When social-data and stock price are moving sharply in opposite […]

United Airlines trails peers in Consumer Demand and Sentiment

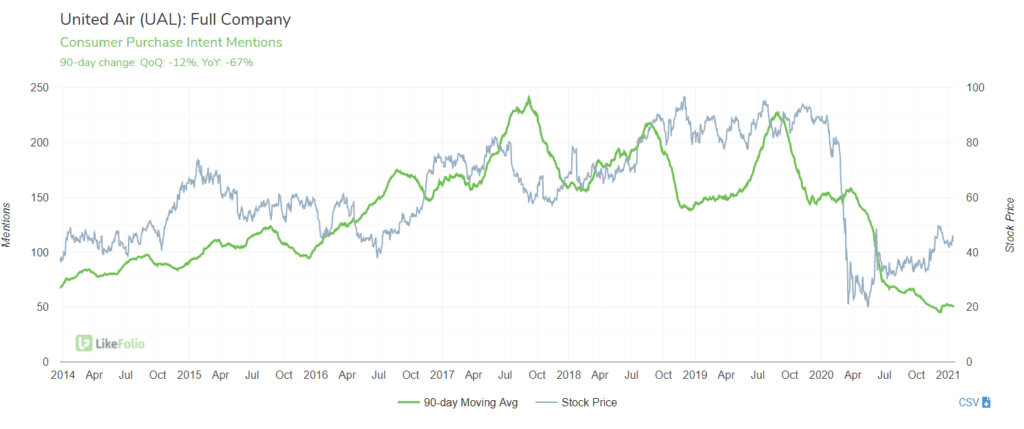

United Airlines (UAL)

When it comes to consumer Purchase Intent (mentions of booking or taking a flight), United Airlines is a laggard in the industry.

UAL Purchase Intent is pacing -67% YoY in the past quarter.

This decline in booking/flying mentions places UAL at the back of the pack vs. airline peers.

UAL also sits in the bottom tier when it comes to Consumer Happiness. At 48% positive, United consumers are happier than Spirit and American flyers, but not as happy as Southwest and Delta flyers.

So, how do we play UAL in earnings? We know UAL isn't best of breed. And we know market expectations for earnings are low. This isn't one we'd bet on...or against for that matter. Sometimes sitting on the sideline is a smart trade.

Netflix (NFLX)

Our data generated a bearish Earnings Signal for Netflix (NFLX) ahead of yesterday's 20Q4 earnings release. Today, NFLX shares are trading +10% higher following the report… So what did we miss?

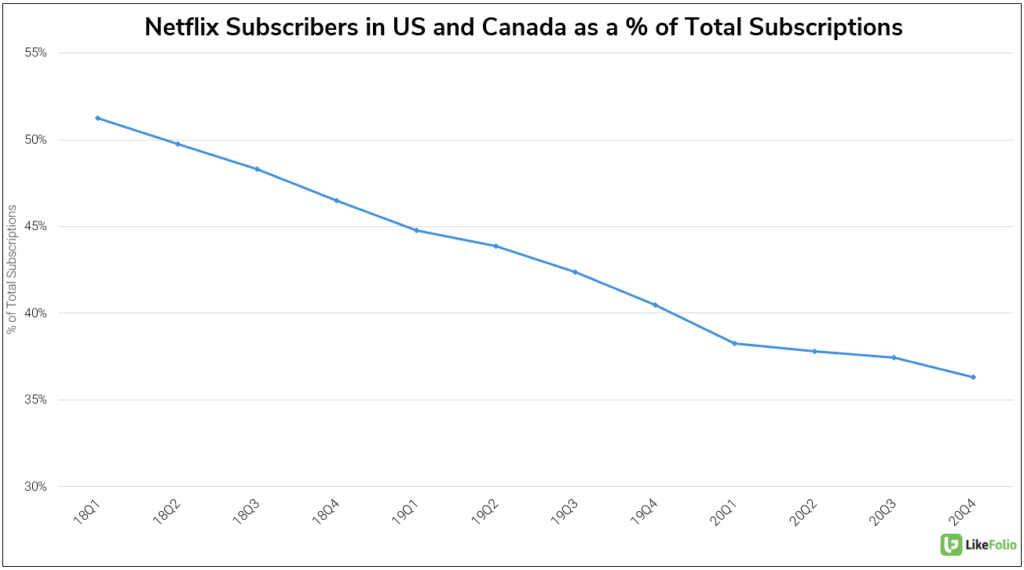

In short, International growth.

Netflix’s 20Q4 revenue managed to surpass expectations (roughly +0.2% higher), and EPS fell -14% short of estimates. However, Netflix added 8.5M new subscriptions, significantly higher than the ~6M expected for the quarter. Roughly 7.6M of those new users came from international markets, meaning the U.S. and Canada have a mere 36% of Netflix’s total subscribers. Unfortunately, we can’t account for growth in non-English-speaking regions, so we’ll need to be increasingly cognizant of NFLX’s global expansion efforts going forward.

Facebook (FB)

2 Weeks ago, we put out a bullish note for Facebook (FB), citing strong growth from Instagram’s newly revamped eCommerce features.

Consumers' adoption of these shopping features has continued to rise since then:

- Mentions of buying an item on Instagram: +86% YoY in the past 90 days

- Mentions of buying an item on Facebook: +18% YoY in the past 90 days.

Now the market has finally started to catch on: Facebook received a price upgrade from BMO yesterday, with the analyst mentioning eCommerce integration as a key factor. Our data suggests...