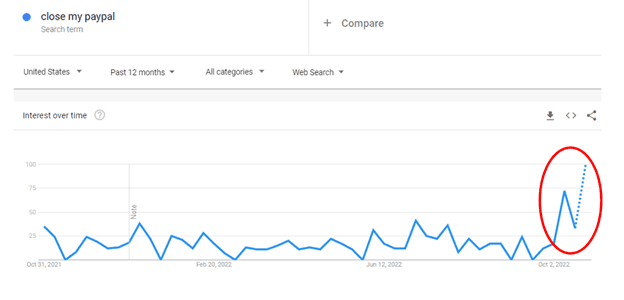

| Consumer sentiment plunged yesterday, continuing the second month of happiness decline. But GoogleTrends reveals consumers aren’t just mad, they’re taking action. Check out searches for “close my PayPal” |

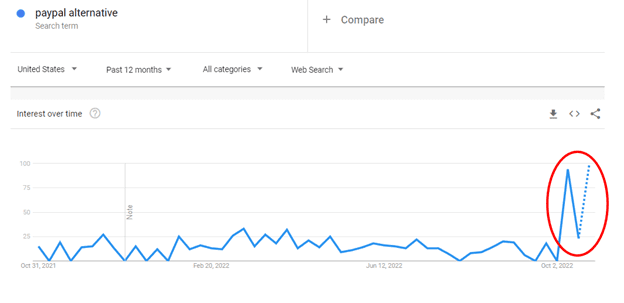

| Note the search line is trending HIGHER over the last week vs. the week the language was first discovered. Also, consider related searches…namely “paypal alternative”… |

Can you see the pattern?

PayPal didn’t change its policies. And many consumers are rejecting the company’s stance at an even higher rate because of it.

In fact, mentions from consumers closing or deleting PayPal accounts have increased by more than +400% on a month-over-month basis.

At LikeFolio, we’ve planned 3 critical action items for our team:

- Closely monitor sentiment to understand permanent brand damage. This is the lowest monthly sentiment level for PayPal in company history. Will consumers forget?

- Analyze consumer adoption of alternative methods…for example, Google/Apple Pay, Cash App, and even Shopify Pay. Is there a company benefitting from PayPal’s pain?

- Reassess our long-term outlook for the eCommerce platform. Previously, LikeFolio data was picking up on signs that PayPal was turning its ship around (despite its near-term stock performance). Now, we aren’t so sure.

Members can expect updates in each of these areas moving forward.

And we’ll be using our proprietary metrics to spot more instances of insanity in the meantime…